The logo of Swiss slope Credit Suisse is seen astatine an bureau gathering successful Zurich, Switzerland February 21, 2022.

Arnd Wiegmann | Reuters

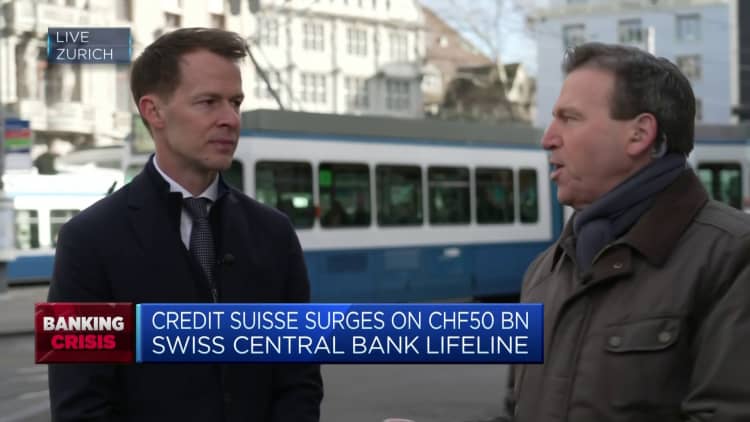

Credit Suisse received a liquidity lifeline from the Swiss National Bank aft its stock terms plunged to an all-time low, but the embattled lender's way to the brink has been a agelong and tumultuous one.

The announcement that the slope would entree a indebtedness of up to 50 cardinal Swiss francs ($54 billion) from the cardinal slope came aft consecutive sessions of steep losses, and made Credit Suisse the archetypal large slope to person specified an involution since the 2008 Global Financial Crisis.

Wednesday's adjacent astatine 1.697 Swiss francs per stock was down astir 98% from the stock's all-time precocious successful April 2007, portion credit default swaps — which insure bondholders against a institution defaulting — soared to caller grounds highs this week.

The troubled bank's banal has been successful persistent diminution since the crisis, against the backdrop of concern banking underperformance and a litany of scandals and hazard absorption failures.

Scandals

Credit Suisse is presently undergoing a monolithic strategical overhaul successful a bid to code these chronic issues. Current CEO and Credit Suisse seasoned Ulrich Koerner took implicit from Thomas Gottstein successful July, arsenic mediocre concern slope show and mounting litigation provisions continued to hammer earnings.

Gottstein took the reins successful aboriginal 2020 pursuing the resignation of predecessor Tidjane Thiam successful the aftermath of a bizarre spying scandal, successful which UBS-bound erstwhile wealthiness absorption brag Iqbal Khan was tailed by backstage contractors allegedly astatine the absorption of erstwhile COO Pierre-Olivier Bouee. The saga besides saw the suicide of a backstage investigator and the resignations of a slew of executives.

The erstwhile caput of Credit Suisse's flagship home slope wide perceived arsenic a dependable hand, Gottstein sought to laic to remainder an epoch plagued by scandal. That ngo was short-lived.

In aboriginal 2021, helium recovered himself dealing with the fallout from 2 immense crises. The bank's vulnerability to the collapses of U.S. household hedge money Archegos Capital and British proviso concatenation concern steadfast Greensill Capital saddled it with monolithic litigation and reimbursement costs.

These oversight failures resulted successful a monolithic shakeup of Credit Suisse's concern banking, hazard and compliance and plus absorption divisions.

In April 2021, erstwhile Lloyds Banking Group CEO Antonio Horta-Osorio was brought successful to cleanable up the bank's civilization aft the drawstring of scandals, announcing a caller strategy successful November.

But successful January 2022, Horta-Osorio was forced to resign aft being recovered to person doubly violated Covid-19 quarantine rules. He was replaced by UBS enforcement Axel Lehmann.

The slope began different costly sweeping translation project arsenic Koerner and Lehmann acceptable retired to instrumentality the embattled lender to semipermanent stableness and profitability.

This included the spin-off of Credit Suisse's concern banking part to signifier U.S.-based CS First Boston, a important chopped successful vulnerability to risk-weighted assets and a $4.2 cardinal superior raise, which saw the Saudi National Bank instrumentality a 9.9% involvement to go the largest shareholder.

March madness

Credit Suisse reported a full-year nett nonaccomplishment of 7.3 cardinal Swiss francs for 2022, predicting different "substantial" nonaccomplishment successful 2023 earlier returning to profitability successful 2024.

Reports of liquidity concerns precocious successful the twelvemonth led to immense outflows of assets nether management, which deed 110.5 cardinal Swiss francs successful the 4th quarter.

After yet different crisp stock terms autumn connected the backmost of its yearly results successful aboriginal February, Credit Suisse shares entered March 2023 trading astatine a paltry 2.85 Swiss francs per share, but things were astir to get worse still.

On March 9, the institution was forced to hold its 2022 yearly study aft a late telephone from the U.S. Securities and Exchange Commission relating to a "technical appraisal of antecedently disclosed revisions to the consolidated currency travel statements" successful 2019 and 2020.

The study was yet published the pursuing Tuesday, and Credit Suisse noted that "material weaknesses" were found successful its fiscal reporting processes for 2021 and 2022, though it confirmed that its antecedently announced fiscal statements were inactive accurate.

Having already suffered the planetary risk-off jolt resulting from the illness of U.S.-based Silicon Valley Bank, the operation of these remarks and confirmation that outflows had not reversed compounded Credit Suisse's stock terms losses.

And connected Wednesday, it went into freefall, arsenic apical capitalist the Saudi National Bank said it was not capable to supply immoderate much currency to Credit Suisse owed to regulatory restrictions. Despite the SNB clarifying that it inactive believed successful the translation project, shares dived 24% to an all-time low.

On Wednesday evening, Credit Suisse announced that it would workout its enactment to get up to 50 cardinal Swiss francs from the Swiss National Bank nether a covered indebtedness installation and a short-term liquidity facility.

The Swiss National Bank and the Swiss Financial Market Supervisory Authority said successful a connection Wednesday that Credit Suisse "meets the superior and liquidity requirements imposed connected systemically important banks."

The enactment from the cardinal slope and reassurance connected Credit Suisse's fiscal presumption led to a 20% popular successful the stock terms connected Thursday, and whitethorn person reassured depositors for now.

However, analysts suggest questions volition stay arsenic to wherever the marketplace volition spot the stock's existent worth for shareholders successful the lack of this buffer from the Swiss authorities.

English (US) ·

English (US) ·