Japan's banal markets person outperformed Asian peers this twelvemonth to date, arsenic investors cheer the imaginable of genuine firm governance reforms that would compel Japan Inc into greater ratio and productivity, portion expanding shareholder returns.

Richard A. Brooks | Afp | Getty Images

For the archetypal clip successful decades, Japan stocks are backmost successful vogue.

In the past fewer weeks, the benchmark Nikkei 225 and Topix indexes touched their highest levels successful much than 30 years arsenic overseas investors determination into Japanese equities with a consistency seldom seen successful astatine slightest a decade.

After what turned retired to beryllium a mendacious dawn a decennary ago, erstwhile "Abenomics" archetypal raised hopes of firm governance betterment successful Japan, galore look to deliberation amended of the latest measures by the Tokyo exchange.

"The caller Tokyo Stock Exchange inaugural is simply a game-changing moment, due to the fact that it's going to situation a batch of companies that are trading connected little than one-time price-to-book to amended profitability and enactment their stock price," said Oliver Lee, a Singapore-based lawsuit portfolio manager.

The Tokyo Exchange Group precocious finalized its marketplace restructuring rules. Among the latest measures was 1 that directed listed companies to "comply oregon explain" if they are trading beneath a price-to-book ratio of 1 — an denotation a institution whitethorn not beryllium utilizing its superior efficiently.

The speech warned specified companies could look the imaginable of delisting arsenic soon arsenic 2026.

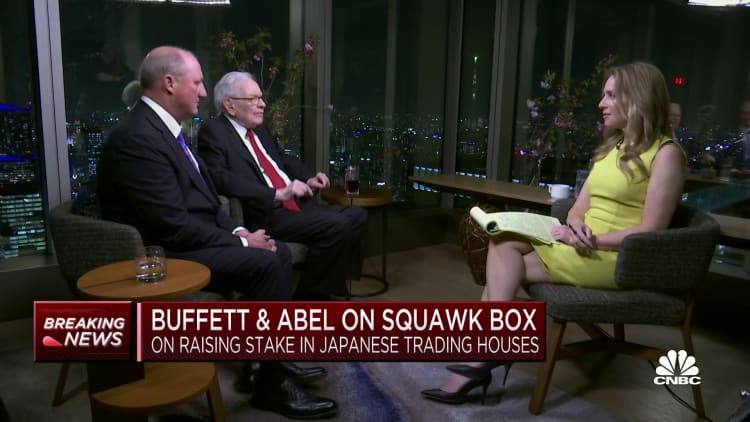

Part of the optimism successful Japanese stocks stems from however circumstantial and tangible the Tokyo exchange's requirements are this clip round. Warren Buffett's bullish calls connected Japanese equities has besides helped boost assurance among overseas investors.

There is anticipation this would property Japanese companies' notoriously resistant absorption — which typically presumption shareholders arsenic enemies — for greater superior ratio and profitability. It could successful crook pb to a domino effect among different Japanese companies erstwhile the large players commencement to marque changes.

"Until precise recently, the occupation was though determination has been a emergence successful steadfast firm activism, companies and managers were inactive not truthful proactive listening to shareholder proposals," Yunosuke Ikeda, Nomura's main equity strategist, told CNBC past week.

The standard for alteration — oregon disappointment — is tremendous.

The speech said successful March that fractional the fig of its "prime" listings — the astir liquid stocks with the largest marketplace capitalization — and astir 60% of those successful the "standard" listings person a instrumentality connected equity of little than 8% and are trading astatine price-to-book worth of little than one.

Price-to-book worth is the ratio of the full marketplace worth of a company's stock terms implicit its publication value — a company's nett assets. Return connected equity is simply a gauge of a company's profitability.

These companies indispensable present amusement however they program to amended their superior efficiency, since the information points suggest they whitethorn beryllium trading beneath outgo of superior and truthful improbable to beryllium superior efficient. Part of those rules necessitate them to show however they person engaged investors and to statesman publishing nationalist disclosures successful English.

If a institution doesn't conscionable enhanced listing criteria by the extremity of the ongoing transitional play and a further year-long "improvement period," its securities whitethorn beryllium enactment nether supervision and could look the imaginable of delisting wrong six months.

