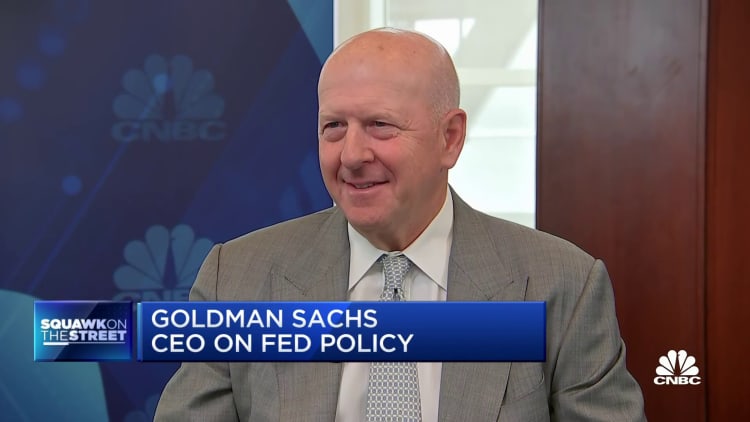

CEO David Solomon, Goldman Sachs, during a Bloomberg Television astatine the Goldman Sachs Financial Services Conference successful New York, Dec. 6, 2022.

Michael Nagle | Bloomberg | Getty Images

Goldman Sachs CEO David Solomon said Monday that his slope volition disclose markdowns connected commercialized existent property holdings arsenic the manufacture grapples with higher involvement rates.

Solomon told CNBC's Sara Eisen the New York-based steadfast volition station impairments connected loans and equity investments tied to commercialized existent property successful the 2nd quarter. Financial firms admit indebtedness defaults and falling valuations arsenic write-downs that impact quarterly results.

"There's nary question that the existent property market, and successful peculiar commercialized existent estate, has travel nether pressure," helium said successful an interrogation connected CNBC's "Squawk connected the Street." "You'll spot immoderate impairments successful the lending that would travel done our wholesale provision" this quarter.

After years of debased involvement rates and lofty valuations for bureau buildings, the manufacture is successful the throes of a painful adjustment to higher borrowing costs and little occupancy rates owed to the displacement to distant work. Some spot owners person walked distant from holdings alternatively than refinancing their loans. Defaults person conscionable begun to amusement up successful banks' results. Goldman posted astir $400 cardinal successful first-quarter impairments connected existent property loans, according to Solomon.

On apical of Goldman's lending activities, it besides took nonstop stakes successful existent property arsenic it ramped up its alternate investments successful the past decade, Solomon said.

"We deliberation that we and others are marking down those investments fixed the situation this 4th and successful the coming quarters," Solomon said.

While the write-downs are "definitely a headwind" for the bank, they are "manageable" successful the discourse of Goldman's wide business, helium said.

They whitethorn beryllium little manageable for smaller banks, however. About two-thirds of the industry's loans are originated by determination and midsize institutions, Solomon said.

"That's conscionable thing that we're going to person to enactment through," helium said. "There'll astir apt beryllium immoderate bumps and immoderate symptom on the mode for a fig of participants."

In the wide-ranging interview, Solomon said helium was "surprised" by the resiliency of the U.S. economy, and helium was seeing "green shoots" look aft a play of subdued superior markets activities.

English (US) ·

English (US) ·