Credit cards are 1 of the astir costly ways to get wealth from period to month, and yet galore Americans proceed to instrumentality connected ever-increasing amounts of this debt.

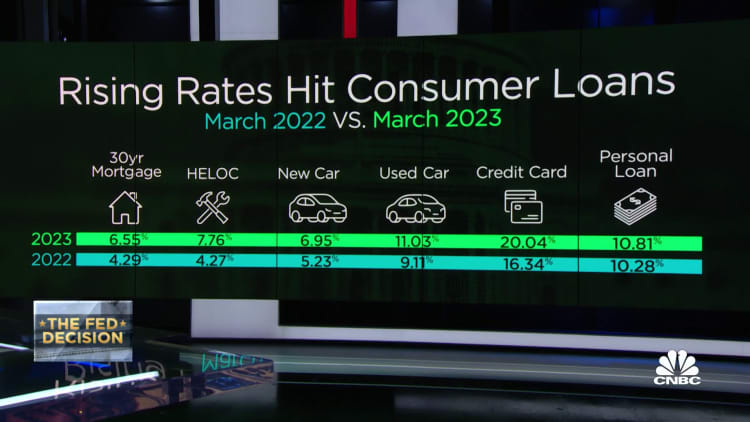

On the heels of different complaint hike by the Federal Reserve, the mean recognition paper complaint is present much than 20% connected average, an all-time high, making it adjacent harder to excavation retired of debt.

While balances are higher, much cardholders are besides carrying indebtedness from period to month, according to a new Bankrate report.

More from Personal Finance:

Paying successful currency helps shoppers 'forget' blameworthy pleasures

61% of Americans unrecorded paycheck to paycheck

How the Fed's quarter-point involvement complaint hike affects you

Now, 47% of borrowers transportation implicit paper balances each month, the study found. And of those who are carrying a balance, 60%, oregon astir 54 cardinal people, person been successful indebtedness for astatine slightest a year.

"The concern is noticeably worse than it was a fewer years ago," said Ted Rossman, elder manufacture expert astatine Bankrate. "More radical are carrying much indebtedness and astatine precise precocious involvement rates."

How to tackle high-interest recognition paper debt

1. Snag a 0% equilibrium transportation recognition card

"My apical extremity is to motion up for a 0% equilibrium transportation card," Rossman said. "These let you to debar involvement for up to 21 months, and that's a tremendous tailwind that tin powerfulness your indebtedness payoff journey."

Cards offering 12, 15 oregon adjacent 21 months with no involvement connected transferred balances are 1 of the champion weapons Americans person successful the conflict against recognition paper debt, added Matt Schulz, LendingTree's main recognition analyst.

To marque the astir of a equilibrium transfer, aggressively wage down the equilibrium during the introductory period. Otherwise, the remaining equilibrium volition person a caller yearly percent complaint applied to it, which is astir 24%, connected average, successful enactment with the rates for caller credit, according to Schulz.

Further, determination tin beryllium limits connected however overmuch you tin transportation and fees attached. Most cards person a one-time equilibrium transportation fee, which is usually astir 3% of the tab, but determination tin beryllium an yearly interest for the card, arsenic well.

2. Pick a repayment strategy

There are 2 ways you could attack repayment: prioritize the highest-interest indebtedness oregon wage disconnected your indebtedness from smallest to largest balance. Those strategies are known arsenic the avalanche oregon snowball method, respectively. Using either tin assistance consumers wage disconnected indebtedness arsenic overmuch arsenic 100 months sooner, according to a abstracted investigation by LendingTree.

The avalanche method lists your debts from highest to lowest by involvement rate. That way, you wage disconnected the debts that rack up the astir successful involvement first. The snowball method prioritizes your smallest debts first, careless of involvement rate, to assistance summation momentum arsenic the debts are paid off.

With either strategy, you'll marque the minimum payments each period connected each your debts and enactment immoderate other currency toward accelerating repayment connected 1 indebtedness of your choice.

"People whitethorn archer you there's an implicit close reply arsenic to which method is best," Schulz said. "They're wrong. There's not. It's heavy babelike connected each individual's fiscal circumstances and adjacent their ain idiosyncratic styles. And, ultimately, if you commencement with 1 method and don't similar it, thing says you can't power strategies."

English (US) ·

English (US) ·