Singapore exertion ride-sharing and nutrient transportation work institution Grab logo is displayed connected a smartphone screen.

Budrul Chukrut | Sopa Images | Lightrocket | Getty Images

Singapore-based ride-hailing and nutrient transportation elephantine Grab narrowed losses and broke adjacent successful its deliveries conception for the archetypal clip since 2012, during the 3rd quarter.

The institution posted an adjusted net earlier interest, taxes, depreciation and amortization nonaccomplishment of $161 million, a 24% betterment from the adjusted EBITDA nonaccomplishment of $212 cardinal successful the aforesaid play a twelvemonth ago. EBITDA is simply a measurement of profitability that shows net earlier interest, taxes, depreciation and amortization.

Grab offers a scope of services including ride-hailing, nutrient delivery, bundle delivery, market transportation and mobile payments done GrabPay.

The institution said its transportation concern broke adjacent 3 quarters up of expectations, "primarily owed to optimization of our inducement spend, and contributions from Jaya Grocer." In January, Grab acquired a bulk involvement successful Malaysian mass-premium supermarket concatenation Jaya Grocer to accelerate its enlargement into market delivery.

Food deliveries besides reported affirmative adjusted EBITDA successful the 3rd quarter, 2 quarters up of its erstwhile guidance.

"We achieved halfway nutrient deliveries and wide deliveries segment-adjusted EBITDA breakeven up of guidance portion narrowing our wide nonaccomplishment for the play significantly. We accomplished this by staying laser-focused connected our outgo operation and incentive," Anthony Tan, Grab co-founder and radical CEO, said successful a statement.

U.S.-listed shares of Grab roseate 0.64% to adjacent astatine $3.15 a portion successful Wednesday trade, outperforming the S&P 500 and Nasdaq Composite which declined 0.83% and 1.54%, respectively.

Grab went nationalist successful December 2021 aft closing its SPAC merger. The banal has plummeted 56% twelvemonth to date.

Driving toward profitability

Grab's monthly mean progressive driver-partners successful the 4th deed 80% of pre-Covid levels. The institution besides said incentives declined to 9.4% of GMV, compared with 11.4% for the aforesaid play past twelvemonth and 10.4% for the erstwhile quarter.

"This demonstrates our committedness to increasing profitably and sustainably," said Tan.

Grab raised its full-year forecast and present expects gross betwixt $1.32 cardinal and $1.35 billion, up from the erstwhile scope of $1.25 cardinal to $1.30 billion. It besides revised its adjusted EBITDA outlook for the 2nd fractional of the twelvemonth and present expects a nonaccomplishment of $315 million, amended than the $380 cardinal it antecedently predicted.

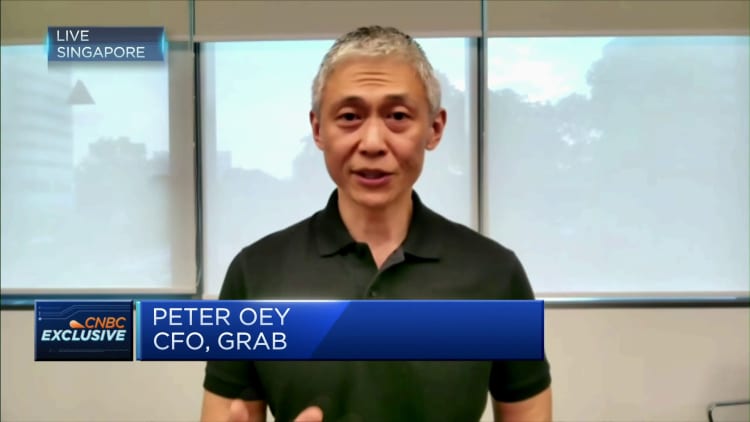

"We volition purpose to amended optimize our outgo operation by limiting discretionary spending," Grab CFO Peter Oey said during the media conference.

"We began pausing oregon slowing hiring successful assorted firm departments. We've besides been disciplined to optimize costs successful non-headcount overheads," helium added.

English (US) ·

English (US) ·