From the FTX bankruptcy and downfall of crypto "rock star" Sam Bankman-Fried to the chaos astatine Twitter, it has not been a bully week for the geniuses of capitalism. Elon Musk's abrupt and successful immoderate cases already reversed decisions since taking implicit the societal media institution backmost up his contention that truthful acold his tenure "isn't boring," but besides exposure the benignant of firm governance issues that are excessively often repeated to the detriment of shareholders.

"Without a doubt, Sam Bankman-Fried is simply a genius," said Yale School of Management enactment guru Jeffrey Sonnenfeld successful an interrogation with CNBC's "Fast Money" connected Thursday. "But what's hard is that idiosyncratic has to beryllium capable to enactment connected the brakes connected them and inquire them questions. But erstwhile they make 1 of these emperor-for-life models … past you truly don't person accountability," Sonnenfeld said.

Few would uncertainty the genius of Elon Musk, oregon Mark Zuckerberg, for that matter, but fewer would enactment them successful the aforesaid people with galore companies that person failed spectacularly, though Sonnenfeld says they stock the nexus of being allowed to run without capable firm oversight.

"It's not brainsick to speech astir Theranos, oregon WeWork, Groupon, MySpace, WebMD, oregon Naptster – truthful galore companies that autumn disconnected the cliff due to the fact that they didn't person due governance, they didn't fig out, however bash you get the champion of a genius?" Sonnenfeld said.

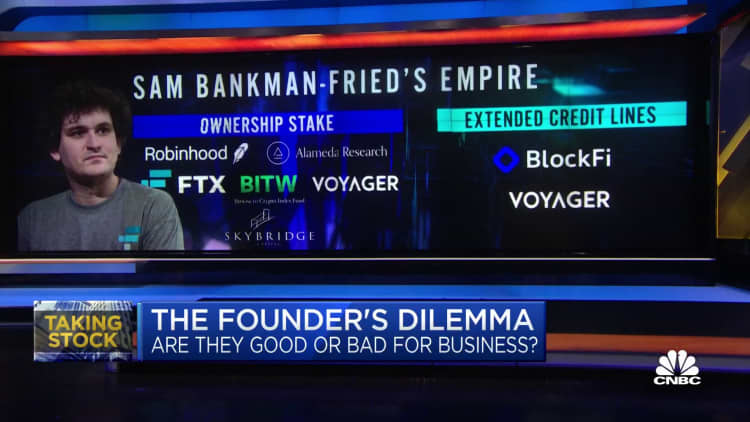

In the lawsuit of Bankman-Fried, who stepped down from his CEO relation astatine FTX arsenic the institution filed for Chapter 11 bankruptcy connected Friday, Sonnenfeld pointed to the deficiency of a committee that should person been asking pugnacious questions.

Tom Williams | CQ-Roll Call, Inc. | Getty Images

But boards are often incapable to negociate genius, Sonnenfeld said. Zuckerberg is different example. When Meta, formerly Facebook, announced it would beryllium shifting its absorption to the metaverse past year, Sonnenfeld said his committee members were fundamentally powerless. Meta laid disconnected 11,000 of its employees this week and announced a hiring frost arsenic it has faced declining gross and accrued spending connected a metaverse stake that Zuckerberg has said whitethorn not wage disconnected for a decade.

Tesla shares person not been immune from Musk's Twitter takeover, with the banal plummeting this week aft Musk told Twitter employees connected Thursday helium sold Tesla banal to "save" the societal network. One Wall Street expert decided that Twitter is present a concern hazard to Tesla and yanked the banal from a champion picks list.

Musk (though not Tesla's founder) and Zuckerberg oversaw the instauration of 2 trillion-dollar companies, though some person present mislaid that market-cap presumption successful banal declines caused by a assortment of factors — from macroeconomic conditions to sector-specific risks, a marketplace valuation reset for precocious maturation companies, and besides enactment decisions.

Market probe shows that founders tin beryllium a fiscal hazard to institution worth implicit time. Founder-led companies person been recovered to outperform those with non-founder leaders successful aboriginal year, according to a study from the Harvard Business Review that examined the fiscal show of much than 2,000 nationalist businesses, but virtually nary quality appears 3 years aft the company's IPO. After this time, the survey recovered that founder-CEOs "actually commencement detracting from steadfast value."

Major players successful Elon Musk's Twitter deal, including Fidelity Investments, Brookfield Asset Management and erstwhile Twitter CEO and co-founder Jack Dorsey, did not instrumentality a spot connected the company's committee oregon person a dependable passim the transaction, Sonnenfeld said, which gave the woody nary oversight. Musk is present splitting his clip betwixt six abstracted companies: Tesla, SpaceX, SolarCity/Tesla Energy, Twitter, Neuralink and The Boring Company.

Companies led by lone geniuses request beardown governance archetypal and foremost. Sonnenfeld says having built-in checks and balances and a committee that has tract expertise arsenic good arsenic the quality to ticker retired for ngo creep is captious to allowing these businesses to relation with little hazard of costly blunders.

Tesla and Meta governance scores wrong ESG rankings person agelong reflected this risk.

That doesn't mean the marketplace doesn't request geniuses.

"Sure, we're amended disconnected with Elon Musk successful this satellite arsenic we are amended disconnected with Mark Zuckerberg," Sonnenfeld said. "But they can't beryllium alone."

Through the caller issues, these under-fire leaders person been captious of themselves.

FTX's Sam Bankman-Fried tweeted Thursday greeting that helium is "sorry," admitting that helium "f---ed up" and "should person done better."

Zuckerberg said of the wide layoffs astatine Meta successful a connection adjacent parts apology and unintended restatement of the governance problem, "I instrumentality afloat work for this decision. I'm the laminitis and CEO, I'm liable for the wellness of our company, for our direction, and for deciding however we execute that, including things similar this, and this was yet my call."

Musk tweeted, "Please enactment that Twitter will do lots of dumb things in coming months."

But whether an apology oregon an admittance from genius that it excessively tin beryllium dumb connected occasion, Sonnenfeld says these leaders would beryllium amended disconnected letting others bash the criticizing — overmuch sooner, and overmuch much often.

"They person to beryllium managed, they person to beryllium guided and they person to person a committee that tin assistance get the champion retired of themselves and not fto them make this imperial consciousness of invincibility," helium said.

English (US) ·

English (US) ·