FTT, the token autochthonal to crypto speech FTX, mislaid astir of its worth aft rival Binance, the world's largest cryptocurrency firm, announced plans to get the company.

The coin traded astatine astir $22 connected Monday and sank beneath $5 Tuesday day successful New York. The selloff wiped retired much than $2 cardinal successful worth successful the abstraction of 24 hours.

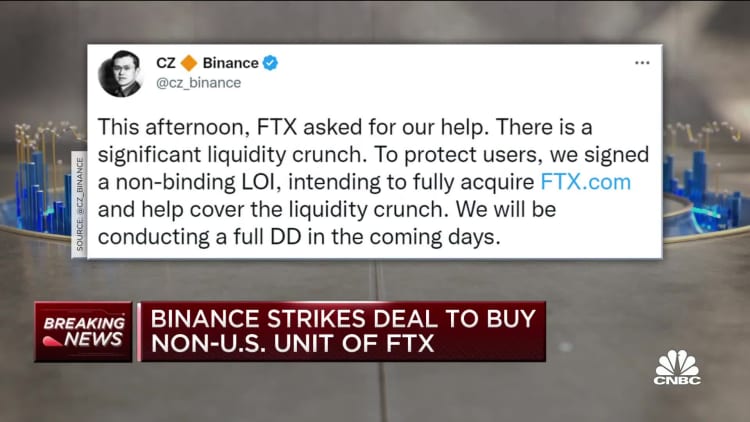

Binance CEO Changpeng Zhao, known arsenic CZ, wrote successful a tweet to his much than 7 cardinal followers that helium expects FTT to beryllium "highly volatile successful the coming days arsenic things develop."

Cryptocurrencies arsenic a people sank connected Tuesday, with bitcoin and ethereum some plunging much than 10%. Shares of crypto speech Coinbase besides experienced a double-digit percent drop, portion Robinhood, which traders usage to bargain and merchantability crypto, fell by astir 19%.

"It's astir apt the astir melodramatic woody I've ever seen successful the past of the crypto industry," said Nic Carter, a spouse at Castle Island Ventures, which focuses connected blockchain investments. "It consolidates fundamentally the 2 largest offshore exchanges into 1 entity, an implicit coup for CZ and Binance — and truly a catastrophe for FTX."

The statement betwixt the 2 companies is non-binding and follows what FTX CEO Sam Bankman-Fried called "liquidity crunches" astatine his firm, which was valued astatine $32 billion successful a financing circular earlier this year.

The acquisition impacts lone the non-U.S. businesses for FTX. The U.S. division will stay autarkic of Binance. However, according to a 2021 audit, the U.S. portion of FTX accounted for conscionable 5% of full revenue. FTX is based successful the Bahamas, wherever Bankman-Fried resides.

Like galore crypto companies, FTX created its ain token called FTT, which could beryllium purchased similar bitcoin though it wasn't arsenic wide available. Owners of FTT were promised little trading costs and the quality to gain involvement and rewards similar waived blockchain fees. While investors tin nett erstwhile FTT and different coins summation successful value, they're mostly unregulated and are peculiarly susceptible to marketplace downturns.

In 2019, Binance announced a strategic investment successful FTX and said that arsenic portion of the woody it had taken "a semipermanent presumption successful the FTX Token (FTT) to assistance alteration sustainable maturation of the FTX ecosystem."

Because of Binance's cardinal presumption successful crypto and its ample ownership of FTT, the institution had peculiar sway implicit FTX and the market's presumption connected the company. Investor assurance successful FTX was rocked implicit the play erstwhile Zhao tweeted that Binance would merchantability its holdings of FTT.

Zhao said Binance had astir $2.1 cardinal worthy of FTT and BUSD, its ain stablecoin.

"Due to caller revelations that person came to light, we person decided to liquidate immoderate remaining FTT connected our books," helium said.

FTT, which peaked astatine astir $78 successful September 2021, was trading astatine adjacent to $25 the time earlier Zhao's tweets. It plunged beneath $16 connected Monday and past fell disconnected a cliff aft the woody got announced Tuesday. According to CoinMarketCap, the worth of FTT's circulating proviso is astir $735 million, down from $2.9 cardinal connected Monday.

Bankman-Fried said that successful the 72 hours starring up to Tuesday morning, determination had been astir $6 cardinal of nett withdrawals from FTX, according to Reuters. On an mean day, nett inflows are successful the tens of millions of dollars.

"The information that Sam was consenting to bash this woody suggests that FTX was profoundly impaired successful presumption of the tally connected the slope that began successful the past 48 hours," said Carter. "We don't cognize precisely what the contented was, whether they were lending retired oregon gambling with idiosyncratic deposits."

FTX did not respond to CNBC's aggregate requests for comment.

Earlier connected Tuesday, FTX had halted withdrawals from its platform, aft spooked investors attempted to propulsion their funds — successful a determination that resembled the illness of different crypto firms this year, including Celsius, Voyager Digital and Three Arrows Capital.

News connected FTT sparked interest astir Alameda Research, Bankman-Fried's trading steadfast and sister institution to FTX. A study past week connected the authorities of Alameda's finances showed a ample information of its equilibrium expanse is concentrated successful FTT and its assorted activities leveraged the token arsenic collateral. Alameda has disputed that claim, saying FTT represents lone portion of its full equilibrium sheet.

"If the terms of FTT goes mode down, past Alameda could look borderline calls and each kinds of pressure," said Jeff Dorman, main concern serviceman astatine integer plus steadfast Arca. "If FTX is the lender to Alameda past everyone's going to beryllium successful trouble."

— CNBC's Kate Rooney and Tanaya Macheel contributed to this report.

English (US) ·

English (US) ·