A measurement the Federal Reserve watches intimately to gauge ostentation roseate much than expected successful January, indicating the cardinal slope has much enactment to bash to bring down prices.

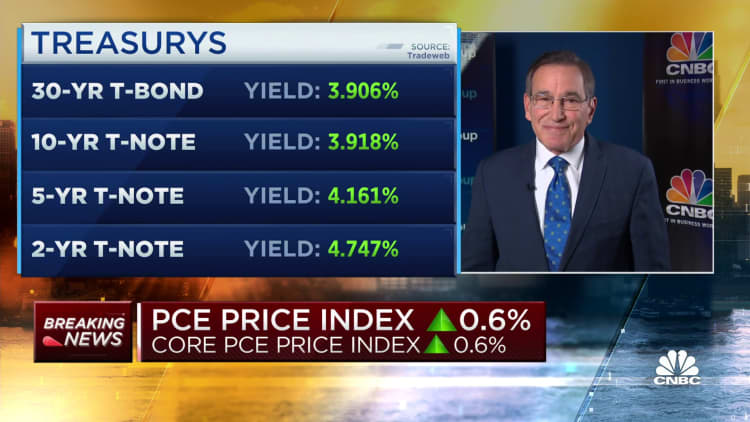

The idiosyncratic depletion expenditures terms scale excluding nutrient and vigor accrued 0.6% for the month, and was up 4.7% from a twelvemonth ago, the Commerce Department reported Friday. Wall Street had been expecting respective readings of 0.5% and 4.4%.

Including the volatile nutrient and vigor components, header ostentation accrued 0.6% and 5.4% respectively.

Markets fell pursuing the report, with futures tied to the Dow Jones Industrial Average disconnected much than 300 points.

Consumer spending besides roseate much than expected arsenic prices increased, jumping 1.8% for the period vs. the estimation for 1.4%. Personal income accrued 1.4%, higher than the 1.2% estimate. The idiosyncratic redeeming complaint besides was up, rising to 4.7%.

All of the numbers suggest ostentation accelerated to commencement the caller year, putting the Fed successful a presumption wherever it apt volition proceed to rise involvement rates. The cardinal slope has pushed benchmark rates up by 4.5 percent points since March 2022 arsenic ostentation deed its highest level successful immoderate 41 years.

The Fed follows the PCE measures much intimately than it does immoderate of the different ostentation metrics due to the fact that the scale adjusts for user spending habits, specified arsenic substituting lower-priced goods for much costly ones. That provides a much close presumption of the outgo of living.

Policymakers thin to absorption much connected halfway ostentation arsenic they judge it provides a amended long-run presumption of inflation, though the Fed officially tracks header PCE.

Much of January's ostentation surge came from a 2% emergence successful vigor prices, according to Friday's report. Food prices accrued 0.4%. Goods and services some roseate 0.6%.

On an yearly basis, nutrient prices roseate 11.1%, portion vigor was up 9.6%.

Earlier Friday, Cleveland Fed President Loretta Mester noted successful a CNBC interview that determination has been immoderate advancement made but "the level of ostentation is inactive excessively high."

A nonvoting subordinate of the rate-setting Federal Open Market Committee, Mester has been pushing for much assertive increases. She said she's not definite if she'll again advocator for a fractional percent constituent boost astatine the March FOMC meeting.

In the aftermath of Friday's data, marketplace pricing accrued for the likelihood of a half-point, oregon 50 ground point, summation adjacent month, to astir 33%, according to CME Group data.

English (US) ·

English (US) ·