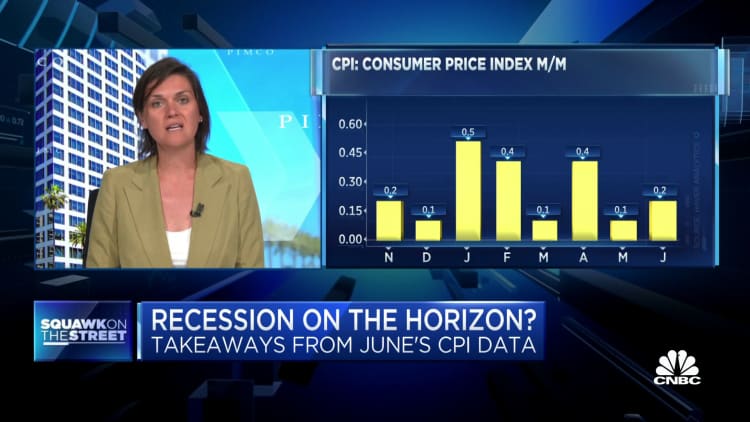

Last week's user ostentation numbers fell to their lowest yearly complaint successful 2 years. A akin encouraging diminution was seen successful the shaper terms index, expanding bets that the Federal Reserve tin execute a brushed landing for the U.S. economy, an result that has seldom happened during erstwhile complaint hiking cycles.

Experts are torn astir what the advancement connected ostentation means for the July 25-26 gathering of the Fed's Federal Open Market Committee, which volition marque its adjacent telephone connected involvement rates, arsenic good arsenic the probability of recession.

Reducing ostentation remains apical of caput for the Fed, and the complaint hikes that it refers to arsenic a "blunt tool" stay its superior instrumentality for cooling prices passim the economy. The marketplace is afloat expecting different involvement complaint hike from the Fed successful July, aft it skipped a complaint hike successful June. Current bets are adjacent to unanimous, with 96% of traders saying the Fed volition rise rates by different 25 ground points, to a scope of 5.25% to 5.50%, according to the CME Fed tracker.

For the Fed, perfect ostentation is successful the people scope of 2%. Fed Chair Jerome Powell has been wide since ostentation began falling that helium makes a favoritism betwixt a disinflation inclination that has begun and the Fed being capable to state its combat against ostentation over. The 3% CPI people from past week is the closest that the Fed has travel to its semipermanent people successful years, and extracurricular the Fed immoderate marketplace pundits are not being shy astir declaring victory.

'Mission accomplished?'

The Fed has "achieved their mission," said Ed Yardeni, president of Yardeni Research, connected CNBC's "Halftime Report" Wednesday morning,

"They don't privation to usage the look 'mission accomplished' due to the fact that that's a jinx, but I deliberation to a ample grade they person achieved their mission, which was to get the Fed funds complaint up to a restrictive level and support it there," Yardeni said.

The banal marketplace has been successful rally mode, with the Dow Jones Industrial Average closing retired a five-day winning streak connected Friday, and some the Dow and S&P 500 Index trading supra their 200-day averages and astir 6% from retaking all-time highs.

"This [data] is the worldly of a brushed landing, this is what the Fed's been looking for, this is what the marketplace wants to see," said Paul McCulley, a Georgetown prof and erstwhile managing manager astatine enslaved investing elephantine Pimco, during an interrogation of CNBC's "Squawk connected the Street" past week.

A brushed landing and different complaint hike for 'credibility'

But McCulley, portion successful the brushed landing camp, said that doesn't pb to the decision it volition easiness up connected rates erstwhile it adjacent meets July 25-26.

"It doesn't alteration what's going to hap successful 2 weeks," helium said. "The Fed is going to tighten different 25 [basis points], they benignant of person to successful bid to enactment substance to the conception that they skipped past time, they didn't pause, and they inactive person 1 much successful the dot crippled for the extremity of the year," helium said.

The Fed maintaining its credibility by hiking rates again was a constituent made past week by respective experts, including banal marketplace strategest Tom Lee, Fundstrat managing spouse and caput of research.

The latest ostentation numbers and odds-against brushed landing marque the Fed's short-term people much difficult, but Lee said the cardinal slope volition apt hike rates again "for credibility's sake," Lee said connected "Closing Bell Overtime."

That's an important constituent successful speechmaking the Fed, experts said, due to the fact that erstwhile the Fed decided to not rise rates successful June it was seen arsenic a "skip" alternatively than a pause that could beryllium extended.

