Alistair Berg | Digitalvision | Getty Images

Death and taxes are, arsenic Benjamin Franklin famously declared, 2 of life's certainties.

Investment fees whitethorn beryllium a worthy summation to that database successful the modern epoch — though not each investors are alert of this near-universal fact.

The fees fiscal services firms complaint tin beryllium murky.

One-fifth of consumers deliberation their concern services are escaped of cost, according to a caller Hearts & Wallets survey of astir 6,000 U.S. households. Another 36% reported not knowing their fees.

A abstracted poll conducted by the Financial Industry Regulatory Authority Investor Education Foundation likewise recovered that 21% of radical judge they don't wage immoderate fees to put successful non-retirement accounts. That stock is up from 14% successful 2018, the past clip FINRA issued the survey.

More from Personal Finance:

Prioritizing retirement, exigency savings successful shaky economy

Bank situation causing recession whitethorn beryllium connected 'wealth effect'

The IRS plans to taxation immoderate NFTs arsenic collectibles

The wide ecosystem of fiscal services companies doesn't enactment for free. These firms — whether an concern money oregon fiscal advisor, for illustration — mostly levy concern fees of immoderate kind.

Those fees whitethorn mostly beryllium invisible to the mean person. Firms disclose their fees successful good people but mostly don't inquire customers to constitute a cheque oregon debit wealth from their checking accounts each month, arsenic non-financial firms mightiness bash for a subscription oregon inferior payment.

Instead, they retreat wealth down the scenes from a customer's concern assets — charges that tin easy spell unnoticed.

"It's comparatively frictionless," said Christine Benz, manager of idiosyncratic concern astatine Morningstar. "We're not conducting a transaction to wage for those services."

"And that makes you overmuch little delicate to the fees you're paying — successful magnitude and whether you're paying fees astatine all."

Small fees tin adhd up to thousands implicit time

Investment fees are often expressed arsenic a percent of investors' assets, deducted annually.

Investors paid an mean 0.40% interest for communal and exchange-traded funds successful 2021, according to Morningstar. This interest is besides known arsenic an "expense ratio."

That means the mean capitalist with $10,000 would person had $40 withdrawn from their relationship past year. That dollar interest would emergence oregon autumn each twelvemonth according to the concern balance.

The percent and dollar magnitude whitethorn look innocuous, but adjacent tiny variations successful fees tin adhd up importantly implicit clip owed to the powerfulness of compounding. In different words, successful paying higher fees an capitalist loses not lone that other wealth but the maturation it could person seen implicit decades.

It's comparatively frictionless. We're not conducting a transaction to wage for those services.

Christine Benz

director of idiosyncratic concern astatine Morningstar

The bulk — 96% — of investors who responded to FINRA's survey noted their main information for investing is to marque wealth implicit the agelong term.

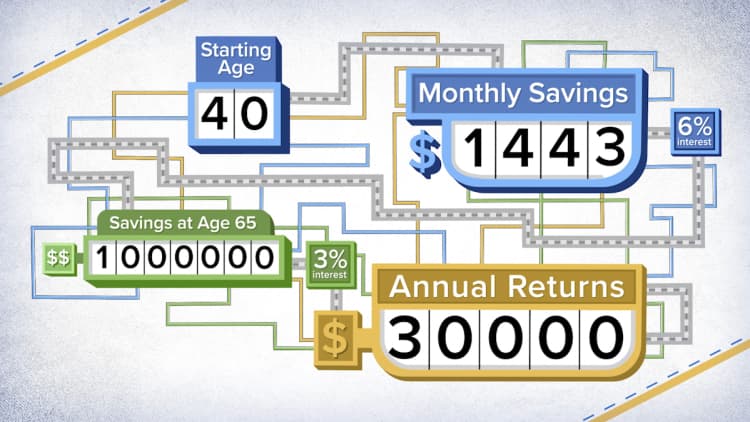

The Securities and Exchange Commission has an example to show the semipermanent dollar interaction of fees. The illustration assumes a $100,000 archetypal concern earning 4% a twelvemonth for 20 years. An capitalist who pays a 0.25% yearly interest versus 1 paying 1% a twelvemonth would person astir $30,000 much aft 2 decades: $208,000 versus $179,000.

That dollar sum mightiness good represent astir a year's worthy of portfolio withdrawals successful retirement, springiness oregon take, for idiosyncratic with a $1 cardinal portfolio.

In all, a money with precocious costs "must execute amended than a low-cost money to make the aforesaid returns for you," the SEC said.

Fees tin impact moves specified arsenic 401(k) rollovers

Fees tin person a large fiscal interaction connected communal decisions specified arsenic rolling implicit wealth from a 401(k) program into an idiosyncratic status account.

Rollovers — which mightiness hap aft status oregon a occupation change, for illustration — play a "particularly important" relation successful opening traditional, oregon pretax, IRAs, according to the Investment Company Institute.

Seventy-six percent of caller accepted IRAs were opened lone with rollover dollars successful 2018, according to ICI, an relation representing regulated funds, including mutual funds, exchange-traded funds and closed-end funds.

10'000 Hours | Digitalvision | Getty Images

About 37 cardinal — oregon 28% — of U.S. households ain accepted IRAs, holding a corporate $11.8 trillion astatine the extremity of 2021, according to ICI.

But IRA investments typically transportation higher fees than those successful 401(k) plans. As a result, investors would suffer $45.5 cardinal successful aggregate savings to fees implicit 25 years, based lone connected rollovers conducted successful 2018, according to an analysis by The Pew Charitable Trusts, a nonpartisan probe organization.

Fees person fallen implicit time

This yearly interest operation isn't needfully the lawsuit for each investors.

For example, immoderate fiscal planners person shifted to a flat-dollar fee, whether an ongoing subscription-type interest oregon a one-time interest for a consultation.

And immoderate interest models are different. Investors who bargain azygous stocks oregon bonds whitethorn wage a one-time upfront committee alternatively of an yearly fee. A uncommon fistful of concern funds whitethorn charge thing astatine all; successful these cases, firms are apt trying to pull customers to past cross-sell them different products that bash transportation a fee, said Benz of Morningstar.

Here's the bully quality for galore investors: Even if you haven't been paying attraction to fees, they've apt declined implicit time.

Fees for the mean money capitalist person fallen by fractional since 2001, to 0.40% from 0.87%, according to Morningstar. This is mostly owed to investors' preferences for low-cost funds, peculiarly alleged scale funds, Morningstar said.

Michaelquirk | Istock | Getty Images

Index funds are passively managed; alternatively of deploying stock- oregon bond-picking strategies, they seek to replicate the show of a wide marketplace index specified arsenic the S&P 500 Index, a barometer of U.S. banal performance. They're typically little costly than actively managed funds.

Investors paid an mean 0.60% for progressive funds and 0.12% for scale funds successful 2021, according to Morningstar.

Benz recommends 0.50% arsenic a "good precocious threshold for fees." It whitethorn marque consciousness to wage much for a specialized fund oregon a tiny money that indispensable complaint much each twelvemonth owed to smaller economies of scale, Benz said.

A higher interest — say, 1% — may besides beryllium tenable for a fiscal advisor, depending connected the services they provide, Benz said. For 1%, which is simply a communal interest among fiscal advisors, customers should expect to get services beyond concern management, specified arsenic taxation absorption and broader fiscal planning.

"The bully quality is astir advisors are so bundling those services together," she said.

English (US) ·

English (US) ·