"If you've suffered losses successful your 401k past year, you're surely not alone," said Winnie Sun, co-founder and managing manager of Sun Group Wealth Partners, based successful Irvine, California, and a subordinate of CNBC's Advisor Council.

"It's important to retrieve that arsenic agelong arsenic you haven't sold those investments, you haven't realized the loss, either, and determination is simply a imaginable for a comeback."

It's tenable to expect that portfolios volition proceed to amended successful the adjacent year, oregon adjacent by year-end, she said.

How to bounce backmost from 401(k) losses

One precise important signifier each capitalist should bash is to reappraisal their concern allocation astatine the commencement of the year, Sun advised.

That means this is is simply a bully clip to cheque if your allocation inactive meets your needs, she said. If you're not sure, consult with a fiscal advisor to assistance you cipher your hazard tolerance and your concern clip skyline and spot if however you're invested inactive works for you.

Odds are, it astir apt doesn't, Sun besides added, and "a rebalance, similar a regular haircut, is needed."

More from Personal Finance:

Why Social Security status age, payroll taxation whitethorn change

Experts reason Social Security status property shouldn't walk 67

Return connected waiting to assertion Social Security is 'huge'

Even if 1 assemblage of the fiscal markets performed well, that whitethorn not continue. "So, if you are excessively heavy weighted successful ample headdress growth, for example, but little truthful successful international, it's amended to physique a much sustainable diversified portfolio."

After a tumultuous year, galore older Americans are acrophobic astir their status security. Nearly half, oregon 48%, of retired Americans judge they'll outlive their savings, a abstracted study by Clever Real Estate found.

"Everyone is feeling unit financially — there's a batch of uncertainty retired determination successful the markets and the economy," said Mike Shamrell, Fidelity's vice president of thought leadership.

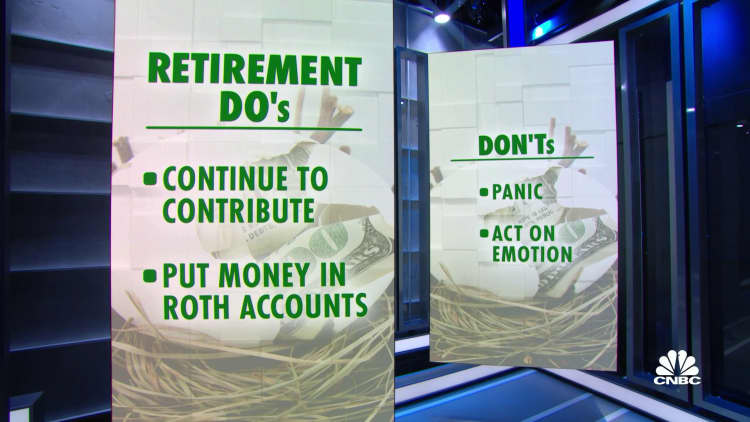

However, "a batch of radical recognize there's going to beryllium ups and downs," helium added. "Don't fto short-term economical events derail your semipermanent status savings efforts."

"If your clip skyline is long, and you're capable to spend to bash so, see adding during marketplace dips," Sun advised. "If you're buying prime investments long-term, this volition assistance you bargain much shares since the marketplace is down."

To that end, effort to summation your 401(k) publication percent this year, she said.

The mean 401(k) publication rate, including leader and worker contributions, presently sits astatine 13.7%, conscionable beneath Fidelity's suggested savings complaint of 15%.

English (US) ·

English (US) ·