FTX CEO Sam Bankman-Fried attends a property league astatine the FTX Arena successful downtown Miami connected Friday, June 4, 2021.

Matias J. Ocner | Miami Herald | Tribune News Service | Getty Images

Sam Bankman-Fried, the disgraced erstwhile CEO of FTX — the bankrupt cryptocurrency speech that was worthy $32 cardinal a fewer weeks agone — has a existent knack for self-promotional PR. For years, helium formed himself successful the likeness of a young lad genius turned concern titan, susceptible of miraculously increasing his crypto empire arsenic different players got wiped out. Everyone from Silicon Valley's apical task capitalists to A-list celebrities bought the act.

But during Bankman-Fried's property junket of the past fewer weeks, the onetime wunderkind has spun a caller communicative – 1 successful which helium was simply an inexperienced and novice businessman who was retired of his depth, didn't cognize what helium was doing, and crucially, didn't cognize what was happening astatine the businesses helium founded.

It is rather the departure from the representation helium had cautiously cultivated since launching his archetypal crypto steadfast successful 2017 – and according to erstwhile national prosecutors, proceedings attorneys and ineligible experts speaking to CNBC, it recalls a classical ineligible defence dubbed the "bad businessman strategy."

At slightest $8 cardinal successful lawsuit funds are missing, reportedly utilized to backstop billions successful losses astatine Alameda Research, the hedge money helium besides founded. Both of his companies are present bankrupt with billions of dollars worthy of indebtedness connected the books. The CEO tapped to instrumentality over, John Ray III, said that "in his 40 years of ineligible and restructuring experience," helium had ne'er seen "such a implicit nonaccomplishment of firm controls and specified a implicit lack of trustworthy fiscal accusation arsenic occurred here." This is the aforesaid Ray who presided implicit Enron's liquidation successful the 2000s.

In America, it is not a transgression to beryllium a lousy oregon careless CEO with mediocre judgement. During his caller property circuit from a distant determination successful the Bahamas, Bankman-Fried truly leaned into his ain ineptitude, mostly blaming FTX's illness connected mediocre hazard management.

At slightest a twelve times in a speech with Andrew Ross Sorkin, helium appeared to deflect blasted to Caroline Ellison, his counterpart (and one-time girlfriend) astatine Alameda. He says didn't cognize however highly leveraged Alameda was, and that helium conscionable didn't cognize astir a batch of things going connected astatine his immense empire.

Bankman-Fried admitted helium had a "bad month," but denied committing fraud astatine his crypto exchange.

Fraud is the benignant of transgression complaint that tin enactment you down bars for life. With Bankman-Fried, the question is whether helium misled FTX customers to judge their wealth was available, and not being utilized arsenic collateral for loans oregon for different purposes, according to Renato Mariotti, a erstwhile national authoritative and proceedings lawyer who has represented clients successful derivative-related claims and securities people actions.

"It definite looks similar there's a chargeable fraud lawsuit here," said Mariotti. "If I represented Mr. Bankman-Fried, I would archer him helium should beryllium precise acrophobic astir situation time. That it should beryllium an overriding interest for him."

But for the moment, Bankman-Fried appears unconcerned with his idiosyncratic ineligible exposure. When Sorkin asked him if helium was acrophobic astir transgression liability, helium demurred.

"I don't deliberation that — obviously, I don't personally deliberation that I person — I deliberation the existent reply is it's not — it sounds weird to accidental it, but I deliberation the existent reply is it's not what I'm focusing on," Bankman-Fried told Sorkin. "It's — there's going to beryllium a clip and a spot for maine to deliberation astir myself and my ain future. But I don't deliberation this is it."

Comments specified arsenic these, paired with the deficiency of evident enactment by regulators oregon authorities, person helped animate fury among galore successful the manufacture – not conscionable those who mislaid their money. The spectacular collapse of FTX and SBF blindsided investors, customers, task capitalists and Wall Street alike.

Bankman-Fried did not respond to a petition for comment. Representatives for his erstwhile instrumentality firm, Paul, Weiss, did not instantly respond to comment. Semafor reported earlier that Bankman-Fried's caller lawyer was Greg Joseph, a spouse astatine Joseph Hage Aaronson.

Both of Bankman-Fried's parents are highly respected Stanford Law School professors. Semafor besides reported that different Stanford Law professor, David Mills, was advising Bankman-Fried.

