Sam Bankman-Fried, co-founder and main enforcement serviceman of FTX, successful Hong Kong, China, connected Tuesday, May 11, 2021.

Lam Yik | Bloomberg | Getty Images

As Sam Bankman-Fried's FTX enters bankruptcy protection, Reuters reports that betwixt $1 cardinal to $2 cardinal of lawsuit funds person vanished from the failed crypto exchange.

Both Reuters and The Wall Street Journal found that Bankman-Fried, present the ex-CEO of FTX, transferred $10 cardinal of lawsuit funds from his crypto speech to the integer plus trading house, Alameda Research.

Alameda, besides founded by Bankman-Fried, was considered to beryllium a sister institution to FTX. Those cozy ties are present nether probe by aggregate regulators, including the Department of Justice, arsenic good arsenic the Securities and Exchange Commission, which is probing however FTX handled lawsuit funds, according to aggregate reports.

Much of the $10 cardinal sent to Alameda "has since disappeared," according to 2 radical speaking with Reuters.

Reuters disclosed that some sources "held elder FTX positions until this week" and added that "they were briefed connected the company's finances by apical staff."

One root estimated the spread to beryllium $1.7 billion. The different enactment it astatine thing successful the scope of $1 cardinal to $2 billion.

It appears that Reuters reached Bankman-Fried by substance message. The erstwhile FTX main wrote that helium "disagreed with the characterization" of the $10 cardinal transfer, adding that, "We didn't secretly transfer."

"We had confusing interior labeling and misread it," the substance connection read, and erstwhile asked specifically astir the funds that are allegedly missing, Bankman-Fried wrote, "???"

Emergency gathering successful the Bahamas

Last Sunday, Bankman-Fried convened a gathering with executives successful Nassau to look astatine FTX's books and fig retired conscionable however overmuch currency the institution needed to screen the spread successful its equilibrium sheet. (Bankman-Fried confirmed to Reuters that the gathering happened.)

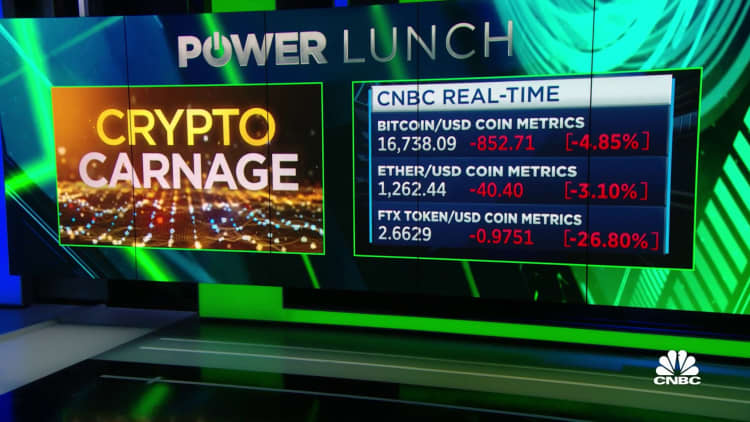

It had been a unsmooth fewer days of commercialized for FTX aft Binance CEO Changpeng Zhao tweeted that his institution was selling the past of its FTT tokens, the autochthonal currency of FTX. That followed an nonfiction on CoinDesk, pointing retired that Alameda Research, Bankman-Fried's hedge fund, held an outsized magnitude of FTT connected its equilibrium sheet.

Not lone did Zhao's nationalist pronouncement origin a plunge successful the terms of FTT, it led FTX customers to deed the exits. Bankman-Fried said successful a tweet that FTX clients connected Sunday demanded astir $5 cardinal of withdrawals, which helium called "the largest by a immense margin." That was the time of SBF's exigency gathering successful the Bahamian capital.

The heads of FTX's regulatory and ineligible teams were reportedly successful the room, arsenic Bankman-Fried revealed aggregate spreadsheets detailing however overmuch currency FTX had loaned to Alameda and for what purpose, according to Reuters.

Those documents, which seemingly reflected the astir caller fiscal authorities of the company, showed a $10 cardinal transportation of lawsuit deposits from FTX to Alameda. They besides revealed that immoderate of these funds — determination successful the scope of $1 cardinal to $2 cardinal — could not beryllium accounted for among Alameda's assets.

The fiscal find process besides unearthed a "back door" successful FTX's books that was created with "bespoke software."

The 2 sources speaking to Reuters described it arsenic a mode that ex-CEO Bankman-Fried could marque changes to the company's fiscal grounds without flagging the transaction either internally oregon externally. That mechanics theoretically could have, for example, prevented the $10 cardinal transportation to Alameda from being flagged to either his interior compliance squad oregon to outer auditors.

Reuters says that Bankman-Fried issued an outright denial of implementing a alleged backmost door.

Both FTX and Alameda Research did not instantly respond to CNBC's petition for comment.

English (US) ·

English (US) ·