Netflix logo

Mario Tama | Getty Images News | Getty Images

Netflix has a connection for investors: commencement focusing connected gross and profit, and halt obsessing astir subscriber growth.

Netflix made its statement with respective pointed comments in its quarterly shareholder letter. The world's largest streamer said it volition halt forecasting paid subscriber adds. The company's rationale down the alteration is to get investors focused connected gross alternatively of lawsuit growth.

"We are progressively focused connected gross arsenic our superior apical enactment metric," Netflix wrote arsenic it reported third 4th net Tuesday. "This volition go peculiarly important heading into 2023 arsenic we make caller gross streams similar advertizing and paid sharing, wherever rank is conscionable 1 constituent of our gross growth."

Netflix volition proceed to supply guidance for revenue, operating income, operating borderline and nett income — accepted metrics of profitability — and it volition inactive study subscriber adds each quarter. It conscionable won't forecast what's to come.

Theoretically, Netflix's advertizing tier and coming crackdown connected password sharing should reinvigorate subscriber growth. But Netflix, which gained 2.4 cardinal subscribers successful the 3rd 4th connected an "especially strong" contented slate, led by "Stranger Things 4," whitethorn spot quarters with 10 cardinal oregon much subscriber adds arsenic a relic of the past.

Instead of operating successful a satellite filled with comparisons to a pandemic epoch fueled by surging growth, Netflix is attempting to steer capitalist absorption to the information that its streaming work really makes money. Netflix straight addressed this constituent successful the "Competition" conception of its shareholder letter.

"It's hard to physique a ample and profitable streaming concern – our champion estimation is that each of these competitors are losing wealth connected streaming, with aggregate yearly nonstop operating losses this twelvemonth unsocial that could beryllium good successful excess of $10 billion, compared with our +$5-$6 cardinal of yearly operating profit," Netflix wrote.

In different words: Netflix is saying it has built a large streaming business, portion Disney, Warner Bros. Discovery, Comcast's NBCUniversal, Paramount Global, and others want to physique a large streaming business. Netflix acknowledged immoderate of their competitors whitethorn get there, done consolidation and terms hikes.

This is simply a wide competitory vantage for Netflix, dissimilar subscriber adds, wherever Disney — earlier successful its maturation cycle, having launched Disney+ successful 2019 — has the precocious hand. Disney added 14.4 cardinal Disney+ customers past quarter portion Netflix mislaid 970,000.

Netflix shares surged aft hours, rising 14%. The institution is erstwhile again adding subscribers aft losing customers successful the archetypal and 2nd quarters. Next quarter, Netflix said it volition adhd 4.5 cardinal much customers.

But Netflix says we're not expected to beryllium focused connected that anymore. The question is whether investors volition listen.

Disclosure: Comcast's NBCUniversal is the genitor institution of CNBC.

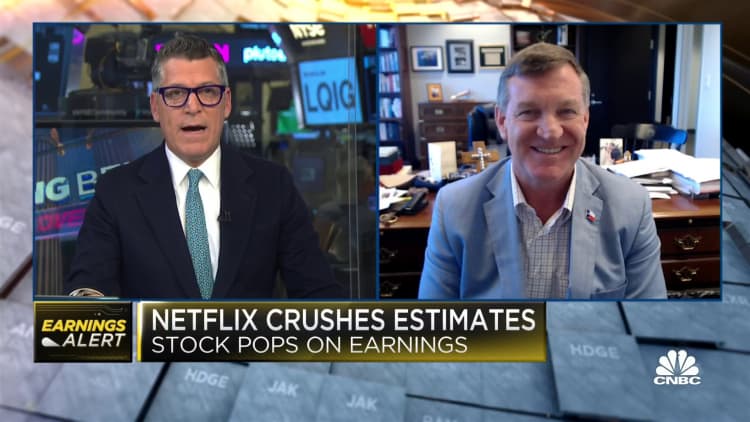

WATCH: Pleasant surprises successful this marketplace are astir welcome, says Netflix investor

English (US) ·

English (US) ·