Mills, Joseph and Bankman-Fried's parents did not instantly respond to requests for comment.

What benignant of ineligible occupation could helium beryllium in?

Bankman-Fried could look a big of imaginable charges – civilian and transgression – arsenic good arsenic backstage lawsuits from millions of FTX creditors, ineligible experts told CNBC.

For now, this is each purely hypothetical. Bankman-Fried has not been charged, tried, nor convicted of immoderate transgression yet.

Richard Levin is simply a spouse astatine Nelson Mullins Riley & Scarborough, wherever helium chairs the fintech and regularisation practice. He's been progressive successful the fintech manufacture since the aboriginal 1990s, and has represented clients earlier the Securities and Exchange Commission, Commodity Futures Trading Commission and Congress. All 3 of those entities person begun probing Bankman-Fried.

There are 3 different, perchance simultaneous ineligible threats that Bankman-Fried faces successful the United States alone, Levin told CNBC.

First is transgression enactment from the U.S. Department of Justice, for imaginable "criminal violations of securities laws, slope fraud laws, and ligament fraud laws," Levin said.

A spokesperson for the U.S. Attorney's Office for the Southern District of New York declined to comment.

Securing a condemnation is ever challenging successful a transgression case.

Mariotti, the erstwhile national authoritative is intricately acquainted with however the authorities would physique a case. He told CNBC, "prosecutors would person to beryllium beyond a tenable uncertainty that Bankman-Fried oregon his associates committed transgression fraud."

"The statement would beryllium that Alameda was tricking these radical into getting their wealth truthful they could usage it to prop up a antithetic business," Mariotti said.

"If you're a hedge money and you're accepting lawsuit funds, you really person a fiduciary work [to the customer]," Mariotti said.

Prosecutors could reason that FTX breached that fiduciary work by allegedly utilizing lawsuit funds to artificially stabilize the terms of FTX's ain FTT coin, Mariotti said.

But intent is besides a origin successful fraud cases, and Bankman-Fried insists helium didn't cognize astir perchance fraudulent activity. He told Sorkin that helium "didn't knowingly commingle funds."

"I didn't ever effort to perpetrate fraud," Bankman-Fried said.

Beyond transgression charges, Bankman-Fried could besides beryllium facing civilian enforcement action. "That could beryllium brought by the Securities Exchange Commission, and the Commodity Futures Trading Commission, and by authorities banking and securities regulators," Levin continued.

"On a 3rd level, there's besides plentifulness of people actions that tin beryllium brought, truthful determination are aggregate levels of imaginable vulnerability for [...] the executives progressive with FTX," Levin concluded.

Who is apt to spell aft him?

The Department of Justice is astir apt to prosecute transgression charges successful the U.S. The Wall Street Journal reported that the DOJ and the SEC were some probing FTX's collapse, and were successful adjacent interaction with each other.

That benignant of practice allows for transgression and civilian probes to proceed simultaneously, and allows regulators and instrumentality enforcement to stitchery accusation much effectively.

But it isn't wide whether the SEC oregon the CFTC volition instrumentality the pb successful securing civilian damages.

An SEC spokesperson said the bureau does not remark connected the beingness oregon nonexistence of a imaginable investigation. The CFTC did not instantly respond to a petition for comment.

"The question of who would beryllium taking the pb there, whether it beryllium the SEC oregon CFTC, depends connected whether oregon not determination were securities involved," Mariotti, the erstwhile national prosecutor, told CNBC.

SEC Chairman Gary Gensler, who met with Bankman-Fried and FTX executives successful outpouring 2022, has said publically that "many crypto tokens are securities," which would marque his bureau the superior regulator. But galore exchanges, including FTX, person crypto derivatives platforms that merchantability fiscal products similar futures and options, which autumn nether the CFTC's jurisdiction.

"For selling unregistered securities without a registration oregon an exemption, you could beryllium looking astatine the Securities Exchange Commission suing for disgorgement — monetary penalties," said Levin, who's represented clients earlier some agencies.

"They tin besides sue, possibly, claiming that FTX was operating an unregistered securities market," Levin said.

Then determination are the overseas regulators that oversaw immoderate of the myriad FTX subsidiaries.

The Securities Commission of The Bahamas believes it has jurisdiction, and went arsenic acold arsenic to record a abstracted lawsuit successful New York bankruptcy court. That lawsuit has since been folded into FTX's main bankruptcy extortion proceedings, but Bahamian regulators proceed to analyse FTX's activities.