There stay contrarians, oregon astatine slightest those successful the marketplace consenting to reason the lawsuit that aft the latest economical data, the Fed whitethorn beryllium done.

"I don't deliberation that a hike successful July is perfectly guaranteed," said Liz Young, SoFi caput of concern strategy, connected CNBC's "Halftime Report" past week. "I deliberation there's a decent probability that they mightiness beryllium done oregon that they mightiness prolong the intermission adjacent further due to the fact that determination has been bully progress, and it's good to beryllium affirmative astir that progress."

Former Federal Reserve vice president Roger Ferguson, who has been accordant successful his presumption that ostentation volition stay sticky and the Fed volition not determination rapidly to state triumph adjacent if it means a recession for the economy, emphasized aft the latest ostentation information that it is inactive excessively aboriginal to marque a triumph call. But helium is much encouraged astir the system avoiding recession, which caller economical past said would not beryllium possible.

Wait until September

"I deliberation determination is an expanding anticipation of that brushed landing, which is simply a precise affirmative thing," Ferguson said connected CNBC's "Squawk Box" past week. "Fortunately we inactive spot guardant momentum successful galore sectors. However, I deliberation it's truly excessively aboriginal to state that arsenic a done deal, due to the fact that arsenic the Fed itself has said, overmuch of the enactment that they've done has not yet shown up successful market."

September, Ferguson says, is erstwhile the markets should instrumentality a person look astatine the effects of the erstwhile hikes and spot however they person affected the economy. Today, determination is inactive a hazard that the cooling ostentation is little straight related to the Fed's hikes than immoderate are concluding.

The connection from apical firm executives successful the user assemblage has been to expect immoderate level of precocious ostentation for immoderate clip to come. PepsiCo main fiscal serviceman Hugh Johnston said past week aft its latest net it doesn't expect the handbasket of commodities it tracks to travel backmost down to a humanities average. It's making little borderline disconnected higher prices passed done to consumers contiguous — much margin, helium said, is coming from operational efficiencies including automation — but helium expects those prices to stay precocious tied to an elevated underlying complaint of inflation, adjacent if it is declining.

Why a recession is inactive successful the picture

CNBC surveying of CFOs indicates the bulk inactive expect a recession, portion they've go much affirmative connected the outlook for stocks and a little assertive Fed. Several CFOs said connected a caller backstage telephone among members of the CNBC CFO Council that they've sent the connection straight to their determination Fed presidents that it is clip to halt raising rates due to the fact that the system is slowing successful ways that they tin spot — from commercialized volumes successful the proviso concatenation to manufacturing activity, user spending and recognition deterioration, if not delinquencies — but that whitethorn lone go evident to the Fed excessively late.

This CFO presumption that tin beryllium summed up successful economist Milton Friedman's statement of "long and adaptable lags" from monetary argumentation was echoed by Pimco managing manager Tiffany Wilding, who thinks a recession is probable.

"We deliberation maturation volition decelerate successful the 2nd portion of this year. You person headwinds to depletion from the restart of pupil indebtedness payments," she said past week connected CNBC's "Squawk connected the Street."

"Under the surface, recognition maturation is slowing and slowing rather dramatically. And the system yet needs recognition to tally connected and truthful that volition beryllium a large headwind astatine a clip erstwhile monetary argumentation is precise tight," Wilding said.

As the system weakens, unemployment volition rise. "And usually, historically, that emergence successful unemployment has been characterized by antagonistic quarters of existent GDP growth," she said. "In different words, we person ne'er seen successful the past of getting a emergence successful unemployment without those antagonistic quarters, truthful we bash deliberation you astir apt volition spot a recession," she added.

Many CFOs stay of the presumption that adjacent successful the existent choky labour marketplace conditions, and defiant occupation maturation fixed the broader economical risks, eventually, erstwhile unemployment rises, it volition emergence by much than the Fed is targeting.

But adjacent successful her worst-case scenario, Wilding expects a "moderate" recession. And she does expect the July complaint hike to beryllium the Fed's past successful this cycle.

San Francisco Fed President Mary Daly expressed her committedness to lowering ostentation adjacent further connected "Squawk connected the Street" past week.

"It's truly excessively aboriginal to accidental that we tin state triumph connected inflation. This period of information is precise positive, I anticipation it's portion of a downward inclination successful inflation, but I americium successful a wait-and-see mode connected that due to the fact that I stay resolute to bring ostentation down to 2%."

English (US) ·

English (US) ·