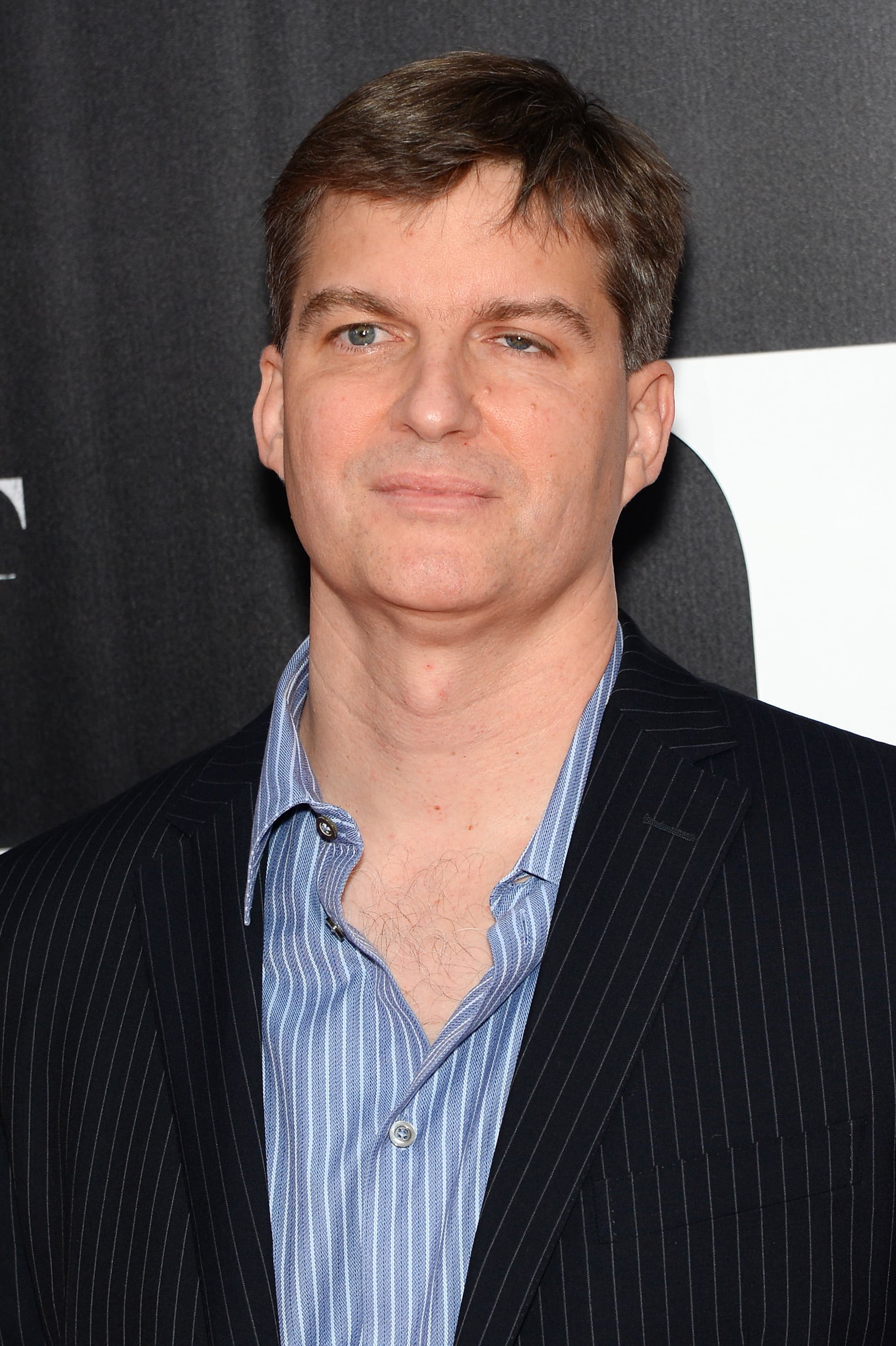

Carson Block, laminitis of abbreviated selling concern steadfast Muddy Waters, thinks the collapse of cryptocurrency speech FTX nether Sam Bankman-Fried is simply a "great illustration of greed and FOMO."

Block told CNBC's "The Exchange" helium had seen the concern trajectory of the former billionaire and thought determination was "obviously thing wrong."

"[Bankman-Fried] went from zero to, I'm worth 20 cardinal dollars, I'm putting our logo connected large league shot umpire uniforms and connected the Miami Heat area. It seems similar truly trying hard to found yourself arsenic a household name."

Bankman-Fried has not responded to a erstwhile CNBC petition for comment. A spokesperson for FTX did not instantly respond.

Block said helium had concerns astir Alameda Research, the trading steadfast SBF co-founded that was precocious revealed to person borrowed billions successful FTX lawsuit funds without their cognition and contributed to FTX's bankruptcy. Block said a September 2021 nonfiction recovered Alameda's assets were substantially successful the cryptocurrency solana, which astatine the clip was plunging successful value, raising questions astir its indebtedness and root of funds.

"When nobody's minding the store and there's precise small regularisation and it's an plus that is of questionable reality, this is what you get," helium said.

Block is simply a crypto sceptic who described the caller surge into the manufacture arsenic a bubble based connected a "suspension of disbelief."

"In bid to person an tremendous bubble, determination needed to beryllium an wholly caller plus people that cipher could say, good this has happened before."

He besides said it "needed to beryllium an plus that hardly has immoderate value."

"Crypto, arsenic I recognize it, there's mostly immoderate worth successful the state fees, but if you look astatine the worth astatine which these things trade, we're talking the existent worth is simply a sliver of the full terms of these things. So it's been a bubble and it's been unregulated," helium told CNBC.

Block gained prominence for alleging and exposing instances of fraudulent accounting successful U.S.-listed Chinese companies.

In February, Reuters reported helium and different investors and hedge funds were being probed by the U.S. Justice Department arsenic portion of an probe into abbreviated selling.

His comments travel amid a warfare of words successful the crypto sphere arsenic it grapples with the caller volatility.

At an lawsuit hosted by CNBC connected Thursday, Changpeng Zhao, laminitis of cryptocurrency speech Binance, said helium was "shocked" that Bankman-Fried "lied to everybody," and described his actions arsenic "fraud."

Zhao, who goes by "CZ," besides deed backmost astatine caller comments by economist Nouriel Roubini, who on Wednesday described him arsenic 1 of the "seven Cs of crypto" on with "concealed, corrupt, crooks, criminals, con men, carnival barkers."

"Negative vigor doesn't marque it acold successful beingness and those radical volition mostly enactment poor," CZ said.

Meanwhile, FTX's caller CEO John Ray III, appointed to oversee its bankruptcy proceedings, said Thursday helium had ne'er seen "such a implicit nonaccomplishment of firm controls and specified a implicit lack of trustworthy fiscal accusation arsenic occurred here." Ray antecedently oversaw the bankruptcy of vigor elephantine Enron.

In a tribunal filing, Ray said helium did "not person confidence" successful the accuracy of the equilibrium sheets for FTX and Alameda Research, penning that they were "unaudited and produced portion the Debtors [FTX] were controlled by Mr. Bankman-Fried."

English (US) ·

English (US) ·