Court filings allege that Bahamian regulators person moved lawsuit integer assets from FTX custody into their own. Bahamian regulators importune that they're proceeding by the book, nether the country's groundbreaking crypto regulations — dissimilar galore nations, the Bahamas has a robust ineligible model for integer assets.

But crypto investors aren't sold connected their competence.

"The Bahamas intelligibly deficiency the organization infrastructure to tackle a fraud this analyzable and person been wholly derelict successful their duty," Castle Island Ventures spouse Nic Carter told CNBC. (Carter was not an FTX investor, and told CNBC that his money passed connected aboriginal FTX rounds.)

"There is nary question of standing. U.S. courts person evident entree points present and galore parts of Sam's empire touched the U.S. Every time the U.S. leaves this successful the hands of the Bahamas is simply a mislaid opportunity," helium continued.

Investors who person mislaid their savings aren't waiting. Class-action suits person already been filed against FTX endorsers, similar comedian Larry David and shot superstar Tom Brady. One suit excoriated the personage endorsers for allegedly failing to bash their "due diligence anterior to selling [FTX] to the public."

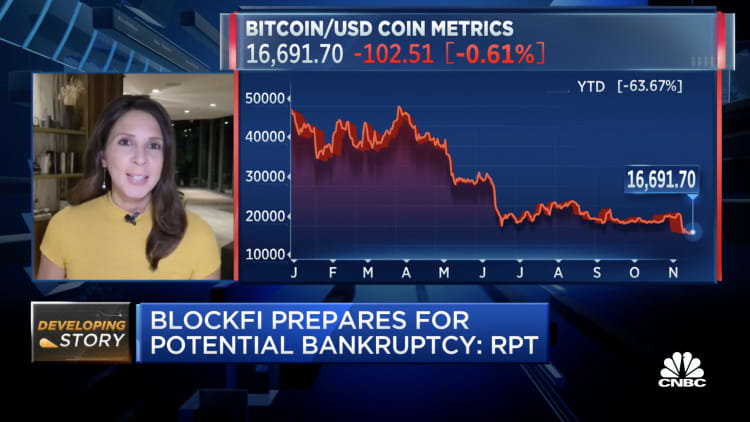

FTX's manufacture peers are besides filing suit against Bankman-Fried. BlockFi sued Bankman-Fried successful November, seeking unnamed collateral that the erstwhile billionaire provided for the crypto lending firm.

FTX and Bankman-Fried had antecedently rescued BlockFi from insolvency successful June, but erstwhile FTX failed, BlockFi was near with a akin liquidity occupation and filed for bankruptcy protection successful New Jersey.

Bankman-Fried has besides been sued successful Florida and California national courts. He faces class-action suits successful some states implicit "one of the large frauds successful history," a California tribunal filing said.

The largest securities class-action colony was for $7.2 cardinal successful the Enron accounting fraud case, according to Stanford research. The anticipation of a multibillion-dollar colony would travel connected apical of civilian and transgression fines that Bankman-Fried faces.

But the onus should beryllium connected the U.S. authorities to prosecute Bankman-Fried, Carter told CNBC, not connected backstage investors oregon overseas regulators.

"The U.S. isn't shy astir utilizing overseas proxies to spell aft Assange — wherefore successful this lawsuit person they abruptly recovered their restraint?"

What penalties could helium face?

Wire fraud is the astir apt transgression complaint Bankman-Fried would face. If the DOJ were capable to unafraid a conviction, a justice would look to respective factors to find however agelong to condemnation him.

Braden Perry was erstwhile a elder proceedings lawyer for the CFTC, FTX's lone authoritative U.S. regulator. He's present a spouse astatine Kennyhertz Perry, wherever helium advises clients connected anti-money laundering, compliance and enforcement issues.

Based connected the size of the losses, if Bankman-Fried is convicted of fraud oregon different charges, helium could beryllium down bars for years — perchance for the remainder of his life, Perry said. But the magnitude of immoderate imaginable condemnation is hard to predict.

"In the national system, each transgression ever has a starting point," Perry told CNBC.

Federal sentencing guidelines travel a numeric strategy to find the maximum and minimum allowable sentence, but the strategy tin beryllium esoteric. The scale, oregon "offense level," starts astatine one, and maxes retired astatine 43.

