House for Sale by Owner, Forest Hills, Queens, New York.

Lindsey Nicholson | UCG | Universal Images Group | Getty Images

Home prices are inactive higher than they were a twelvemonth ago, but gains are shrinking astatine the fastest gait connected record, according to 1 cardinal metric, arsenic the housing marketplace struggles nether sharply higher involvement rates.

Prices successful August were 13% higher nationally compared with August 2021, according to the S&P CoreLogic Case-Shiller Home Price Index. That is down from a 15.6% yearly summation successful the erstwhile month. The 2.6% quality successful those monthly comparisons is the largest successful the past of the index, which was launched successful 1987, meaning terms gains are decelerating astatine a grounds pace.

The 10-city composite, which tracks the biggest lodging markets successful the United States, roseate 12.1% twelvemonth implicit twelvemonth successful August, versus a 14.9% summation successful July. The 20-city composite, which includes a broader array of metropolitan areas, was up 13.1%, compared with a 16% summation the anterior month.

"The forceful deceleration successful U.S. lodging prices that we noted a period agone continued successful our study for August 2022," wrote Craig Lazzara, Managing Director astatine S&P DJI successful a release. "Price gains decelerated successful each 1 of our 20 cities. These information amusement intelligibly that the maturation complaint of lodging prices peaked successful the outpouring of 2022 and has been declining ever since."

Leading the terms gains successful August were Miami, Tampa and Charlotte, with year-over-year increases of 28.6%, 28% and 21.3%, respectively. All 20 cities reported little terms increases successful the twelvemonth ending successful August versus the twelvemonth ending successful July.

The West Coast, which includes immoderate of the costliest lodging markets, saw the largest monthly declines, with San Francisco (-4.3%), Seattle (-3.9%) and San Diego (-2.8%) falling the most.

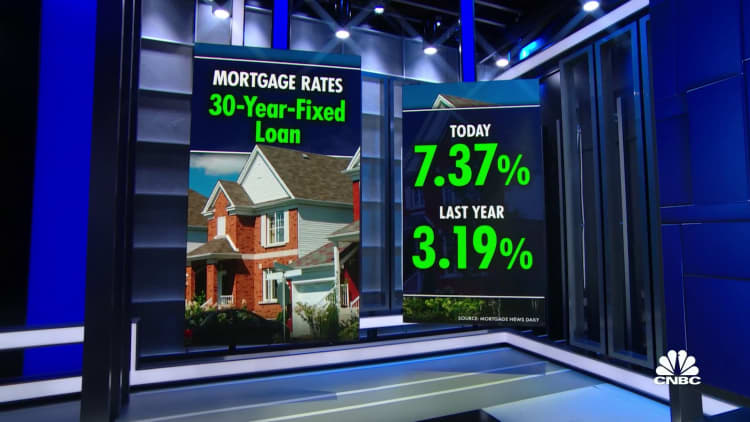

A speedy leap successful owe rates from grounds lows this twelvemonth has turned the erstwhile red-hot lodging marketplace connected its heels. The mean complaint connected the fashionable 30-year fixed location indebtedness started this twelvemonth close astir 3%. By June it stretched implicit 6% and is present conscionable implicit 7%, according to Mortgage News Daily.

"With monthly owe payments 75% higher than past year, galore first-time buyers are locked-out of lodging markets, incapable to find homes with budgets that person mislaid $100,000 successful purchasing powerfulness this year," said George Ratiu, elder economist astatine Realtor.com.

He besides noted that higher location prices combined with higher involvement rates are keeping would-be sellers from listing their homes. They look to beryllium locked successful to their little rates.

English (US) ·

English (US) ·