Sam Bankman-Fried, CEO of cryptocurrency speech FTX, astatine the Bitcoin 2021 league successful Miami, Florida, connected June 5, 2021.

Eva Marie Uzcategui | Bloomberg | Getty Images

Sam Bankman-Fried, co-founder of bankrupt crypto steadfast FTX, spent astir a twelvemonth trying to person regulators to fto him present a derivatives merchandise that would let retail investors to commercialized with borrowed money, according to Rostin Behnam, president of the Commodity Futures Trading Commission.

In an interrogation with CNBC's "Squawk Box" connected Wednesday, Behnam said Bankman-Fried had been lobbying the CFTC to amend the rules truthful FTX could fto users commercialized derivatives utilizing borderline alternatively than paying upfront. He besides wanted to connection the contracts straight to users, without having to spell done a futures committee merchant.

"It would person been a non-intermediated, margined model," said Behnam, who described the connection arsenic a "very tricky contented from a hazard perspective."

Prior to its bankruptcy filing past week, FTX had a registered derivatives level with the CFTC called FTX US Derivatives. The level was a rebranding of LedgerX, a institution that FTX acquired successful 2021.

FTX US Derivatives is 1 of the fewer FTX-related properties that's not a portion of its bankruptcy proceedings and remains operational today. However, it appears to person returned to utilizing the LedgerX brand. If you spell to the FTX US Derivatives website, it redirects you to ledgerx.com. And Zach Dexter, who was CEO of FTX US Derivatives, says connected his LinkedIn profile that he's CEO astatine LedgerX. The level lets traders bargain options, swaps and futures connected bitcoin and ethereum.

Starting successful Dec. 2021, Bankman-Fried and his elder enactment squad made predominant visits to the CFTC to advocator for an amendment to its existing license, Behnam said.

When asked what Behnam thought of Bankman-Fried implicit the people of gathering with him for astir a year, the president said that the erstwhile FTX main "knows markets, astatine slightest helium tries to suggest that" and helium "wanted to truly aggressively person this amendment passed."

Bankman-Fried's backers appealed to the CFTC straight to backmost his plan, Behnam said. They included Fidelity Investments, Fortress Investment Group, and adjacent universities from crossed the country.

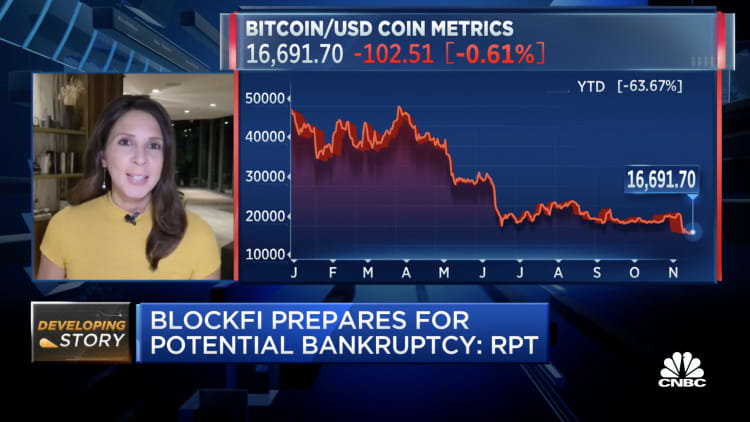

FTX, which was valued astatine $32 cardinal by backstage investors earlier this year, spiraled successful spectacular fashion past week arsenic reports of liquidity problems resulted successful customers withdrawing billions of dollars a time from their accounts. However, FTX didn't person the superior to grant those requests due to the fact that it had utilized lawsuit deposits for a assortment of purposes, including for trading astatine Bankman Fried's hedge fund, Alameda Research. Bankman-Fried besides disclosed connected Twitter connected Wednesday that FTX had built up around $13 cardinal of leverage.

Behnam said his agency's staffers were inactive successful the process of reviewing FTX's exertion for an amended licence erstwhile FTX and astir 130 further affiliated companies, including Alameda and FTX's U.S. subsidiary collectively filed for bankruptcy protection.

Since then, LedgerX has reportedly withdrawn its application for leveraged derivatives trading.

Before the implosion, Bankman-Fried had been trying to play the relation of manufacture savior arsenic the crypto marketplace sank and lenders and hedge funds went belly up. In May, helium besides bought a 7.6% involvement successful trading app Robinhood, which astatine the clip had mislaid much than three-quarters of its worth since its IPO past year. In April, FTX bought a involvement successful equities speech IEX.

"If you deliberation astir it, successful retrospect, with his Robinhood acquisition and his narration with IEX — it goes beyond crypto what FTX was trying to do," Behnam said.

WATCH: Authorities eyeing bringing Sam Bankman-Fried to the U.S. for questioning

English (US) ·

English (US) ·