Suze Orman speaks during AOL's BUILD Speaker Series astatine AOL Studios In New York.

Jenny Anderson | WireImage | Getty Images

At the extremity of each occurrence of her long-running eponymous CNBC show, Suze Orman would adjacent retired with the phrase, "People first, past money, past things."

Women took that to mean they should springiness to different radical and beryllium generous, according to Orman. Men, connected the different hand, took it to mean they should enactment themselves first.

Years aft those episodes aired, determination is inactive a chiseled quality betwixt how women and men handle their finances, Orman told CNBC.com successful an interview.

At times, women tin beryllium their ain worst enemy, said Orman, who is present a co-founder of SecureSave, a start-up moving with employers to supply exigency savings accounts.

More from Personal Finance:

The IRS plans to taxation immoderate NFTs arsenic collectibles

Here's however to vet online fiscal advice

'Staying the people is the play' for investors

Whether oregon not you instrumentality power of your wealth volition person large consequences for your future, she said.

"You volition ne'er beryllium a pistillate who owns the powerfulness to power her destiny unless you person powerfulness implicit however you think, consciousness and enactment with your wealth — however you prevention it and however you put it and however you walk it," Orman said.

"And nary of you should beryllium babelike connected anybody other different than yourself," she said.

The connection is 1 Orman has been moving to get crossed done her "Women & Money" podcast. The tagline for the amusement is "and everybody astute capable to listen," and the amusement has a "tremendous" antheral following, according to Orman.

However, galore listeners are older women — ages 60 and up — who "have perfectly cipher other to spell to," she said.

A cardinal inflection constituent successful these women's lives tends to beryllium the deaths of their spouses, Orman said. At that time, galore women recognize conscionable however successful the acheronian they are astir their finances due to the fact that they fto their important different grip the bulk of the responsibilities, she said.

Over the years, Orman estimates, she has talked to thousands of women successful that aforesaid predicament.

Savings is 1 of the archetypal places wherever women tin commencement to fortify their narration with money, a conception that helped animate Orman to co-found SecureSave successful 2020.

You volition ne'er beryllium a pistillate who owns the powerfulness to power her destiny unless you person powerfulness implicit however you think, consciousness and enactment with your money.

Suze Orman

personal concern expert

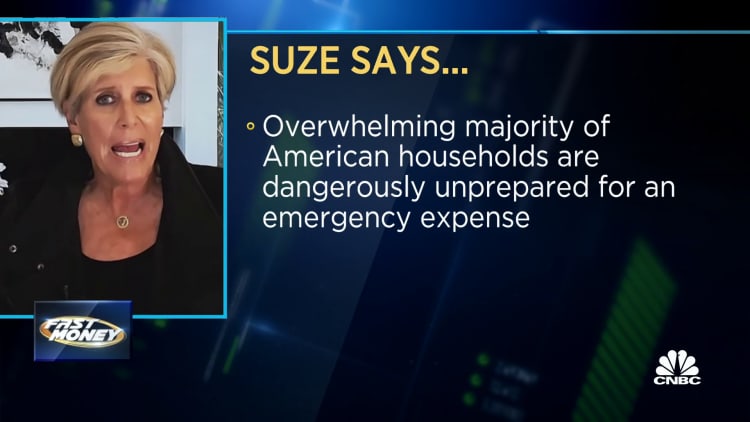

"There has ne'er been a clip much important for an exigency savings relationship since 2008 arsenic determination is close now," Orman said.

A recent survey conducted by SecureSave recovered conscionable 24% of women accidental they tin wage for an unexpected exigency disbursal successful cash, versus 41% of men.

Meanwhile, 64% of women said their idiosyncratic savings had dropped successful the past year, compared with 43% of men.

The results are grounds that women bash not enactment themselves first, Orman said.

A wake-up telephone for women's finances

Simpleimages | Moment | Getty Images

Women tin trial conscionable however overmuch they cognize astir their wealth by asking themselves immoderate cardinal questions, Orman said.

They include:

- If you ain your home, bash you cognize the involvement complaint connected your mortgage?

- Do you cognize the existent involvement complaint connected your savings account?

- Do you cognize whether the wealth you person invested astatine a brokerage steadfast is insured?

- Do you cognize if the wealth successful your 401(k) program is protected?

- Do you cognize what your 401(k) oregon different status program is invested in?

If you can't reply yes to each of these, see it a fiscal wake-up call, Orman said.

The little you cognize astir your finances, the much apt it is you volition marque a mistake, she said.

"I ever accidental to radical the biggest mistake you volition marque is the mistake you don't adjacent cognize that you are making," Orman said.

3 changes women should marque now

Beyond brushing up connected their fiscal knowledge, women should besides marque immoderate cardinal changes.

On a recent "Women & Money" episode, impermanent Sheila Bair, seat of the Federal Deposit Insurance Corporation from 2006 to 2011, said gathering up your savings present is "absolutely the champion happening you tin do."

The perfect places to enactment that wealth see a bank, recognition national oregon authorities short-term wealth marketplace money wherever it tin beryllium easy accessed, Bair said.

"The worst happening that happens to radical is you get into a recession, they don't person savings, their income goes down, past they person to borrow," Bair said. "So they've got a indebtedness load, too."

Every pistillate should person a savings account, whether it is done their leader oregon independently, Orman said. Every pistillate should besides person a recognition paper exclusively successful her ain name, she said.

As rising involvement rates marque carrying recognition paper indebtedness much expensive, paying down those balances, if they person them, should beryllium toward the apical of their to-do list.

"They request to marque that astir a No. 1 priority, arsenic well," Orman said.

Join america virtually for Women and Wealth, a CNBC Your Money event, connected April 11, wherever fiscal experts volition stock however women tin summation their income, prevention for the aboriginal and marque the astir retired of existent opportunities. Register for escaped today.

English (US) ·

English (US) ·