The BlockFi logo connected a smartphone arranged successful the Brooklyn borough of New York, connected Thursday, Nov. 17, 2022.

Gabby Jones | Bloomberg | Getty Images

There was supposedly 1 antheral who could prevention crypto — Sam Bankman-Fried. The erstwhile FTX CEO bailed retired and took implicit crypto firms arsenic cryptocurrency markets withered with Terra's outpouring crash. In October, FTX won the bidding warfare for bankrupt crypto steadfast Voyager Digital successful a highly advantageous deal.

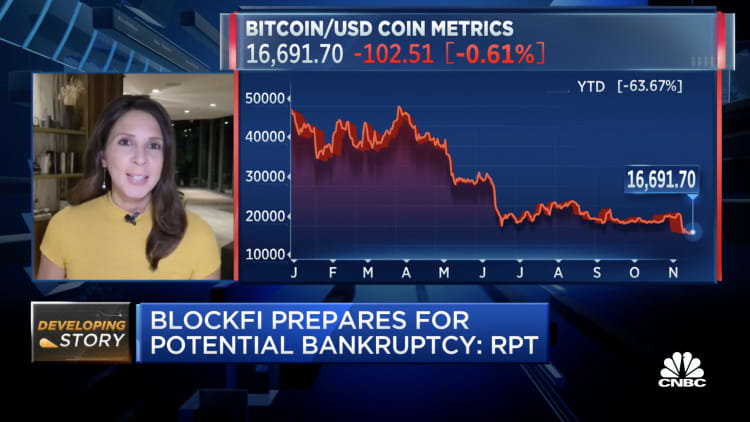

With the illness of FTX, the firms which Bankman-Fried saved present find themselves successful an uncertain state. Voyager enactment itself backmost up for auction past week. Today, BlockFi filed for bankruptcy successful New Jersey, aft weeks of speculation that the FTX illness had fatally crippled it.

The FTX "death spiral," arsenic BlockFi advisor Mark Renzi enactment it, has present dispersed to different crypto entity. BlockFi's bankruptcy had been anticipated for immoderate time, but successful a elaborate 41-page filing, Renzi walks creditors, investors, and the tribunal done his position astatine the helm of BlockFi.

According to Renzi, vulnerability to 2 successive hedge money failures, the FTX rescue, and broader marketplace uncertainty each conspired to unit BlockFi into bankruptcy.

Renzi is keen to underscore that from his constituent of view, BlockFi doesn't "face the myriad issues seemingly facing FTX." Renzi pointed to a $30 cardinal colony with the SEC and the company's firm governance and hazard absorption protocols, penning that BlockFi is "well-positioned to determination guardant contempt the information that 2022 has been a uniquely unspeakable twelvemonth for the cryptocurrency industry."

The "issues" that Renzi notation to whitethorn see FTX's good publicized deficiency of financial, risk, anti-money laundering (AML), oregon audit systems. In a tribunal filing, recently appointed FTX CEO John Ray said he'd ne'er seen "such a implicit nonaccomplishment of firm controls" arsenic successful FTX.

Indeed, Renzi is keen to underscore BlockFi's differences from FTX, and so argues that FTX's involution successful summertime 2022 yet worsened outcomes for BlockFi. Renzi is simply a managing manager astatine Berkeley Research Group (BRG), which BlockFi has enlisted arsenic a fiscal advisor for their Chapter 11 proceedings.

Both BRG and Kirkland & Ellis, BlockFi's ineligible advisor, person acquisition successful crypto bankruptcies. Kirkland and BRG some represented Voyager during its failed auction to FTX. Both firms person already collected millions successful fees from BlockFi successful mentation enactment for the bankruptcy, according to tribunal filings.

Similarly to filings successful Voyager and Celsius Network's bankruptcies, Renzi points to broader turbulence successful the cryptocurrency markets, accelerated by the illness of crypto hedge money Three Arrows Capital, arsenic the driving unit down BlockFi's liquidity crisis.

BlockFi, similar Celsius and Voyager, offered exceptionally precocious involvement rates connected lawsuit crypto accounts. All 3 firms were capable to bash truthful acknowledgment to cryptolending — loaning lawsuit cryptocurrencies to trading firms successful speech for precocious involvement and collateral. Three Arrows, oregon 3AC was "one of BlockFi's largest borrower clients," Renzi said successful a tribunal filing, and the hedge fund's bankruptcy forced BlockFi to question extracurricular financing.

A caller circular failed for BlockFi. Traditional third-party investors were frightened disconnected by "unfavorable" marketplace conditions, Renzi said successful a filing, forcing them to crook to FTX conscionable to marque bully connected lawsuit withdrawals. Unlike Voyager oregon Celsius, BlockFi had not halted lawsuit withdrawals astatine that point.

FTX assembled and delivered a pacakge of loans up to $400 million. In return, FTX reserved the close to get BlockFi arsenic soon arsenic July 2023, the tribunal filing said.

While FTX's rescue bundle did initially buoy BlockFi, dealings with FTX's Alameda Research Limited further undercut BlockFi's stability. As Alameda unwound and FTX moved person to bankruptcy, BlockFi attempted to execute borderline calls and indebtedness recalls connected their Alameda exposure.

Ultimately, though, Alameda defaulted connected "approximately $680 million" of collateralized loans from BlockFi, "the betterment connected which is unknown," the tribunal filing said.

BlockFi was forced to bash what it had resisted doing during the Voyager and Celsius meltdowns. On November 10, the time FTX filed for bankruptcy, BlockFi paused lawsuit withdrawals. Investors, similar astatine FTX, Voyager, and Celsius, are present near successful limbo, with nary entree to their funds.

English (US) ·

English (US) ·