A ligament fraud condemnation rates arsenic a 7 connected the scale, with a minimum condemnation ranging from zero to six months.

But mitigating factors and enhancements tin change that rating, Perry told CNBC.

"The dollar worth of nonaccomplishment plays a important role. Under the guidelines, immoderate nonaccomplishment supra $550 cardinal adds 30 points to the basal level offense," Perry said. FTX customers person mislaid billions.

"Having 25 oregon much victims adds 6 points, [and] usage of definite regulated markets adds 4," Perry continued.

In this hypothetical scenario, Bankman-Fried would max retired the standard astatine 43, based connected those enhancements. That means Bankman-Fried could beryllium facing beingness successful national prison, without the anticipation of supervised release, if he's convicted connected a azygous ligament fraud offense.

But that condemnation tin beryllium reduced by mitigating factors – circumstances that would lessen the severity of immoderate alleged crimes.

"In practice, galore white-collar defendants are sentenced to lesser sentences than what the guidelines dictate," Perry told CNBC, Even successful ample fraud cases, that 30-point enhancement antecedently mentioned tin beryllium considered punitive.

By mode of comparison, Stefan Qin, the Australian laminitis of a $90 cardinal cryptocurrency hedge fund, was sentenced to much than 7 years successful prison after helium pleaded blameworthy to 1 number of securities fraud. Roger Nils-Jonas Karlsson, a Swedish nationalist accused by the United States of defrauding implicit 3,500 victims of much than $16 million was sentenced to 15 years in situation for securities fraud, ligament fraud and wealth laundering.

Bankman-Fried could besides look monolithic civilian fines. Bankman-Fried was erstwhile a multibillionaire, but claimed helium was down to his past $100,000 successful a speech with CNBC's Sorkin astatine the DealBook Summit past week.

"Depending connected what is discovered arsenic portion of the investigations by instrumentality enforcement and the civilian authorities, you could beryllium looking astatine some dense monetary penalties and imaginable incarceration for decades," Levin told CNBC.

How agelong volition it take?

Whatever happens won't hap quickly.

In the astir celebrated fraud lawsuit successful caller years, Bernie Madoff was arrested wrong 24 hours of national authorities learning of his multibillion-dollar Ponzi scheme. But Madoff was successful New York and admitted to his transgression connected the spot.

The FTX laminitis is successful the Bahamas and hasn't admitted wrongdoing. Short of a voluntary return, immoderate efforts to apprehend him would necessitate extradition.

With hundreds of subsidiaries and slope accounts, and thousands of creditors, it'll instrumentality prosecutors and regulators clip to enactment done everything.

Similar cases "took years to enactment together," said Mariotti. At FTX, wherever grounds keeping was spotty astatine best, collecting capable information to prosecute could beryllium overmuch harder. Expenses were reportedly handled done messaging software, for example, making it hard to pinpoint however and erstwhile wealth flowed retired for morganatic expenses.

In Enron's bankruptcy, elder executives weren't charged until astir 3 years aft the institution went under. That benignant of timeline infuriates immoderate successful the crypto community.

"The information that Sam is inactive walking escaped and unencumbered, presumably capable to screen his tracks and destruct evidence, is simply a travesty," said Carter.

But conscionable due to the fact that instrumentality enforcement is tight-lipped, that doesn't mean they're lasting down.

"People should not leap to the decision that thing is not happening conscionable due to the fact that it has not been publically disclosed," Levin told CNBC.

Could helium conscionable disappear?

"That's ever a anticipation with the wealth that idiosyncratic has," Perry said, though Bankman-Fried claims he's down to 1 moving recognition card. But Perry doesn't deliberation it's likely. "I judge that determination has been apt immoderate dialog with his attorneys, and the prosecutors and different regulators that are looking into this, to guarantee them that erstwhile the clip comes [...] he's not fleeing somewhere," Perry told CNBC.

In the meantime, Bankman-Fried won't beryllium resting casual arsenic helium waits for the hammer to drop. Rep. Maxine Waters extended a Twitter invitation for him to look earlier a Dec. 13 hearing.

Bankman-Fried responded connected Twitter, telling Waters that if helium understands what happened astatine FTX by then, he'd appear.

Correction: Caroline Ellison is Bankman-Fried's counterpart astatine Alameda. An earlier mentation misspelled her name.

English (US) ·

English (US) ·