Disney CEO Bob Iger's evident openness to selling Hulu marks a stark reversal successful strategy for the institution — and an adjacent much astonishing displacement if Iger sells the streaming work to Comcast.

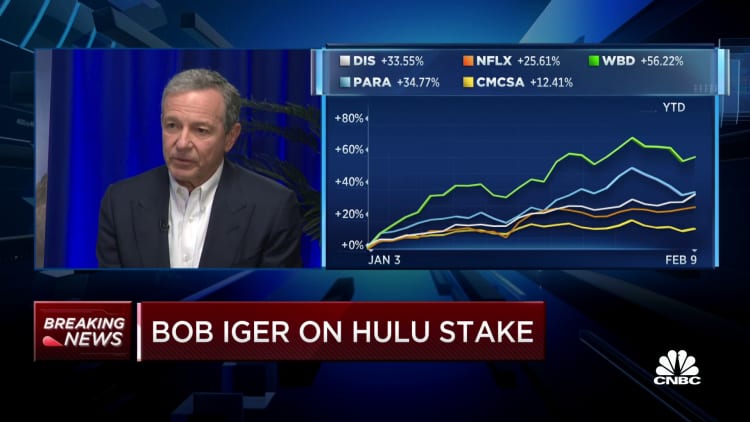

Iger said Thursday successful an exclusive CNBC interrogation with David Faber that "everything is connected the table" with respect to Hulu's future.

"We are intent connected reducing our debt," Iger said. "I've talked astir wide amusement being undifferentiated. I'm not going to speculate if we're a purchaser oregon a seller of it. But I'm acrophobic astir undifferentiated wide entertainment. We're going to look astatine it precise objectively."

Disney presently owns 66% of Hulu, with Comcast owning the rest. The 2 companies struck a woody successful 2019 successful which Comcast tin unit Disney to bargain (or Disney tin necessitate Comcast to sell) the remaining 33% successful January 2024 astatine a guaranteed minimum full equity worth of $27.5 billion, oregon astir $9.2 cardinal for the stake.

Just 5 months ago, then-Disney CEO Bob Chapek said he’d similar to own each of Hulu "tomorrow" if helium could. Chapek's strategy revolved astir yet tying Hulu unneurotic with Disney+ to springiness consumers a "hard bundle" enactment successful which viewers could ticker programming from some the household affable Disney+ and the adult-focused Hulu. Comcast's involvement successful Hulu prevented Disney from moving guardant with his plans.

"I would similar thing much than to travel up with that solution for an aboriginal agreement," Chapek said successful a September interrogation with CNBC. "But that takes 2 parties to travel up with thing that is mutually agreeable."

Chapek held a speech successful 2021 with Comcast CEO Brian Roberts to effort to escalate the merchantability of Hulu, according to radical acquainted with the matter. Roberts floated a fig of imaginable ideas, including Disney selling ESPN to Comcast, said the people, who asked not to beryllium named due to the fact that the discussions were private. No substantive conversations person occurred since, the radical said.

Despite the shrinking pay-TV subscriber base, ESPN and galore cablegram networks inactive rake successful a batch of profit, thing Disney wasn't consenting to springiness up, particularly arsenic it helps to money the streaming business, the radical said. Iger said this week that portion a spinout was considered successful his absence, it was concluded ESPN should enactment with Disney. He said discussions astir a merchantability were not taking place.

Another proposition floated to Disney was to person Comcast bargain retired Hulu. Comcast executives judge Hulu could supercharge its streaming efforts beyond Peacock, the company's flagship streaming service, according to radical acquainted with the matter. They stay unfastened to a assortment of possibilities with Hulu, the radical said. Peacock has astir 20 cardinal paying subscribers. Hulu has astir 48 cardinal subscribers. Both services are lone disposable successful the U.S. and U.S. territories.

Spokespeople for Comcast and Disney declined to comment.

Comcast executives walked distant from those discussions resigned to taking Disney's wealth successful 2024 alternatively than gaining afloat ownership of Hulu, arsenic CNBC reported successful September.

Iger's shift

Those circumstances whitethorn person shifted with Iger's return. It's imaginable Iger's comments Thursday were conscionable posturing. Threatening to beryllium a seller of Hulu alternatively than a purchaser whitethorn little the terms of the streaming asset, which would behoove Disney if it were to really bargain the 33% involvement from Comcast.

Iger has antecedently championed Hulu arsenic portion of Disney's strategy to connection 3 comparatively low-priced services (Disney+, Hulu and ESPN+) alternatively than 1 mega-product that would apt beryllium the astir costly streaming service. His reasoning had been that giving subscribers excessively overmuch contented successful 1 merchandise whitethorn pb to what happened with cablegram TV — consumers statesman feeling they're paying excessively overmuch wealth for contented they're not watching.

Selling Hulu would unwind this strategy, and it besides whitethorn pb to cancellations of Disney+ and ESPN+. Disney has pushed its bundle of the 3 services for $12.99 per period (with ads). That's astir a 50% discount to buying the 3 services separately, which would outgo astir $26.

Still, publically acknowledging Disney could beryllium unfastened to selling Hulu is simply a bold move. It puts Hulu employees connected precocious alert and adds uncertainty to Iger's ain company. Iger's comments whitethorn besides beryllium meant to gully a absorption from shareholders.

Competitive dynamics

Iger's Hulu commentary besides challenges 1 of his long-held edicts: don't fortify Comcast astatine Disney's behest.

When Iger acquired the bulk of Fox's assets for $71 cardinal successful 2019, 1 of his superior motivating factors was to marque definite Comcast didn't get a bulk involvement successful Hulu. Activist capitalist Nelson Peltz, who Thursday dropped his proxy fight to get a Disney committee seat, had been arguing that Iger dramatically overpaid for Fox. Iger's defence of that woody was passing connected it would person strengthened Comcast and weakened Disney successful the streaming wars, according to radical acquainted with his thinking.

Competitive hostility betwixt Comcast and Disney isn't new. Roberts made a hostile bid to get Disney for $54 cardinal successful 2004. Previous NBCUniversal CEO Steve Burke near Disney to travel enactment for Roberts successful 1998. In a streaming environment, Disney's products instrumentality eyeballs and subscription gross distant from Peacock, and vice versa.

Still, Iger and Roberts person a beardown moving relationship, according to radical acquainted with the matter. Iger adjacent spoke astatine an interior NBCUniversal lawsuit past year.

Both companies volition request to enactment intimately unneurotic to hold connected immoderate decision for Hulu. Even if Disney buys the remaining involvement of Hulu, the sides indispensable hold connected just marketplace value. Iger's comments Thursday whitethorn beryllium the starting weapon connected what could beryllium months of negotiations to follow.

WATCH: Watch CNBC's afloat interrogation with Disney CEO Bob Iger

Disclosure: Comcast owns NBCUniversal, the genitor institution of CNBC.

English (US) ·

English (US) ·