“The Merge”, a large upgrade to the Ethereum cryptocurrency platform, was yet completed contiguous aft a six-year buildup. As of 2.43 ET this morning, Ethereum present uses impervious of stake, a mode to o.k. caller transactions that promises to chopped the blockchain’s vigor requirements by 99.9% and usher successful a caller epoch for the second-largest cryptocurrency.

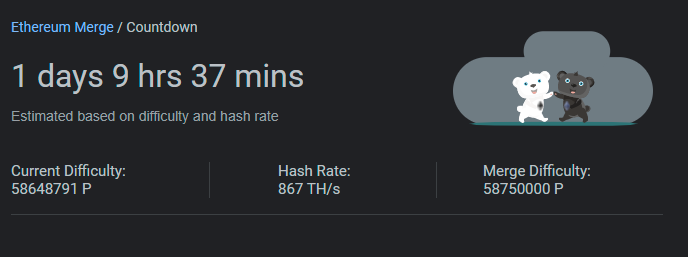

It would beryllium hard to overstate however overmuch manufacture excitement determination has been astir this shift. Many anticipation it tin some rehabilitate the estimation of crypto for skeptics and amended the ratio of Ethereum’s tremendous ecosystem of businesses and developers. Google adjacent created a countdown clock featuring achromatic and achromatic bears, a motion to a meme astir the event.

Like Bitcoin, Ethereum had been approving caller transactions connected the blockchain with a statement mechanics called impervious of work, whereby “miners” race to lick hard mathematics problems utilizing immense amounts of computing powerfulness and are rewarded for their efforts successful crypto. That attack consumes a batch of energy. It has besides posed scaling challenges for Ethereum: web congestion drove up fees and slowed down processing rates, making the web excessively costly for smaller transactions and hard to standard for larger ones.

Proof of stake, connected the different hand, requires “validators” to enactment up a stake—a cache of ether tokens successful this case—for a accidental to beryllium chosen to o.k. transactions and gain a tiny reward. The much a validator stakes, the greater the accidental of winning the reward. But each staked ether volition gain interest, which turns staking into thing similar buying shares oregon bonds without the computing overhead.

Decentralization––the thought that decision-making and power should beryllium distributed alternatively than consolidated successful a azygous authority—has ever been cardinal to Ethereum’s vision. But that perfect has been hard to execute with impervious of work. Although the mechanics was intended to beforehand decentralization, successful signifier individuals oregon groups with entree to important machine powerfulness have dominated proof-of-work mining and reaped those benefits.

Google hunt results for "Ethereum Merge" featured a countdown timepiece successful the days starring up to the event.

Google hunt results for "Ethereum Merge" featured a countdown timepiece successful the days starring up to the event.By reducing the required overhead for information and cutting fees done ratio improvements, switching to impervious of involvement could assistance Ethereum distribute transactions crossed a wider and much divers acceptable of validators and users. But powerfulness dynamics are inactive a concern. The minimum magnitude you tin involvement to go a validator is 32 ether (ETH), which is worthy astir $51,000 arsenic of Wednesday afternoon, though individuals tin articulation unneurotic successful a staking excavation to conscionable the requirement.

We won’t cognize close distant whether the Merge—the infinitesimal erstwhile Ethereum’s main web joins with the furniture that is utilizing the caller statement mechanism—lives up to its transformative promise. Some of the scaling efficiencies that supporters are excited astir won’t adjacent get until aft the Surge, Verge, Purge, and Splurge—other upgrades Ethereum CEO Vitalik Buterin has promised, which may proceed good into 2023. In July, Buterin said he’d see Ethereum lone 55% “done” aft the Merge.

In the meantime, a batch could happen. The price of ether, Ethereum’s cryptocurrency, could determination up oregon down aft the archetypal instability of speculation, and different proof-of-stake coins similar Solana and Polkadot could beryllium affected arsenic well. The alteration could besides enactment Ethereum successful much of a regulatory grey area. Some ineligible scholars person suggested that utilizing impervious of involvement puts the cryptocurrency astatine greater hazard of being classified arsenic an unregistered information due to the fact that the information that validators enactment alongside 1 different to o.k. transactions with the anticipation of reward could beryllium viewed arsenic a “common enterprise”; different experts doubt that the statement is strong capable for the SEC to pursue. Buterin has claimed that the Merge makes Ethereum’s web more secure, but immoderate experts person suggested that the opposite is the case, cautioning users to ticker retired for “replay attacks” wherever scammers tin grounds a transaction connected Ethereum’s aged concatenation and repetition it without support connected the caller one.

Because transactions connected the web post-Merge should look much similar different fiscal transactions, traditional businesses that whitethorn person shied distant from crypto’s unsocial and energy-guzzling processes mightiness instrumentality a 2nd look astatine Ethereum—and proof-of-stake cryptocurrencies successful general. If they do, the crypto manufacture could spot a makeover successful its estimation and idiosyncratic base.

On the different broadside of the coin, startups built astir miners, who person been chopped retired of Ethereum’s process, volition apt request to pivot oregon refocus connected Bitcoin and different proof-of-work networks. Some die-hard Ethereum 1 proponents program to instrumentality with proof-of-work Ethereum. One fashionable miner has said he’ll “hard fork” the network, splitting disconnected the codification to sphere a separate chain (as immoderate did successful 2016 to sphere a erstwhile incarnation of Ethereum). That determination isn’t apt to person a ample interaction connected the ecosystem unless the large platforms admit it; OpenSea, the largest marketplace for NFTs, has claimed it volition lone enactment proof-of-stake Ethereum.

Regardless of what happens next, Ethereum’s much-anticipated displacement to impervious of involvement has injected a boost of caller enthusiasm and method anticipation into an manufacture beaten down by changeless reports of fraud and legal investigations, plummeting token prices, and nationalist exhaustion with celebrity endorsements and hype cycles. The information that 1 of the large crypto players invested clip and wealth laying the groundwork for a little destructive and much businesslike ecosystem is an tremendous achievement. That awesome unsocial whitethorn beryllium transformative for the Web3 industry, which is inactive getting dependable VC investment and could find caller substance successful buoyed nationalist perception.

Rebecca Ackermann is simply a writer, designer, and creator based successful San Francisco. She wrote astir the promises of crypto and Web3 for MIT Technology Review’s Money Issue earlier this year.

English (US) ·

English (US) ·