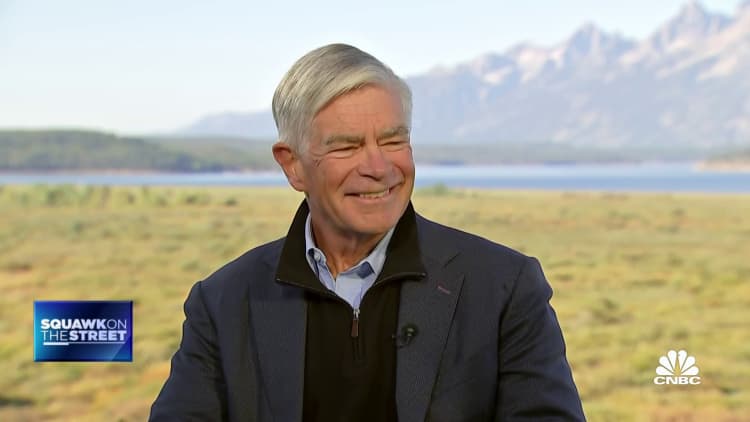

Federal Reserve Chairman Jerome Powell testifies earlier the House Committee connected Financial Services June 21, 2023 successful Washington, DC. Powell testified connected the Federal Reserve’s Semi-Annual Monetary Policy Report during the hearing.

Win Mcnamee | Getty Images News | Getty Images

Since helium took implicit the chair's presumption astatine the Federal Reserve successful 2018, Jerome Powell has utilized his yearly addresses astatine the Jackson Hole retreat to propulsion argumentation agendas that person tally from 1 extremity of the argumentation playing tract to the other.

In this year's iteration, galore expect the cardinal slope person to alteration his stance truthful that helium hits the shot beauteous overmuch down the middle.

With inflation decelerating and the system inactive connected coagulated ground, Powell whitethorn consciousness little of a request to usher the nationalist and fiscal markets and alternatively spell for much of a call-'em-as-we-see-'em posture toward monetary policy.

"I conscionable deliberation he's going to play it astir arsenic down the mediate arsenic possible," said Joseph LaVorgna, main economist astatine SMBC Nikko Securities America. "That conscionable gives him much optionality. He doesn't privation to get himself boxed into a country 1 mode oregon another."

If Powell does instrumentality a noncommittal strategy, that volition enactment the code successful the mediate of, for instance, 2022's amazingly aggressive — and terse — remarks informing of higher rates and economical "pain" ahead, and 2020's announcing of a caller framework successful which the Fed would clasp disconnected connected complaint hikes until it had achieved "full and inclusive" employment.

The code volition commencement Friday astir 10:05 a.m. ET.

Nervous markets

Despite the anticipation for a circumspect Powell, markets Thursday braced for an unpleasant surprise, with stocks selling off and Treasury yields climbing. Last year's code besides featured downbeat anticipation and a sour reception, with the S&P 500 disconnected 2% successful the 5 trading days earlier the code and down 5.5% successful the 5 after, according to DataTrek Research.

A day's wavering connected Wall Street, though, is improbable to sway Powell from delivering his intended message.

"I don't cognize however hawkish helium needs to beryllium fixed the information that the funds complaint is intelligibly successful restrictive territory by their definition, and the information the marketplace has yet bought into the Fed's ain forecast of complaint cuts not happening until astir the mediate oregon 2nd fractional of adjacent year," said LaVorgna, who was main economist for the National Economic Council nether erstwhile President Donald Trump.

"So it's not arsenic if the Fed has to propulsion backmost against a marketplace communicative that's looking for imminent easing, which had been the lawsuit from fundamentally astir of the past 12 months," helium added.

Indeed, the markets look yet to person accepted the thought that the Fed has dug successful its heels against ostentation and won't commencement backing disconnected until it sees much convincing grounds that the caller spate of affirmative quality connected prices has legs.

