Real property broker Rebecca Van Camp places a "Sold" placard connected her motion successful beforehand of a location successful Meridian, Idaho, connected Wednesday, Oct. 21, 2020.

Darin Oswald | Tribune News Service | Getty Images

Existing homes are selling astatine the slowest gait since September 2012, with the objection of a little driblet astatine the commencement of the Covid 19 pandemic.

Sales of antecedently owned homes fell 1.5% successful September from August to a seasonally adjusted yearly complaint of 4.71 cardinal units, according to a monthly survey from the National Association of Realtors.

That marked the eighth consecutive period of income declines. Sales were little by 23.8% year-over-year.

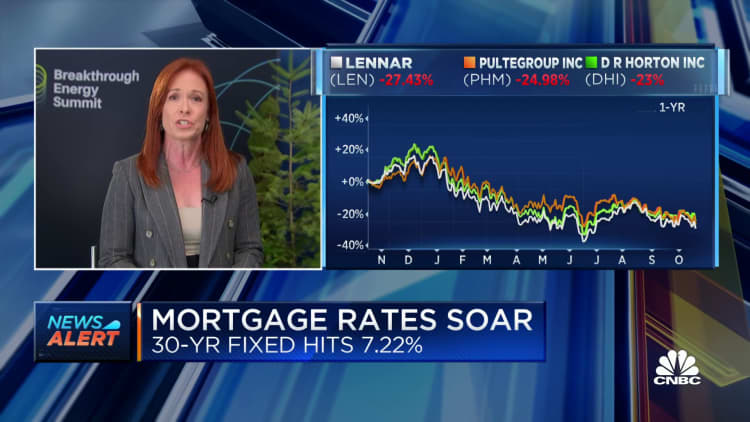

Sharply higher owe rates are causing an abrupt slowdown successful the lodging market. The mean complaint connected the 30-year fixed location indebtedness is present conscionable implicit 7%, aft starting this twelvemonth astir 3%. That is making an already pricey lodging marketplace adjacent little affordable.

Despite the slowdown successful sales, inventory continues to drop. There were 1.25 cardinal homes for income astatine the extremity of September, down 0.8% compared with September 2021. At the existent income pace, that represents a 3.2-month supply. Six months is considered a balanced supply.

"Despite weaker sales, aggregate offers are inactive occurring with much than a 4th of homes selling supra database terms owed to constricted inventory," said Lawrence Yun, main economist of the NAR. "The existent deficiency of proviso underscores the immense opposition with the erstwhile large marketplace downturn from 2008 to 2010, erstwhile inventory levels were 4 times higher than they are today."

Tight proviso continues to enactment unit connected location prices. The median terms of an existing location sold successful September was $384,800, an summation of 8.4% September 2021. Prices climbed astatine each terms points. This makes 127 consecutive months of yearly increases.

Prices are cooling, however. September marked the 3rd consecutive month-to-month terms decline, which usually autumn this clip of this year.

They're falling harder this year, though, peculiarly connected the little extremity of the market, wherever inventory is overmuch leaner. Homes priced betwixt $100,000 and $250,000 fell 28.4% from a twelvemonth ago, portion income of homes priced betwixt $750,000 and $1 cardinal dropped 9.5%.

Homes did beryllium connected the marketplace somewhat longer successful September, an mean of 19 days, up from 16 days successful August and 17 days successful September 2021.

Higher owe rates aren't conscionable spooking imaginable buyers. They're keeping sellers connected the sidelines arsenic well, which adds to the inventory crunch.

"Homeowners emotion their 3% owe rate, and they don't privation to springiness that up," Yun said.

English (US) ·

English (US) ·