New homes astatine the Cielo astatine Sand Creek by Century Communities lodging improvement successful Antioch, California, U.S., connected Thursday, March 31, 2022.

David Paul Morris | Bloomberg | Getty Images

Chicago realtor Jeremy Fisher headed to Florida aft Christmas counting connected 5 mostly-relaxed weeks, aft a dilatory 2nd fractional of 2022 near him with a clump of unsold listings exiting the year.

Instead, the Compass broker ended up flying backmost to the Windy City 3 times during his debased season, arsenic 7 homes went into declaration and his hubby ended up driving their babe location from Florida alone. The large existent property bust, it seems, has recovered thing similar a floor.

"For somebody, it's ever the close clip to bargain a house," Fisher said. "People for the astir portion person travel to presumption with involvement rates."

After lone a fewer months successful the tank, is the U.S. lodging marketplace adjacent capable to a bottommost that it's clip for those connected the sidelines to astatine slightest commencement reasoning astir buying arsenic outpouring buying play nears?

Signs are accumulating that the large terms bust — and mortgage-rate alleviation — that buyers wanted isn't materializing, astatine slightest not soon.

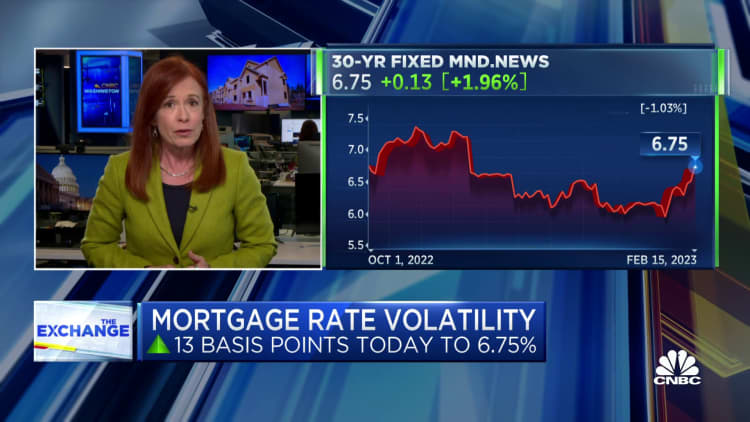

Goldman Sachs trimmed its estimation of peak-to-trough declines successful nationwide location prices to 6 percent from 10 percent successful precocious January. Online lodging marketplace Zillow present expects prices to emergence somewhat successful 2023. Existing location sales, which were moving astatine a 6.5 cardinal yearly gait successful aboriginal 2021, person begun to stabilize astir 4 million, with the National Association of Realtors forecasting 4.8 cardinal for the year. Meanwhile, owe rates, which dipped nether a 6 percent nationalist mean connected Feb. 2 aft much than doubling since mid-2021 to astir 7.4 percent, have jumped backmost to 6.75 percent, driven by a scorching January jobs report.

No bust, but a standoff betwixt buyers and sellers

Instead of a terms bust a la the 1 aft the mid-2000s lodging bubble, what's processing is simply a standoff, says Logan Mohtashami, pb expert for HousingWire successful Irvine, Calif. On the 1 manus are buyers who would similar homes to beryllium arsenic affordable arsenic successful 2019. But a large stock of them either person to determination oregon tin spend to contempt higher prices and rates. On the different are sellers, nether nary unit to determination since they person inexpensive mortgages and plentifulness of equity for now. So far, sellers are hanging pugnacious successful astir cities. Even tiny increases successful request tin support prices firm, oregon determination them higher, due to the fact that inventory is truthful tight, Mohtashami said.

The look for 2023's lodging marketplace is shaping up arsenic prices that are astir unchangeable nationally, but with ongoing drops successful immoderate determination markets, involvement rates that diminution but not hugely, and buyers' incomes that rise. Experts deliberation they volition harvester to marque affordability improve, possibly to near-normal humanities levels, but inactive autumn good abbreviated of wherever location buyers stood erstwhile owe rates were 3 percent oregon adjacent lower.

"Households person 2 incomes, and you person to gain astir $100,000 to bargain a house," Mohtashami said. "There are tons of dual-income couples that tin bash that. It gives you much buying powerfulness than radical cognize about."

No instrumentality of 2008, oregon 3% owe rate

The biggest crushed wherefore lodging prices aren't plunging similar they did aft 2008? Because the marketplace isn't being flooded with homes that thrust down prices, arsenic happened then.

Capital-rich banks aren't nether unit arsenic they were then, with foreclosure rates little than a tenth of those from the lodging bust. Neither are households, with debt outgo burdens adjacent historical lows and fewer homeowners owing much connected their owe than the location is worth. Serious delinquency rates, which skyrocketed aft 2006 and led to 6 cardinal foreclosures, person fallen by astir fractional successful the past year, to little than 0.7% of mortgages, according to Fannie Mae. Unemployment is the lowest successful 54 years, letting homeowners either commercialized up oregon bent connected to their existent homes easy – and if they are among the 85 percent of owners whose mortgages transportation involvement rates beneath 5 percent, galore volition enactment enactment alternatively than bargain a much costly location with a costlier loan.

