In this photograph illustration, a ocular practice of the integer Cryptocurrency Ripple is displayed connected January 30, 2018 successful Paris, France.

Chesnot | Getty Images

Blockchain startup Ripple is assured U.S. banks and different fiscal institutions successful the state volition commencement showing involvement successful adopting its XRP cryptocurrency successful cross-border payments aft a landmark ruling determined the token was not, successful itself, needfully a security.

The San Francisco-based steadfast expects to commencement talks with American fiscal firms astir utilizing its On-Demand Liquidity (ODL) product, which uses XRP for wealth transfers, successful the 3rd quarter, Stu Alderoty, Ripple's wide counsel, told CNBC successful an interrogation past week.

Last week, a New York justice delivered a watershed ruling for Ripple determining that XRP itself is "not needfully a information connected its face," contesting, successful part, claims from the U.S. Securities and Exchange Commission against the company.

Ripple has been warring the SEC for the past 3 years implicit allegations from the bureau that Ripple and 2 of its executives conducted an amerciable offering of $1.3 cardinal worthy via income of XRP. Ripple disputed the claims, insisting XRP cannot beryllium considered a information and is much akin to a commodity.

Ripple's concern suffered arsenic a result, with the institution losing astatine slightest 1 lawsuit and investor. MoneyGram, the U.S. wealth transportation giant, ditched its concern with Ripple successful March 2021.

Meanwhile, Tetragon, a U.K.-based capitalist that antecedently backed Ripple, sold its involvement backmost to Ripple aft unsuccessfully trying to writer the institution to redeem its cash.

Asked whether the ruling meant that American banks would instrumentality to Ripple to usage its ODL product, Alderoty said: "I deliberation the reply to that is yes."

Ripple besides uses blockchain successful its concern to nonstop messages betwixt banks, benignant of similar a blockchain-based alternate to Swift.

"I deliberation we're hopeful that this determination would springiness fiscal instauration customers oregon imaginable customers comfortableness to astatine slightest travel successful and commencement having the speech astir what problems they are experiencing successful their business, real-world problems successful presumption of moving worth crossed borders without incurring obscene fees," Alderoty told CNBC Friday.

"Hopefully this 4th volition make a batch of conversations successful the United States with customers, and hopefully immoderate of those conversations volition really crook into existent business," helium added.

Ripple present sources astir of its concern from extracurricular of the U.S., with Alderoty antecedently telling CNBC that, "[Ripple], its customers and its gross are each driven extracurricular of the U.S., adjacent though we inactive person a batch of employees wrong of the U.S.," helium added.

Ripple has implicit 750 employees globally, with astir fractional of them based successful the U.S.

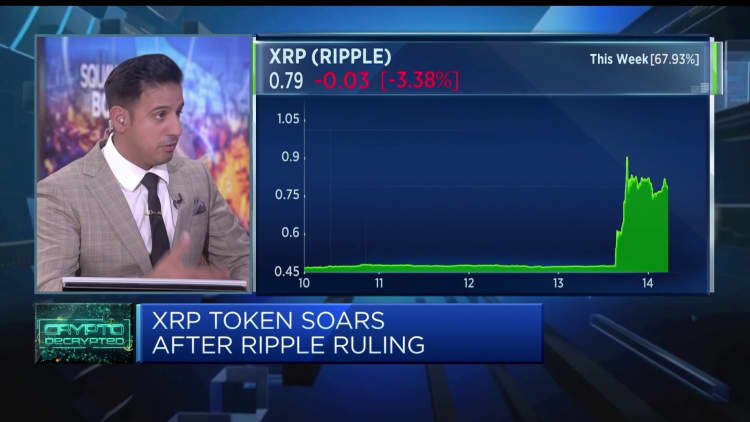

XRP is simply a cryptocurrency that Ripple uses to determination wealth crossed borders. It is presently the fifth-largest cryptocurrency successful circulation, with a marketplace capitalization of $37.8 billion.

The institution uses the token arsenic a "bridge" currency betwixt transfers from 1 fiat currency to different – for example, U.S. dollars to Mexican pesos – to lick the contented of needing pre-funded accounts connected the different extremity of a transportation to hold for the wealth to beryllium processed.

Ripple says XRP tin alteration wealth movements successful a fraction of a second.

Still, the ruling did not correspond a full triumph for Ripple. While the justice stated XRP was not a security, they besides said that immoderate income of the token did suffice arsenic securities transactions.

For example, astir $728.9 cardinal of income of XRP to institutions the institution worked with did suffice arsenic securities, the justice said, stating determination was a communal enterprise, an anticipation of profit.

Alderoty conceded it was not a full triumph for Ripple, and that the institution would survey the determination successful owed people to spot however it affects its business.

"She [Judge Analisa Torres] recovered — though we had disagreed with her — that our earlier income straight to organization buyers had the attributes of a information and should person been registered," helium said.

He said Ripple's concern arsenic it stands would beryllium unaffected by that constituent of the ruling arsenic its customers are chiefly located extracurricular of the U.S.

"We'll survey the the judge's decision, we'll look astatine our clients' needs to look astatine the market, and spot if there's a concern present that complies with the 4 corners of what the justice recovered erstwhile it comes to institutions," helium said.

English (US) ·

English (US) ·