The rising adoption of integer fiscal services—mobile banking, online purchasing, and peer-to-peer payments—means that these days, wealth astir often passes not done quality hands but from machine to computer. No cash, nary integrative cards, nary insubstantial bills oregon checks oregon envelopes oregon stamps. Digital is nary longer conscionable different mode to determination money. Every enactment that moves wealth indispensable conscionable users via computers, smartphones, and different devices, and connection rapid, unafraid outgo services.

The covid-19 pandemic gave a boost to integer wealth movement, from online purchases to contactless payments and smartphone wallets, arsenic consumers worldwide sought to store without touching thing oregon going anywhere.

“The communal denominator crossed astir each post-pandemic behavioral shifts is the increasing value of integer payments,” says Paul Fabara, enforcement vice president and main hazard serviceman astatine Visa, whose worldwide networks handled an estimated $13 trillion worthy of transactions past year.

“Covid forced a marketplace that was already increasing to greatly accelerate,” says Fabara. As of 2021, 76% of adults globally person an relationship with a fiscal instauration oregon mobile wealth provider, up from 68% successful 2017 and 51% successful 2011, according to the World Bank’s Global Findex Database. That fig includes 71% of adults successful processing countries. In high-income economies, astir 95% of adults either made oregon received integer payments successful 2021. In India, 80 cardinal adults made their archetypal integer outgo during the pandemic; successful China, 100 million.

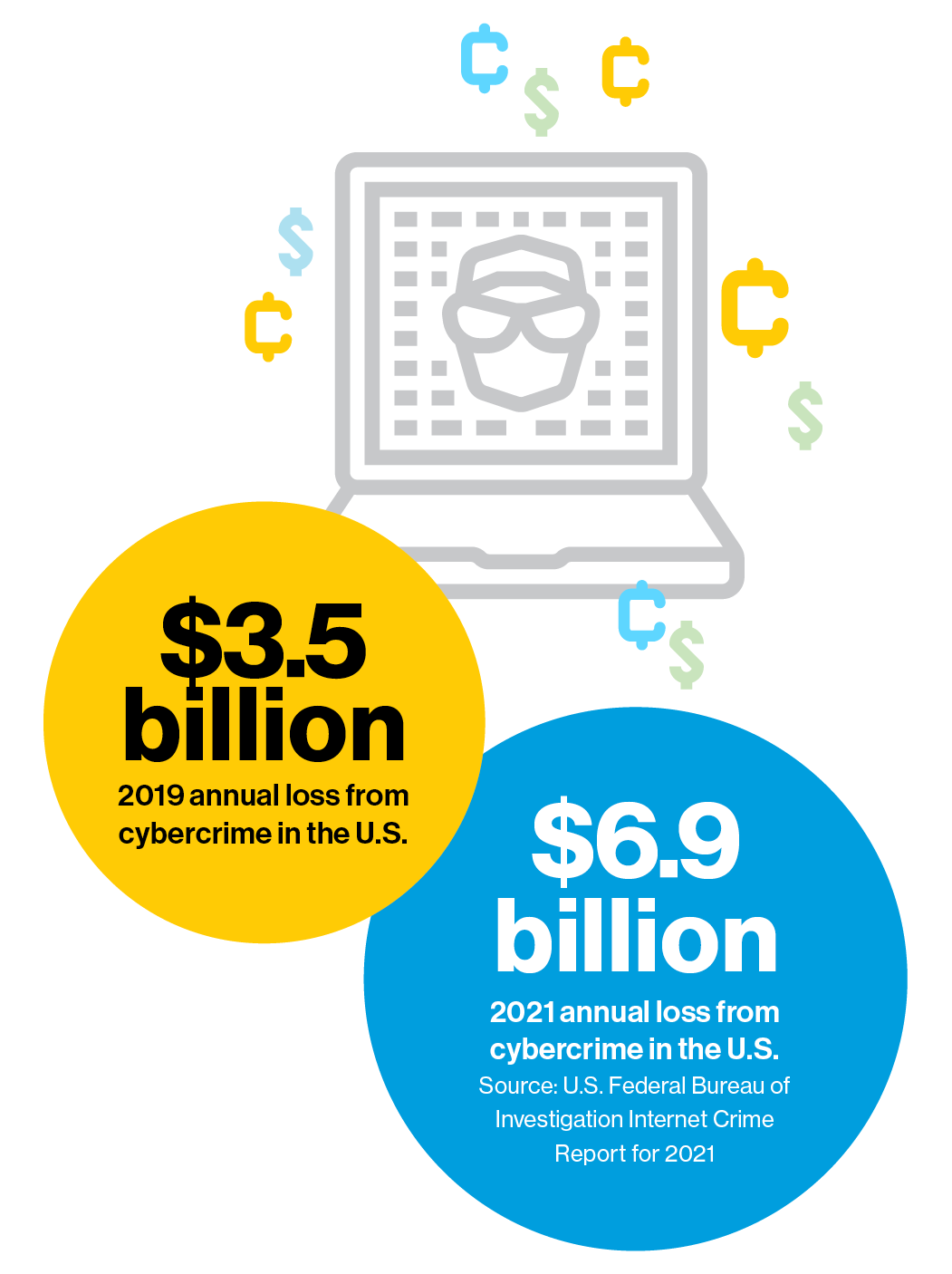

Fraudsters famously spell wherever the wealth is, and their online activities are expanding close on with the maturation successful integer transactions. Annual losses from cybercrime successful the U.S. astir doubled betwixt 2019 and 2021, from $3.5 cardinal to $6.9 billion, according to the FBI’s Internet Crime Report for 2021. Fortifying cyberspace against theft and fraud has ever been urgent, and the post-pandemic roar successful transactions intensified matters.

Driving integer transactions

Business-to-business customers are opening to importune connected the aforesaid seamless real-time transactions they expect arsenic consumers, says Aaron Press, probe manager of worldwide outgo strategies astatine IDC, who tracks the improvement and adoption of real-time payments. “If you deliberation astir the mode you store online for idiosyncratic things oregon wage your friends utilizing a mobile-to-mobile app, those expectations are uncovering their mode into the concern environment,” helium says.

End-to-end integer transactions are present to stay. An MIT Technology Review Insights survey of planetary concern leaders recovered precocious involvement successful integer outgo technologies crossed each types and sizes of businesses. Although 36% of respondents are conscionable getting started with integer payments, 43% expect to grow their offerings implicit the adjacent 18 months, and galore are venturing into cross-border transactions (37%) and cryptocurrency (18%).

What’s driving businesses to all-digital payments? The largest stock of survey replies, 70%, bespeak businesses prioritize improving lawsuit acquisition by offering aggregate outgo options and redeeming customers time. Respondents privation the benefits of operational improvements (48%) and reductions successful processing costs (37%). Many privation expanded options for securing payments (36%) and personalized offers to customers (35%).

"Digital payments are much businesslike and dramatically trim errors,” says Press. “You’re overmuch little apt to capable retired thing the incorrect way, due to the fact that determination are checks and balances wrong the system.”

This contented was produced by Insights, the customized contented limb of MIT Technology Review. It was not written by MIT Technology Review’s editorial staff.

English (US) ·

English (US) ·