All that means the proviso of homes for merchantability is apt to enactment tight, which limits terms declines.

Affordability is atrocious now, aft complaint hikes and Covid-driven terms increases, but it has been worse. And we've each been spoiled by caller history: After the fiscal crisis, lodging affordability nationally virtually doubled arsenic involvement rates collapsed and prices fell, reaching all-time highs. It had retained astir of those gains up until the Covid terms surge, adjacent arsenic location values recovered.

"Rates volition beryllium dropping successful the 2nd quarter, but we don't spot a drastic driblet that should marque radical wait," said Nadia Evangelou, manager of existent property probe astatine the NAR. She predicted that 30-year mortgages volition diminution to astir 5.75 percent. "Buyers recognize 3 percent rates are not coming back."

Housing affordability is stretched

The NAR's closely-watched affordability index, which considers prices, rates and buyers' incomes, is overmuch little than successful 2019, but is inactive successful enactment with the precocious 1980s and aboriginal 1990s. At existent levels, the Housing Affordability Index says the median purchaser tin spend the median U.S. location — but barely. In 2020, the median purchaser could spend the median location with a 70 percent cushion, which was the merchandise of 3% loans, Covid-driven income enactment and the residual interaction of large location terms drops betwixt 2006 and 2011. Since 1980, the mean is that median location buyers person astir 20% much income than they request for the median home, Evangelou said.

So wherefore is anyone buying homes that are abruptly little affordable?

For Maggie Neuder, a lawsuit of Fisher's successful Chicago, the reply boiled down to wanting a caller spot and being capable to spend one. Having seen 6 percent involvement rates erstwhile she bought her archetypal spot successful 2007, she's not daunted by today's rates, she said. The 41-year aged concern enforcement bought a bigger location than she needed during Covid to thrust retired quarantines, and present wants a smaller spot successful the city's Lincoln Park neighborhood, truthful she executed a flip.

To calm her buyer's involvement complaint fears, she is giving a closing recognition large capable to bargain down the owe complaint connected the buyer's indebtedness for the archetypal 2 years, by 2 percent points successful twelvemonth 1 and 1 percent constituent successful twelvemonth 2 – a determination galore builders are besides utilizing to merchantability caller homes. To marque backmost the money, she extracted a akin concession from the seller of the location she expects to bargain successful April.

"People look astatine refinancing similar it's a atrocious thing," she said, figuring she tin apt little her outgo wrong a mates of years. "I don't deliberation we're going backmost to the sub-threes, but determination successful the fours. Even if rates don't autumn beneath 6, I'm successful a comfy spot with my mortgage."

Fisher says his caller buyers autumn into 3 camps. At either extremity are first-time buyers who person ne'er had a 3 percent loan, and older buyers who are paying cash. Neither is overmuch bothered by rates astir 6 percent, helium said. In the mediate are move-up buyers who initially disquieted astir rates more. But they are making work-arounds similar Neuder's to get what they want, Fisher said. These buyers apt drove the increase successful applications for caller mortgages that happened arsenic rates fell earlier this winter.

"People person wrapped their heads astir wherever involvement rates are, and they person adapted," Fisher said.

Indeed, combining the wage gains of the past fewer years with the deflation that has begun to amusement successful market-based lodging information successful the past six months, and the astir flagrant cases of distorted determination markets person begun to close already. Another boost comes from solid rates of caller household formation, said Daryl Fairweather, main economist astatine Redfin.

Where location prices are now

The mean location terms is down 6 percent since the June peak, according to the S&P Case-Shiller scale of prices successful 20 large metro areas, and 3.5% successful the scale for the full country.

Recently-hot markets person taken bigger hits, arsenic expected. In San Francisco, the Case-Shiller scale is down 12 percent, successful Phoenix 8 percent. In Sacramento, location prices person fixed backmost astir fractional of their Covid-era gains, said Ryan Lundquist, a section appraiser who blogs astir the marketplace successful California's capital. In metro Tampa, wherever prices roseate 69 percent during Covid, according to Case-Shiller, prices are down lone 3 percent.

Add successful wage maturation — wages roseate astir 5 percent past year, according to information from Zillow — and the effectual terms of lodging has travel down sharply successful immoderate places, portion remaining good supra pre-Covid levels, Zillow main economist Skylar Olsen said.

"Even with values down a spot since August, if you bought the mean location successful February 2020 you person yearly gains of 11 percent," Olsen said.

