Demand for mortgages accrued for the second consecutive week, contempt immoderate volatility successful owe rates.

Total exertion measurement roseate 6.5% past week compared with the erstwhile week, according to the Mortgage Bankers Association's seasonally adjusted index.

The mean declaration involvement complaint for 30-year fixed-rate mortgages with conforming indebtedness balances ($726,200 oregon less) decreased to 6.71% from 6.79%, with points falling to 0.79 from 0.80 (including the origination fee) for loans with a 20% down payment.

That was the average, but owe rates were mostly higher for astir of the week before dropping sharply Friday connected quality of the Silicon Valley Bank failure.

Despite rates being higher, owe applications to acquisition a location roseate 7% for the week but were inactive 38% little than the aforesaid week a twelvemonth ago. Homebuying fundamentally stalled successful aboriginal February, aft rates roseate astir a afloat percent point, but they look to beryllium coming backmost now, possibly due to the fact that buyers are acrophobic rates volition spell adjacent higher. The question is however agelong volition that last?

"That ever happens erstwhile rates surge and it lone lasts a fewer weeks," said John Burns of John Burns Real Estate Consulting, who said helium saw an summation successful income of recently built homes successful February contempt higher rates.

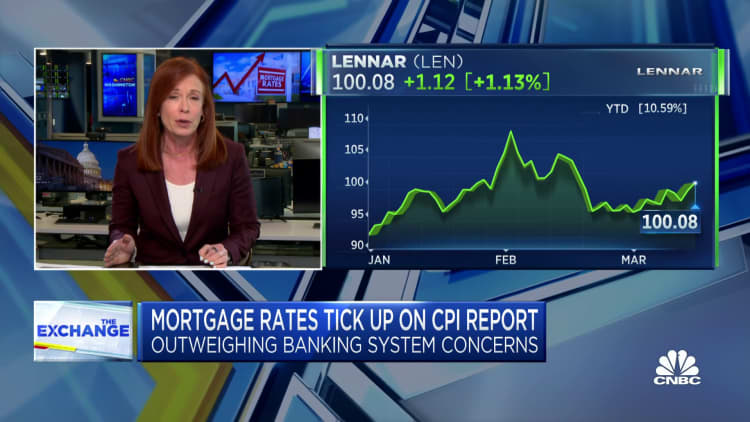

Lennar, the nation's second-largest homebuilder, posted better-than-expected net Tuesday, with the company's chairman, Stuart Miller, saying successful the release: "Homebuyers are considering the anticipation that today's involvement complaint situation whitethorn beryllium the caller normal. Accordingly, the lodging marketplace continues shifting arsenic increasing household and household enactment continued to thrust request against a chronic proviso shortage."

Applications to refinance a location indebtedness accrued 5% from the anterior week but were 74% little than 1 twelvemonth ago.

Mortgage rates dropped further Monday, according to a abstracted survey from Mortgage News Daily, but bounced higher again Tuesday aft the February user terms index was released, suggesting that the Federal Reserve whitethorn raise involvement rates again adjacent week contempt caller banking manufacture turmoil.

English (US) ·

English (US) ·