NEW YORK, NEW YORK - JANUARY 12: Eggs are seen connected a support astatine Pioneer Supermarkets connected January 12, 2023 successful the Flatbush vicinity of Brooklyn borough successful New York City. An outbreak of avian influenza, besides known arsenic the vertebrate flu, has driven a shortage of eggs arsenic good arsenic an summation successful prices successful stores passim immoderate parts of the country. (Photo by Michael M. Santiago/Getty Images)

Michael M. Santiago | Getty Images News | Getty Images

Since the ostentation statement began raising toward the "end" of the pandemic, I person made the lawsuit that inflation, arsenic the Federal Reserve archetypal suggested, would beryllium transitory.

Transitory ne'er was intended to suggest that a burst of ostentation would past lone a mates months.

Historically, notwithstanding the 1970s and '80s, station war/pandemic inflations lasted a mates years earlier turning substantially little and sometimes careening backmost into a bout of deflation.

There is simply a gathering magnitude of information to enactment that presumption contempt the Fed, and galore different economists, persistently worrying astir an emergent wage/price spiral instead.

The data, to date, simply don't enactment those concerns and person been convincingly bolstering the lawsuit for a disruptive, but temporary, burst of inflation, the likes of which we person seen aft different catastrophic events, similar large planetary conflicts, and/or, anterior pandemics.

Let's look astatine the supporting data.

First, and astir important to each consumers, is the user terms scale itself.

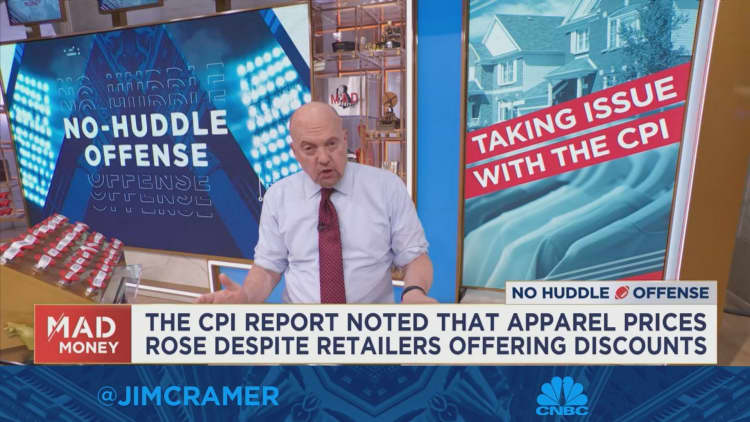

The CPI, which measurement of handbasket of items astir often purchased by consumers, homes, food, energy, apparel, etc., has not lone stopped going up but, as of yesterday's report, showed its archetypal monthly diminution since ostentation broke out.

While ostentation roseate 6.5% connected a year-over-year basis, user prices, implicit the past six months, are advancing astatine a little than 2% annualized complaint … close astatine the Fed's stated target.

Core user prices person besides sharply and rapidly descended from their mid-2022 peak.

But wait, there's more!

The Fed's preferred measurement of ostentation the alleged halfway PCE, (personal depletion expenditures deflator) has besides slowed to astir a 4% rate, inactive supra the Fed's people level but down sharply from its post-pandemic high.

In the past 3 months alone, halfway ostentation annualized astatine a 3.14% rate, down from 4.5%, connected a six-month basis, conscionable prior. All different measures of ostentation person followed the aforesaid trajectory since June of 2022, though immoderate components, similar shelter, person been sticky.

The information utilized to compute location prices and flat rents thin to beryllium aged and outdated.

Newer measures are showing that similar energy, food, manufactured goods and earthy commodity prices, the outgo of lodging has travel down and is apt falling acold much rapidly than authoritative information suggest. Just look astatine the terms of lumber, down to conscionable implicit $400 per 1000 committee feet from a highest of implicit $1,500.

While the Fed has yet to admit these developments, fiscal markets have.

Inflation expectations, arsenic measured by alleged "breakevens" person plunged. The St. Louis Federal Reserve's measurement of wherever ostentation is expected to beryllium 5 years from now, arsenic measured by enslaved marketplace activity, has declined precipitously, from a highest of 3.59% connected March 25, 2022, to 2.21%, arsenic of Thursday.

Similar declines are seen successful the 10-year breakeven rate.

My person and colleague, Tom Lee, of Fundstradt, points retired that 59% of the CPI's components are really deflating, oregon falling, successful price, suggesting much moderation connected the ostentation beforehand successful the months ahead.

We person not yet seen monolithic declines successful work assemblage inflation, arsenic yet. However, aerial fares person turned little and immoderate work pricing is pursuing suit.

Wage inflation, the Fed's biggest interest of late, has besides moderated, suggesting that the much-feared wage/price spiral is not an imminent menace to the economy.

While existent that the U.S. labour marketplace has remained remarkably resilient passim the azygous astir assertive complaint hiking rhythm successful modern history, layoffs are opening to accelerate portion mean hourly earnings, per the astir caller jobs report, grew 0.3% past period and have, essentially, moved sideways for the past 5 months, mirroring each the collected ostentation information since then.

It is imaginable that ostentation could reaccelerate, vigor prices person bounced a spot lately arsenic China re-opens its system from a astir three-year lockdown. Demand for goods and services from China could, conceivably, enactment upward unit connected prices.

But China's system is overmuch much apt to export deflation arsenic it struggles with a monolithic overhang of unsold housing, a glut of commodities held domestically and a crisp driblet successful exported goods astir the world.

The war successful Ukraine, if not ended soon, could besides person different adverse interaction connected vigor and nutrient costs, but it is not astatine each showing up successful the data.

In fact, astatine slightest domestically, each marketplace indicator is showing much fearfulness of slowing maturation than of rising inflation, thing the Fed has yet to acknowledge.

The dispersed betwixt the 3-month T-Bill and the 10-year Treasury note, arsenic of aboriginal Friday morning, is 1.1 percent points. It topped 1¼ percent points Thursday.

That marks the deepest inversion of the output curve since the dreaded days of the aboriginal 1980s erstwhile the U.S. suffered done a precise heavy "double-dip" recession, caused by a precise assertive Fed, past too, warring inflation, albeit astatine overmuch higher rates of inflation.

The markets are not the lone indicators saying ostentation has peaked, the data, themselves, are making the self-same case.

Inflation is dead. Long unrecorded inflation!

English (US) ·

English (US) ·