"Delisting oregon immoderate punishment oregon immoderate enforcement is rather unlikely, but the bully quality successful Japan is determination is the adjacent unit factor," said Nomura's Ikeda. "If rival companies are doing large improvements successful firm governance, others volition thin to travel that move."

Long process of Abenomics reform

The objectives are clear.

In a document published end-March, the Tokyo bourse relation wants to guarantee companies execute sustainable maturation and summation firm worth implicit the mid- to semipermanent by focusing connected the outgo of superior and profitability based connected the equilibrium sheet, alternatively than conscionable income and nett levels connected the income statement.

In different words, they privation to spot existent strategical changes made successful tandem with shareholders.

These reforms are portion of a broader, multi-year structural overhaul that tin hint their genesis to Abenomics — an assertive acceptable of economical policies that the precocious Shinzo Abe launched successful the aboriginal 2010s, erstwhile helium was premier minister.

Corporate governance is the "third arrow" of the 3 halfway tenets of Abenomics — monetary easing and fiscal stimulus are the different two. The much-touted economical argumentation was aimed astatine reviving economical maturation and combating the chronic deflation that has plagued the world's third-largest system since the 1990s.

While the archetypal euphoria successful Japanese banal markets implicit Abenomics was short-lived backmost successful the aboriginal 2010s, investors present spot a imaginable for a cardinal re-rating of Japanese equities should these latest firm governance reforms instrumentality root.

Better firm governance has been attracting much planetary investors including the caller ones similar Warren Buffett's Berkshire Hathaway...

Asli M. Colpan

professor of firm strategy, Kyoto University

"Investing successful Japan equities is not investing successful Japan macro, it's not investing successful themes," said Shuntaro Takeuchi, a San Francisco-based Japan money manager with Matthews Asia.

"It's investing successful much of a nett maturation accidental coming from borderline improvement, instrumentality connected equity improvement, full instrumentality improvement."

The Buffett effect

Known arsenic "sogo shosha," Japan's trading houses are akin to conglomerates and bash concern successful a wide assortment of products and materials, and helped motorboat Japan's system connected to the planetary stage.

While their diversified operations were portion of the gully for Buffett, immoderate investors person criticized their analyzable operations, and highlighted their increasing vulnerability to risks overseas arsenic they expanded internationally.

Buffett's May disclosures helped spur 10 consecutive weeks of nett overseas purchases of Japanese equities. Foreigners bought a nett $57.8 cardinal worthy of Japanese equities successful the past 10 weeks until June 3, according to Japan Ministry of Finance data.

"There is simply a unit from investors, particularly overseas ones to comply," said Asli M. Colpan, a prof of firm strategy astatine Kyoto University's Graduate School of Management and Graduate School of Economics.

"Better firm governance has been attracting much planetary investors including the caller ones similar Warren Buffett's Berkshire Hathaway; and much planetary investors are putting much unit for compliance — forming a virtuous cycle," she added.

Cash rich, casual wins

And that's already starting to tell.

"As a effect of nett growth, the cashflow procreation and accumulation is present astatine a level that much than 50% of corporates are nett currency and mightiness beryllium hoarding excessively overmuch currency connected their equilibrium sheet," said Matthews Asia's Takeuchi.

We're astir apt conscionable halfway done that travel of firm reform.

Oliver Lee

Eastspring Investments

Read much astir Japan concern connected CNBC

"But a bigger origin successful the agelong word is whether they volition clasp the absorption connected profitability by cutting underperforming concern units and restructuring," helium added.

These are much hard decisions to undertake, but would yet beryllium the existent gauge of firm Japan's appetite for reform, greater ratio and productivity.

Still, the broader absorption of semipermanent structural alteration successful Japan is clear.

In a satellite that is combating stubbornly precocious ostentation and confronting anemic maturation prospects, that's conscionable adding connected to the entreaty of the Japanese equity markets — with the assistance of Japan's accommodative monetary policy, its comparatively much mean ostentation aft years of chronic deflation, the anemic yen, and comparatively inexpensive valuations.

"We're astir apt conscionable halfway done that travel of firm reform," Lee said.

English (US) ·

English (US) ·