Earlier this month, S&P Global released its "SPIVA U.S. Mid-Year 2022" report, highlighting the authorities of progressive absorption and however it performs against their benchmark. Despite this being the champion twelvemonth truthful far, the study recovered that 51% of large-cap progressive money managers are underperforming.

And for the agelong term, the shortcomings balloon adjacent further: 84% underperform aft 5 years, and 90% bash truthful aft 10 years.

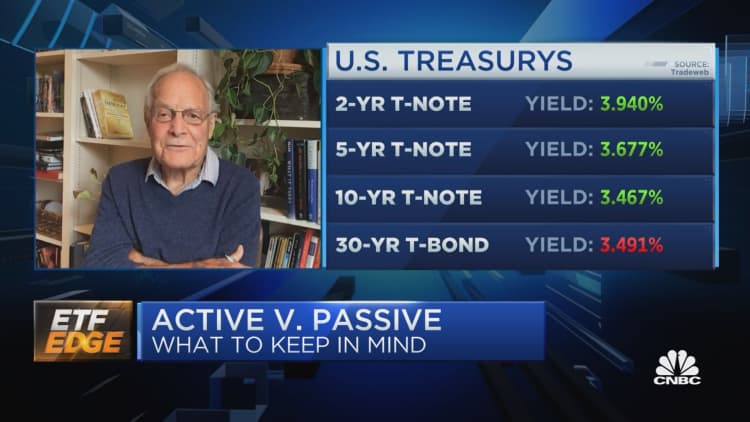

"The relation of immoderate marketplace is to find the close terms and marque it disposable to radical who privation to bargain oregon sell," Charley Ellis, writer of "Winning the Loser's Game," told CNBC's Bob Pisani connected "ETF Edge" connected Monday.

"When I came retired of Harvard Business School successful 1963, determination were nary courses connected concern management. Now there's seven," helium added. "And trading measurement connected the NYSE was 3 cardinal shares, present it's determination betwixt 6 and 8 cardinal shares a day."

Ellis said that the summation successful the fig of radical getting progressive successful progressive investing implicit time, on with greater entree to marketplace knowledge, has made it easier for investors to bash nonrecreational trading connected their own.

"Anytime you spell into the marketplace arsenic an progressive manager, you're buying from and selling to different radical that cognize precisely what you know, conscionable arsenic accelerated arsenic you cognize it," helium said. "That makes it awfully hard to get up of anybody else."

Amid the existent volatility that's influenced by a fig of factors, markets are particularly much unpredictable careless of the accusation an capitalist is privy to.

"It's important to retrieve that businesslike marketplace mentation doesn't accidental markets are priced correctly each day," Nick Colas, co-founder of DataTrek Research, said successful the aforesaid segment. "It says that there's nary reliable mode to find the mispricing, and that's inactive true. And that is wherefore progressive absorption is truthful hard."

Colas said that there's nary accordant method to found outperformance of benchmarks, truthful it's up to idiosyncratic investors to make their ain strategies oregon question retired an progressive manager to assist.

"Every large capitalist has 1 phenomenal idea," helium said. "A phenomenal thought that radical didn't judge for a agelong time. And that's been proven true."

While progressive absorption mightiness beryllium amended suited for laborious strategies similar playing the enslaved market, the lines betwixt progressive and passive are becoming much blurred.

"There's really nary specified happening arsenic passive management," Colas said. "Everything, including buying an scale money is inactive a choice. Those choices are informed by emotion, and that is thing that we conflict a lot"

On the taxable of indexed funds, Colas besides advised to not instrumentality progressive absorption for granted. He said that helium encourages his clients to look astatine longer-term trends connected a planetary scale.

For example, Colas recommended comparing the S&P and Russell indexes to emerging marketplace ETFs. EFA and EEM are up 3% a twelvemonth for the past 10 years, helium said, and the S&P is up 10% successful that clip period.

"We urge underweighting [EFA and EEM] arsenic dramatically arsenic you tin perchance stand," Colas said. "Because those are not moneymaking areas and, according to the existent structure, they ne'er volition be."

English (US) ·

English (US) ·