Swiss authorities brokered the arguable exigency rescue of Credit Suisse by UBS for 3 cardinal Swiss francs ($3.37 billion) implicit the people of a play successful March.

Fabrice Coffrini | AFP | Getty Images

UBS estimates a fiscal deed of astir $17 cardinal from its exigency takeover of Credit Suisse, according to a regulatory filing, and said the rushed woody whitethorn person affected its owed diligence.

In a caller filing with the U.S. Securities and Exchange Commission (SEC) precocious Tuesday night, the Swiss banking elephantine flagged a full antagonistic interaction of astir $13 cardinal successful just worth adjustments of the caller combined entity's assets and liabilities, on with a imaginable $4 cardinal deed from litigation and regulatory costs.

However, UBS besides expects to offset this by booking a one-off $34.8 cardinal summation from alleged "negative goodwill," which refers to the acquisition of assets astatine a overmuch little outgo than their existent worth.

The bank's exigency acquisition of its stricken home rival for 3 cardinal Swiss francs ($3.4 billion) was brokered by Swiss authorities implicit the people of a play successful March, with Credit Suisse teetering connected the brink of illness amid monolithic lawsuit deposit withdrawals and a plummeting stock price.

In the amended F-4 filing, UBS besides highlighted that the abbreviated clip framework nether which it was forced to behaviour owed diligence whitethorn person affected its quality to "fully measure Credit Suisse's assets and liabilities" anterior to the takeover.

Swiss governmental authorities approached UBS connected March 15 portion considering whether to initiate a merchantability of Credit Suisse successful bid to "calm markets and debar the anticipation of contagion successful the fiscal system," the filing revealed. The slope had until March 19 to behaviour its owed diligence and instrumentality with a decision.

"If the circumstances of the owed diligence affected UBS Group AG's quality to thoroughly see Credit Suisse's liabilities and weaknesses, it is imaginable that UBS Group AG volition person agreed to a rescue that is considerably much hard and risky than it had contemplated," UBS said successful the Risk Factors conception of the filing.

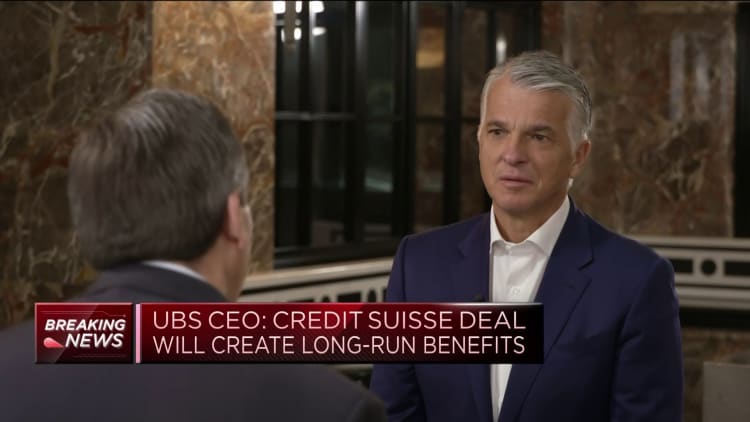

Though this is highlighted arsenic a imaginable risk, UBS CEO Sergio Ermotti told CNBC past period that the Credit Suisse woody was not risky and would make semipermanent benefits.

The astir arguable facet of the woody was regulator FINMA's determination to hitch retired astir $17 cardinal of Credit Suisse's further tier-one (AT1) bonds earlier shareholdings, defying the accepted bid of constitute downs and resulting successful ineligible enactment from AT1 bondholders.

Tuesday's filing showed the UBS Strategy Committee began evaluating Credit Suisse successful October 2022 arsenic its rival's fiscal concern worsened. The long-struggling lender experienced monolithic nett plus outflows toward the extremity of 2022 connected the backmost of liquidity concerns.

The UBS Strategy Committee concluded successful February that an acquisition of Credit Suisse was "not desirable," and the slope continued to behaviour investigation of the fiscal and ineligible implications of specified a woody successful lawsuit the concern deteriorated to the constituent that Swiss authorities would inquire UBS to measurement in.

UBS past week announced that Credit Suisse CEO Ulrich Koerner volition articulation the enforcement board of the caller combined entity erstwhile the woody legally closes, which is expected wrong the adjacent fewer weeks.

The radical volition run arsenic an "integrated banking group" with Credit Suisse retaining its marque independency for the foreseeable future, arsenic UBS pursues a phased integration.

English (US) ·

English (US) ·