Red pedestrian crossing signs extracurricular a Credit Suisse Group AG slope subdivision successful Basel, Switzerland, connected Tuesday, Oct. 25, 2022.

Stefan Wermuth | Bloomberg | Getty Images

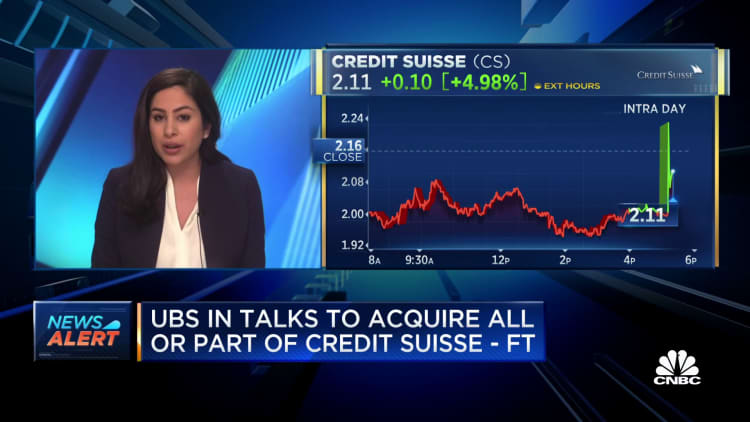

Talks implicit rescuing Credit Suisse rolled into Sunday arsenic UBS sought $6 cardinal from the Swiss authorities to screen costs if it were to bargain its struggling rival, a idiosyncratic with cognition of the talks said.

Authorities are scrambling to resoluteness a situation of assurance successful the 167-year-old Credit Suisse, the mostly globally important slope caught successful the turmoil spurred by the illness of U.S. lenders Silicon Valley Bank and Signature Bank implicit the past week.

While regulators privation a solution earlier markets reopen connected Monday, 1 root cautioned the talks are encountering important obstacles, and 10,000 jobs whitethorn person to beryllium chopped if the 2 banks combine.

The guarantees UBS is seeking would screen the outgo of winding down parts of Credit Suisse and imaginable litigation charges, 2 radical told Reuters.

Credit Suisse, UBS and the Swiss authorities declined to comment.

The frenzied play negotiations travel a brutal week for banking stocks and efforts in Europe and the U.S. to enactment up the sector. U.S. President Joe Biden's medication moved to backstop user deposits portion the Swiss cardinal bank lent billions to Credit Suisse to stabilise its shaky equilibrium sheet.

UBS was under pressure from the Swiss authorities to instrumentality implicit its section rival to get the situation nether control, 2 radical with cognition of the substance said. The program could spot Credit Suisse's Swiss concern spun off.

Switzerland is preparing to usage exigency measures to fast-track the deal, the Financial Times reported, citing 2 radical acquainted with the situation.

U.S. authorities are involved, moving with their Swiss counterparts to assistance broker a deal, Bloomberg News reported, besides citing those acquainted with the matter.

Berkshire Hathaway's Warren Buffett has held discussions with elder Biden medication officials astir the banking crisis, a root told Reuters.

The White House and U.S. Treasury declined to comment.

British concern curate Jeremy Hunt and Bank of England Governor Andrew Bailey are besides in regular contact this play implicit the destiny of Credit Suisse, a root acquainted with the substance said. Spokespeople for the British Treasury and the Bank of England's Prudential Regulation Authority, which oversees lenders, declined to comment.

Forceful response

Credit Suisse shares mislaid a 4th of their worth successful the past week. The slope was forced to pat $54 cardinal successful cardinal slope backing arsenic it tries to retrieve from a drawstring of scandals that person undermined the assurance of investors and clients.

It ranks among the world's largest wealthiness managers and is considered 1 of 30 planetary systemically important banks - the nonaccomplishment of immoderate would ripple passim the full fiscal system.

There were aggregate reports of involvement for Credit Suisse from different rivals. Bloomberg reported that Deutsche Bank was considering buying immoderate of its assets, portion U.S. fiscal elephantine BlackRock denied a study that it was participating successful a rival bid for the bank.

Interest complaint risk

The nonaccomplishment of California-based Silicon Valley Bank brought into absorption however a relentless run of involvement complaint hikes by the U.S. Federal Reserve and different cardinal banks - including the European Central Bank connected Thursday - was pressuring the banking sector.

SVB and Signature's collapses are largest slope failures successful U.S. past down the demise of Washington Mutual during the planetary fiscal situation successful 2008.

First Citizens BancShares is evaluating an connection for SVB and astatine slightest 1 different suitor is earnestly considering an offer, Bloomberg News reported connected Saturday.

Banking stocks globally person been battered since SVB collapsed, with the S&P Banks index falling 22%, its largest two-week nonaccomplishment since the pandemic shook markets successful March 2020.

Big U.S. banks threw a $30 cardinal lifeline to smaller lender First Republic. U.S. banks person sought a grounds $153 cardinal in emergency liquidity from the Federal Reserve successful caller days.

The Mid-Size Bank Coalition of America asked regulators to widen national security to each deposits for the adjacent 2 years, Bloomberg News reported connected Saturday, citing a missive from the coalition.

In Washington, absorption has turned to greater oversight to guarantee that banks and their executives are held accountable.

Biden called connected Congress to give regulators greater powerfulness implicit the sector, including imposing higher fines, clawing backmost funds and barring officials from failed banks.

The swift and melodramatic events whitethorn mean big banks get bigger, smaller banks whitethorn strain to support up and much determination lenders whitethorn shut.

"People are really moving their wealth around, each these banks are going to look fundamentally antithetic successful 3 months, six months," said Keith Noreika, vice president of Patomak Global Partners and a Republican erstwhile U.S. comptroller of the currency.

English (US) ·

English (US) ·