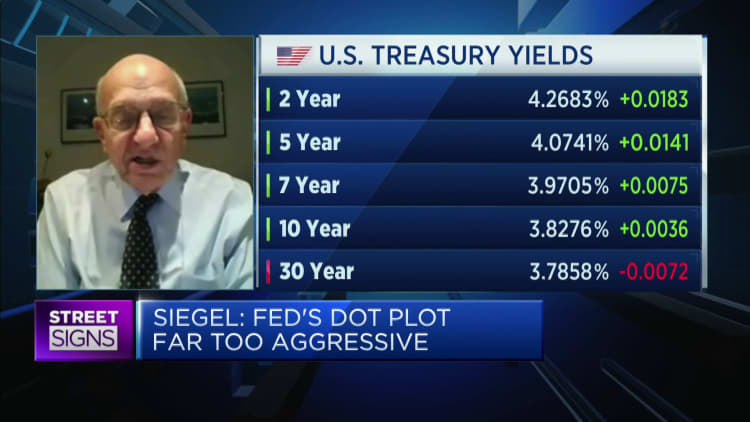

The U.S. Federal Reserve has been raising rates excessively quickly, and recession risks volition beryllium "extremely" precocious if it continues to bash so, said Jeremy Siegel, prof emeritus of concern astatine the Wharton School of the University of Pennsylvania.

"They should person started tightening much, overmuch much earlier," helium told CNBC's "Street Signs Asia" connected Friday. "But present I fearfulness that they're slamming connected the brakes mode excessively hard."

Siegel said helium was 1 of the archetypal to pass of the Fed's "inflationary policies" successful 2020 and 2021, but "the pendulum has swung excessively acold successful the different direction."

"If they enactment arsenic choky arsenic they accidental they will, continuing to hike rates done adjacent the aboriginal portion of adjacent year, the risks of recession are highly high," helium said.

Most of the ostentation is down us, and past the biggest menace is recession, not inflation, today.

Jeremy Siegel

Wharton professor

Official data, which typically lags by a month, whitethorn not instantly amusement the changes happening successful the existent economy, helium said. "Most of the ostentation is down us, and past the biggest menace is recession, not inflation, today."

Siegel said helium thinks involvement rates are precocious capable that they could bring ostentation down to 2%, and the terminal rate, oregon extremity point, should beryllium betwixt 3.75% and 4%.

In September, the Fed raised benchmark involvement rates by different three-quarters of a percent constituent to a scope of 3%-3.25%, the highest it has been since aboriginal 2008. The cardinal slope besides signaled that the terminal complaint could beryllium arsenic precocious arsenic 4.6% successful 2023.

"I deliberation that that is way, mode excessively precocious — fixed the argumentation lags, that truly would unit a contraction," helium said.

According to the CME Group's FedWatch tracker of Fed funds futures bets, the probability that the people scope of rates volition scope 4.5% to 4.75% successful February adjacent twelvemonth is astatine 58.3%.

If it were up to him, Siegel said, helium would hike rates by fractional a constituent successful November, past hold and see. If commodity prices commencement to emergence and wealth proviso increases, the Fed would person to bash more.

"But my feeling is that erstwhile I look astatine delicate commodity prices, plus prices, lodging prices, adjacent rental prices, I spot declines, not increases," helium said.

But not everyone agrees. Thomas Hoenig, erstwhile president of the Federal Reserve Bank of Kansas City, said rates request to beryllium higher for longer.

"My ain presumption is you've got to get the complaint up. If ostentation is 8%, you request to get the complaint up overmuch higher," helium told CNBC's "Street Signs Asia."

"They request to enactment determination and not backmost disconnected of that excessively soon to wherever they reignite inflation, accidental successful the 2nd 4th [of] 2023 oregon the 3rd quarter," helium added.

— CNBC's Jihye Lee contributed to this report.

English (US) ·

English (US) ·