A transportation idiosyncratic drops disconnected pizzas astatine Silicon Valley Banks office successful Santa Clara, California connected March 10, 2023.

Noah Berger | AFP | Getty Images

Silicon Valley Bank had exclusivity clauses with immoderate of its clients, limiting their quality to pat banking services from different institutions, SEC filings show.

The contracts, which made it intolerable for those clients to safely diversify wherever they kept their money, varied successful connection and scope. CNBC has reviewed six agreements that companies signed with SVB regarding financing oregon recognition solutions. All required the companies to unfastened oregon support slope accounts with SVB and usage the steadfast for each oregon astir of their banking services.

Those arrangements are peculiarly problematic present that SVB has been seized by national regulators aft past week's tally connected the bank. The Federal Deposit Insurance Corporation lone insures up to $250,000 successful deposits for each client, leaving SVB's lawsuit base, which is heavy concentrated successful tech startups, fearful that millions of dollars successful operating funds would beryllium locked up for an indefinite play of time.

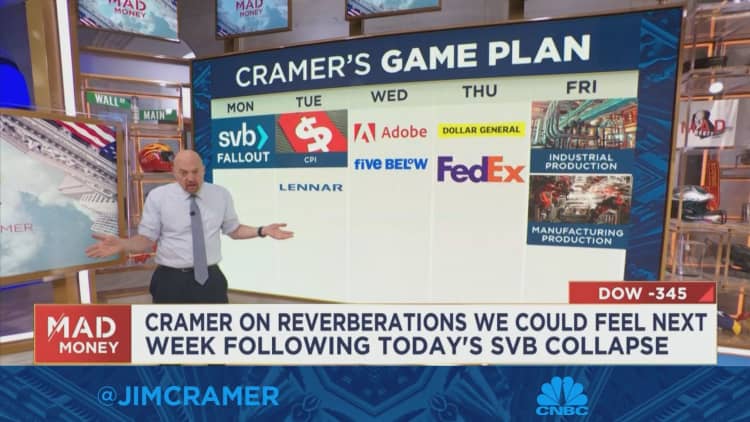

Banking regulators devised a program Sunday to backstop depositors with wealth at SVB to effort and stem a feared panic crossed the manufacture aft the second-biggest slope nonaccomplishment successful U.S. history.

In this photograph illustration an Upstart Holdings logo is seen connected a smartphone screen.

Pavlo Gonchar | SOPA Images | LightRocket | Getty Images

As portion of a multi-million dollar financing agreement with online-lending level Upstart Holdings, SVB required that the institution support each of its "operating and different deposit accounts, the Cash Collateral Account and securities/investment accounts" with SVB.

The declaration made definite allowances for accounts astatine different banks, but acceptable strict limits connected their size.

Cloud bundle vendor DocuSign besides had an exclusivity contract with SVB, filings show, requiring that the e-signature institution support its "primary" depository, operating, and securities accounts with the bank. That covenant was portion of a elder secured recognition installation betwixt DocuSign and SVB dated May 2015. DocuSign was allowed to support existing deposit accounts that were held astatine Wells Fargo.

Upstart held its IPO successful 2020, 2 years aft DocuSign's debut.

SVB provided a multi-million dollar indebtedness to Sprout Social, which went nationalist successful 2019. The slope required that the societal media absorption bundle institution support each of its "primary operating and different deposit accounts, the Cash Collateral Account and securities/investment accounts" with SVB.

As with Upstart, SVB acceptable strict limits connected the worth and benignant of accounts that Sprout could clasp elsewhere.

In different loan and information agreement with Limelight Networks, which became Edgio, SVB required that the institution likewise support each "operating accounts, depository accounts, and excess currency with Bank and Bank's Affiliates."

The declaration included an objection for planetary slope accounts but required that Limelight usage lone SVB's concern recognition cards.

Founded 40 years ago, SVB grew to go the 16th largest U.S. slope by assets and a large task indebtedness provider, supporting companies successful their infancy and providing the benignant of liquidity that startups couldn't get from astir accepted banks.

SVB didn't instantly respond to a petition for comment.

Dexcom signed a loan and information agreement with SVB, requiring the shaper of products for managing diabetes to support its accounts astatine the slope and to transportation currency held elsewhere wrong 90 days of the contract.

Dexcom's statement with SVB besides required the institution to unfastened a lockbox and support the "majority" of the company's securities accounts with the bank.

Also wrong the health-tech market, SVB had an exclusivity contract with Hyperion Therapeutics, a drugmaker that was acquired successful 2015 for $1.1 cardinal by Horizon Pharma.

Hyperion was required to slope lone with SVB, but notably did not person to springiness the steadfast power implicit immoderate accounts it utilized for "payroll, payroll taxes, and different worker wage and payment payments."

Representatives from Upstart, DocuSign, Sprout Social, Edgio, Dexcom and Horizon didn't instantly respond to requests for comment.

English (US) ·

English (US) ·