Coinbase's arguments successful its ineligible lawsuit against the U.S. Securities and Exchange Commission person been strengthened aft a cardinal tribunal ruling went partially successful favour of cryptocurrency steadfast Ripple, the U.S. exchange's ineligible main told CNBC connected Friday.

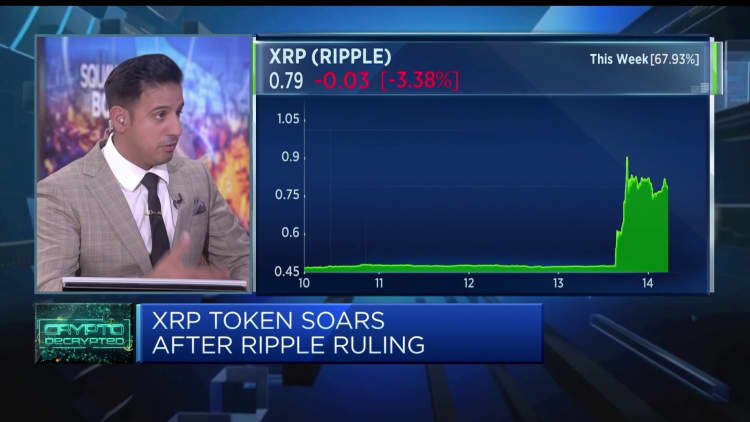

On Thursday, a U.S. justice ruled that XRP token purchases via exchanges were not securities transactions. The SEC sued Ripple, the institution down the XRP token, successful 2020, alleging that the institution broke securities laws.

The ruling was cheered by the cryptocurrency assemblage and peculiarly by exchanges, which consciousness the result volition assistance make immoderate much regulatory clarity.

One specified speech is Coinbase, which was sued successful June by the SEC connected charges of operating an unregistered speech and broker.

But the latest XRP tribunal sentiment has fixed assurance to Coinbase successful its lawsuit against the SEC.

"For exchanges, for tokens that are listed connected exchanges, for regular investors, there's nary question that this ruling strikes a stroke to the thought that someway securities are being traded erstwhile radical spell onto exchanges and commercialized the assets," Paul Grewal, main ineligible serviceman astatine Coinbase, told CNBC successful a TV interrogation connected Friday.

"I deliberation we volition win. Now, I thought we would triumph earlier this decision. We deliberation this determination has lone further strengthened the case," helium added.

Part of Coinbase's optimism stems from the determination regarding XRP not being a security. If XRP isn't designated such, determination is anticipation that hundreds of different cryptocurrencies volition besides not beryllium taxable to information laws.

"I deliberation it would beryllium a mistake to presume that, successful each instance, and successful each transaction, the securities laws bash not apply. That's ne'er been Coinbase's position, I don't deliberation it should beryllium anyone's tenable position. But if you virtually replaced the letters XRP with the letters for immoderate different token, successful this decision, the logic inactive holds," Grewal said.

However, different portion of the judgement really deemed it a securities transaction to merchantability XRP specifically to blase investors oregon organization clients.

Coinbase has been trying to turn its ain organization trading platform. Grewal shrugged disconnected this portion of the case, due to the fact that it related precisely to however Ripple sold XRP to organization clients.

"I deliberation each investors, organization and retail, tin instrumentality large comfortableness from the information that, erstwhile it comes to speech trading, wherever determination is arm's magnitude dealing, the tribunal has made it precise clear, these tokens are not being traded arsenic securities," Grewal said.

SEC slammed

Whether oregon not cryptoassets are securities is an important question with respective implications. If they are deemed securities, past they would request to registry with the SEC and would person strict disclosure requirements. It would besides springiness the SEC the powerfulness to oversee these assets and related firms, specified arsenic cryptocurrency exchanges.

The SEC has maintained that astir cryptocurrencies are securities — but the determination connected XRP appeared to weaken its argument.

The crypto manufacture has had heated words for the SEC implicit the past month, accusing the bureau of regulating by enforcing, alternatively than by moving with the industry.

Pavlo Gonchar | Lightrocket | Getty Images

Tyler Winklevoss, the co-founder of cryptocurrency speech Gemini that is besides taxable to a SEC lawsuit, called the regulator a "failed institution."

Coinbase's Grewal said helium did not deliberation the SEC was waging an ideological conflict against the cryptocurrency industry, but that each actions were done successful "good faith." However, helium added, "they've been wrong."

"What determination has been I think, is simply a nonaccomplishment of enactment to travel tenable engagement with the manufacture and with different stakeholders, alternatively than resorting to court," Grewal said, calling for "new rules to woody with a caller technology."

English (US) ·

English (US) ·