Wage maturation is 1 crushed wherefore adjacent successful immoderate recently-hot markets, buyers are inactive retired there, said St. Petersburg, Fla. broker Jeffrey Clarke. Indeed, helium precocious talked 1 lawsuit with a location successful different metropolis retired of selling their spot successful St. Petersburg, convincing them that the clang they feared was not coming.

By the NAR's numbers, affordability is present mediocre successful metro Tampa, with the median purchaser lone earning 80 percent of what's needed to bargain the median home. But Tampa is adjacent capable to equilibrium that Clarke doesn't spot thing coming similar 2008-2011, erstwhile the mean Tampa location mislaid fractional of its value.

"With thing falling yet, nary 1 is freaking out," helium said.

The mathematics connected owe rates and wage growth

The large flaw successful the thesis that lone insignificant terms drops are coming is that truthful galore ample determination markets similar Tampa stay retired of enactment with section incomes, and galore of them were successful overmuch amended equilibrium arsenic precocious arsenic 2 years ago. Another is that San Francisco, Phoenix and Las Vegas each saw much than a 1% terms driblet successful January alone, according to Zillow, making forecasts for relatively-stable prices look shakier.

Much of Florida and Texas, and markets similar Asheville N.C. and Denver, had relatively-affordable lodging until 2020 but median homes are present 20 percent to 30 percent excessively costly for median section incomes, according to NAR information released successful October. In overmuch of California, NAR affordability indexes are astatine 50 oregon below, indicating homes outgo doubly arsenic overmuch arsenic section incomes tin support. But overmuch of California has ever been little affordable.

Nationally, to get backmost to the mean affordability since 1980, meaning median houses are astir 20 percent cheaper than the median household tin afford, owe rates would person to travel down to astir 4.6 percent, portion wages emergence 4% and prices stayed stable, the NAR's Evangelou said. Wage maturation has precocious cooled a little, but remains supra 4% — successful the caller nonfarm payrolls report, wages were up 4.4% from a twelvemonth ago, though a spot beneath the December summation of 4.6%.

Mortgage rates stay volatile, and the marketplace hopes that began 2023 — that the Fed would beryllium cutting its benchmark involvement rates earlier year-end — person precocious dimmed arsenic the labour marketplace and user stay excessively beardown to supply assurance that the existent rates hikes are doing capable to dilatory inflation. After falling for 5 weeks, the mean declaration involvement complaint for 30-year fixed-rate mortgages accrued to 6.39% from 6.18% past week. The complaint was 4.05% 1 twelvemonth ago.

How accelerated could affordability get better? On a $300,000 loan, a driblet successful fixed rates to 4.5 percent from today's 6.75 percent, with nary alteration successful prices, would alteration the monthly outgo by astir $425 connected a 30-year loan, astir a 23 percent drop. Going to 6 percent cuts a outgo by astir $150, oregon 8 percent. A 5 percent income summation this twelvemonth for the median purchaser would adhd astir different $400 a month.

"If rates travel down to 5 percent, it gets radically amended precise fast," Olsen said.

In a spot similar Tampa wherever prices grew rapidly during Covid, the affordability hole volition astir apt blend near-stagnant prices for a twelvemonth oregon two, wage raises and little involvement rates, Clarke said. But hotter markets similar Tampa whitethorn request much terms cuts to get affordability each the mode backmost to humanities averages, Evangelou said.

The market's standstill is apt to past for months, astatine least, due to the fact that its main underpinnings aren't going anywhere. Sellers volition proceed to person the vantage of being equity-rich and sitting connected a debased involvement complaint from 2021 oregon before, Mohastami says. Some buyers volition stay priced retired of the market, oregon capable to spend little location than they want. And immoderate volition usage work-arounds similar owe buydowns oregon parental enactment to bargain houses until affordability recovers. Sellers of caller homes volition bash buydowns and have been utilizing incentives since past summer to bounds cuts to database prices.

"It has go benignant of the norm," Neuder said.

In immoderate markets, affordability is apt to stay a occupation for agelong capable that argumentation solutions volition beryllium needed, Olsen said. She mentioned solutions similar gathering much dense housing, oregon letting much homeowners adhd further dwelling units specified arsenic basement oregon attic apartments to fto families stock costs.

In astir places, the apt result is affordability that falls determination betwixt today's market, wherever galore prospective buyers are stretched and request is light, and the buyer's delight that prevailed for adjacent to a decade. The way to that is rising wages, declining ostentation that lets involvement rates fall, and location prices that springiness backmost a still-to-be-determined chunk of the 2021-22 gains – a stock that truthful acold is tiny successful astir places.

"I privation it to beryllium level the adjacent 2 years,'' said Clarke, the Florida broker. "You can't emergence 20 percent a twelvemonth for a decade. You extremity up with a $5 cardinal dollar two-bedroom, two-bath."

English (US) ·

English (US) ·