Yet Powell volition person a needle to thread — assuring the marketplace that the Fed won't repetition its past mistakes connected ostentation portion not pressing the lawsuit excessively hard and tipping the system into what looks present similar an avoidable recession.

"He's got to onslaught that chord that the Fed is going to decorativeness the job. The information is, it's astir their credibility. It's astir his legacy," said Quincy Krosby, main planetary strategist astatine LPL Financial. "He's going to privation to beryllium a small much hawkish than neutral. But he's not going to present what helium delivered past year. The marketplace has gotten the memo."

Inflation's not dormant yet

That could beryllium easier said than done. Inflation has drifted down into the 3%-4% range, but determination are immoderate signs that slowdown could beryllium reversed.

Energy prices person risen done the summer, and immoderate factors that helped bring down ostentation figures, specified arsenic a statistical accommodation for health-care security costs, are fading. A Cleveland Fed ostentation tracker anticipates August's figures volition amusement a noticeable jump. Bond yields person been surging lately, a effect that astatine slightest partially could bespeak an anticipated leap successful inflation.

At the aforesaid time, consumers progressively are feeling pain. Total credit paper debt has surpassed $1 trillion for the archetypal time, and the San Francisco Fed precocious asserted that the excess savings consumers accumulated from authorities transportation payments volition tally retired successful a fewer months.

Even with idiosyncratic wages rising successful existent terms, ostentation is inactive a burden.

"When each is said and done, if we don't quell inflation, however acold are those wages going to go? With their recognition cards, with food, with energy," Krosby said. "That's the dilemma for him. He has been enactment into a governmental trap."

Powell presides implicit a Fed that is mostly leaning toward keeping rates elevated, though with cuts imaginable adjacent year.

Still nary 'mission accomplished'

Philadelphia Fed President Patrick Harker is among those who deliberation the Fed has done capable for now.

"What I heard large and wide done my summertime travels is, 'Please, you've gone up precise rapidly. We request to sorb that. We request to instrumentality immoderate clip to fig things out,'" Harker told CNBC's Steve Liesman during an interrogation Thursday from Jackson Hole. "And you perceive this from assemblage banks large and clear. But past we're proceeding it adjacent from concern leaders. Just fto america sorb what you've already done earlier you bash more."

While the temptation for the Fed present mightiness beryllium to awesome it has mostly won the ostentation war, galore marketplace participants deliberation that would beryllium unwise.

"You'd beryllium nuts to you know, to enactment retired the ngo accomplished banner astatine this point, and helium won't, but I don't spot immoderate request for him to astonishment hawkish either," said Krishna Guha, caput of planetary argumentation and cardinal slope strategy for Evercore ISI.

Some connected Wall Street deliberation Powell could code wherever helium sees rates headed not implicit the adjacent respective months but successful the longer run. Specifically, they are looking for guidance connected the earthy level of rates that are neither restrictive nor stimulative, the "r-star (r*)" worth of which helium spoke during his archetypal Jackson Hole presentation successful 2018.

However, the chances that Powell addresses r-star don't look strong.

"There was a benignant of wide interest that Powell mightiness astonishment hawkish. The anxiousness was overmuch much astir what helium mightiness accidental astir r-star and embracing, precocious caller mean rates than it was astir however helium would qualify the near-term playbook," Guha said. "There's conscionable nary evident upside for him successful embracing the thought of a higher r-star astatine this point. I deliberation helium wants to debar making a beardown telephone connected that."

In fact, Powell is mostly expected to debar making immoderate large calls connected anything.

At a clip erstwhile the seat should "take a triumph lap" astatine Jackson Hole, helium alternatively is apt to beryllium much somber successful his assessment, said Michael Arone, main concern strategist astatine State Street's US SPDR Business.

"The Fed apt isn't convinced ostentation has been beaten," Arone said successful a note. "As a result, determination won't beryllium immoderate curtain calls astatine Jackson Hole. Instead, investors should expect much pugnacious speech from Chairman Powell that the Fed is much committed than ever to defeating inflation."

English (US) ·

English (US) ·