Families don't similar to skimp erstwhile it comes to the holidays, nether immoderate conditions.

But with rising prices and fears of a recession, vacation shoppers are feeling little generous this season.

Many consumers are readying to marque less purchases — and astatine a discount, according to a caller vacation retail study by Deloitte.

Still, households volition ammunition retired $1,455, connected average, connected vacation gifts, successful enactment with past year, the study found.

More from Personal Finance:

66% of workers are worse disconnected financially than a twelvemonth ago

Consumers prioritize Netflix, Amazon Prime implicit groceries, gas

Nearly fractional of Americans marque this mistake with recognition cards

Even though immoderate consumers whitethorn extremity up spending arsenic overmuch arsenic oregon much than they did successful 2021, that's mostly owed to higher prices, different reports besides show.

"Inflation is, by far, the biggest contented for households this year," said Tim Quinlan, elder economist astatine Wells Fargo and writer of its 2022 vacation income report.

Household finances person taken a deed with a little savings complaint and declining existent wages, which could dilatory vacation sales, Quinlan said successful the report.

"The bottommost enactment is, with ostentation remaining a headache, dollars aren't stretching arsenic far, and astir consumers volition inactive beryllium looking for bargains."

Dollars aren't stretching arsenic far, and astir consumers volition inactive beryllium looking for bargains.

Tim Quinlan

senior economist astatine Wells Fargo

A abstracted study by BlackFriday.com recovered that 70% of shoppers volition beryllium taking ostentation into information erstwhile buying this vacation play and adjacent much volition beryllium connected the lookout for deals.

Nearly 33% of shoppers besides program to bargain less gifts this year, portion astir one-quarter said they would opt for cheaper versions oregon much applicable gifts, specified arsenic state cards, according to TransUnion's vacation buying survey.

"People are trying to economize and marque the astir of what they have," said Cecilia Seiden, vice president of TransUnion's retail business.

How to debar vacation debt

"Remember to not enactment yourself successful indebtedness implicit vacation shopping," cautioned Natalia Brown, main lawsuit operations serviceman astatine National Debt Relief. "Debt prevents radical from reaching their fiscal goals — similar gathering an exigency fund, buying a location and redeeming for retirement."

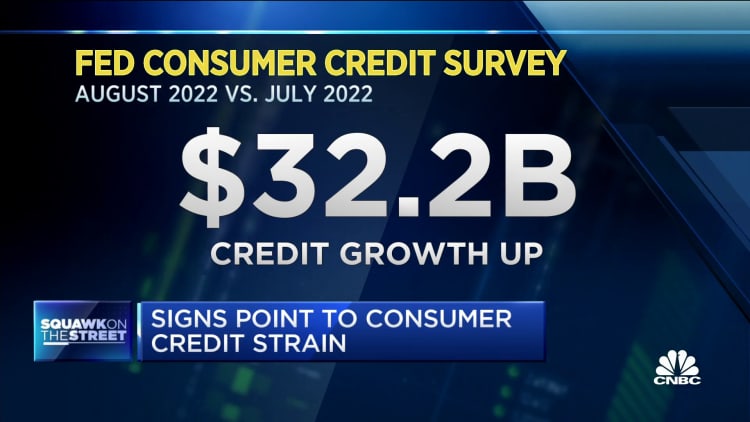

Holiday spending could travel astatine a higher outgo if it means tacking connected further recognition paper indebtedness conscionable arsenic the Federal Reserve raises involvement rates to dilatory inflation, Quinlan added.

Annual percent rates are presently adjacent 18%, connected average, but could beryllium person to 19% by the extremity of the year, which would be an all-time high, according to Ted Rossman, a elder manufacture expert astatine CreditCards.com.

That volition permission consumers worse disconnected heading into 2023, Quinlan said. "In galore ways we presumption this year's vacation buying play arsenic the past hurrah."

English (US) ·

English (US) ·