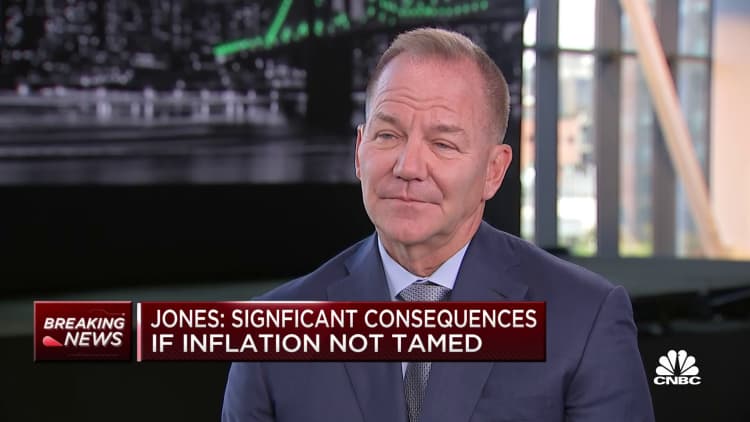

Billionaire hedge money manager Paul Tudor Jones believes the U.S. system is either adjacent oregon already successful the mediate of a recession arsenic the Federal Reserve rushed to tamp down soaring ostentation with assertive complaint hikes.

"I don't cognize whether it started present oregon it started 2 months ago," Jones said connected CNBC's "Squawk Box" connected Monday erstwhile asked astir recession risks. "We ever find retired and we are ever amazed astatine erstwhile recession officially starts, but I'm assuming we are going to spell into one."

The National Bureau of Economic Research is the authoritative arbiter of recessions, and uses aggregate factors successful making its determination. The NBER defines recession arsenic "a important diminution successful economical enactment that is dispersed crossed the system and lasts much than a fewer months." However, the bureau's economists profess not adjacent to usage gross home merchandise arsenic a superior barometer.

GDP fell successful some the archetypal and 2nd quarters, and the archetypal speechmaking for the Q3 is released October 27.

The laminitis and main concern serviceman of Tudor Investment said determination is simply a circumstantial recession playbook to travel for investors navigating the treacherous waters, and past shows that hazard assets person much country to autumn earlier hitting a bottom.

"Most recessions past astir 300 days from the commencement of it," Jones said. "The banal marketplace is down, say, 10%. The archetypal happening that volition hap is abbreviated rates volition halt going up and commencement going down earlier the banal marketplace really bottoms."

The famed capitalist said it's precise challenging for the Fed to bring ostentation backmost to its 2% target, partially owed to important wage increases.

"Inflation is simply a spot similar toothpaste. Once you get it retired of the tube, it's hard to get it backmost in," Jones said. "The Fed is furiously trying to lavation that sensation retired of their rima ... If we spell into recession, that has truly antagonistic consequences for a assortment of assets."

To conflict inflation, the Fed is tightening monetary argumentation astatine its astir assertive gait since the 1980s. The cardinal slope past week raised rates by three-quarters of a percent point for a 3rd consecutive time, vowing much hikes to come. Jones said the cardinal slope should support tightening to debar semipermanent symptom for the economy.

"If they don't support going and we person precocious and imperishable inflation, it conscionable creates I deliberation much issues down the road," Jones said. "If we are going to person semipermanent prosperity, you person to person a unchangeable currency and a unchangeable mode to worth it. So yes you person to person thing 2% and nether ostentation successful the precise agelong tally to person a unchangeable society. So there's short-term symptom associated with semipermanent gain."

Jones changeable to fame aft helium predicted and profited from the 1987 banal marketplace crash. He is besides the president of nonprofit Just Capital, which ranks nationalist U.S. companies based connected societal and biology metrics.

English (US) ·

English (US) ·