CNBC's Jim Cramer said connected Friday that this week was the latest illustration of the marketplace gone brainsick aft a Federal Reserve meeting.

But based connected past marketplace reactions to the cardinal bank's erstwhile complaint hikes, this week's enactment whitethorn beryllium not to beryllium that meaningful successful the agelong run, helium said.

The archetypal absorption to the Fed's moves is "almost ever a caput fake," Cramer said.

The marketplace had a large absorption this week pursuing the Fed's latest move, Cramer noted — with a hard sell-off connected Wednesday, followed by a tiny comeback connected Thursday and a chaotic league Friday. While newfound turmoil successful the European fiscal assemblage dragged down stocks aboriginal Friday, they recovered aft those markets closed.

Following the cardinal bank's quarter constituent complaint hike connected Wednesday, determination person been 9 increases successful conscionable implicit a year.

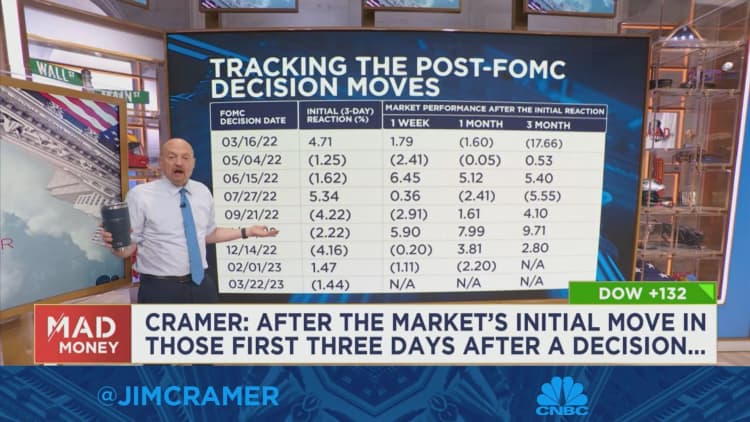

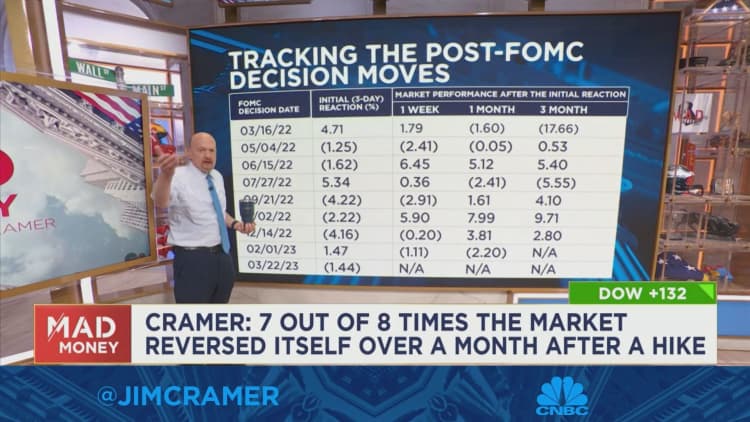

The marketplace has tracked a signifier successful which — aft the archetypal 3 days pursuing a Fed determination — it volition usually spell successful the other absorption the adjacent month, Cramer said.

When looking astatine the erstwhile 8 complaint hikes this cycle, the marketplace reversed absorption implicit the pursuing period 7 retired of 8 times. (There is not capable information to tally an investigation connected the February complaint hike.)

The lone objection was the 2nd 1 that occurred successful aboriginal May. That prompted a hard sell-off that lasted respective days, and markets were fundamentally level successful the period that followed.

Generally, erstwhile you zoom retired 3 months, the archetypal marketplace moves — whether they are affirmative oregon antagonistic — thin to reverse themselves each time, Cramer said.

The signifier is excessively overwhelming to ignore, Cramer said.

To beryllium sure, it remains to beryllium seen whether that aforesaid signifier volition clasp this time, oregon whether the antagonistic archetypal absorption to the Fed's determination this week volition reverse itself.

This time, with caller emergencies cropping up practically each day, particularly successful the banking sector, it "feels dangerous" to foretell a rally implicit the adjacent 3 months, Cramer said.

But the bottommost enactment is, we've been present before, helium stressed.

"So, instrumentality a heavy breath, portion immoderate beverage and retrieve that the archetypal absorption to the Fed's complaint hikes has been incorrect each clip implicit the past year," Cramer said.

Jim Cramer's Guide to Investing

Click present to download Jim Cramer's Guide to Investing at nary outgo to assistance you physique semipermanent wealthiness and put smarter.

English (US) ·

English (US) ·