When it comes to the U.S. economy, assurance is key. But the banking crisis has threatened to upset however astir radical consciousness astir their fiscal picture.

"The slope problems are astir apt making a batch of radical deliberation twice," said Diana Furchtgott-Roth, an economics prof astatine George Washington University and erstwhile main economist astatine the U.S. Department of Labor.

"People are not arsenic confident," she said, referring to the "wealth effect," oregon the mentation that radical walk little erstwhile they consciousness little well-off than they did before.

More from Personal Finance:

What the Fed's complaint hike means for you

What happens during a 'credit crunch'

What is simply a 'rolling recession' and however does it impact you?

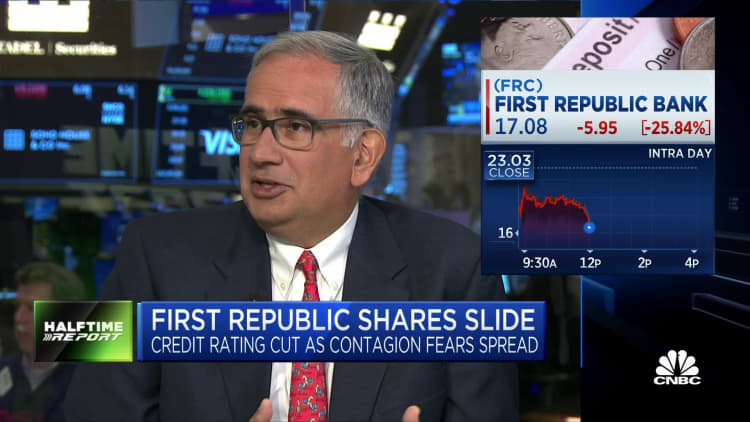

As caller events prove, the enactment betwixt Wall Street and Main Street has go progressively blurred: When stocks fall, radical thin to rein successful their spending.

A diminution successful spending slows retail income and that, successful turn, triggers a marketplace absorption that spills backmost onto consumers.

At the aforesaid time, income is going down — aft adjusting for inflation — interest rates are going up and Federal Reserve Chair Jerome Powell says turmoil successful the fiscal sector will origin banks to tighten their lending standards, making it adjacent harder to borrow.

That leaves consumers with little entree to currency to screen the rising outgo of food, lodging and different expenses. As households consciousness progressively squeezed, that weighs connected their assurance successful the wide economical picture.

What it takes to consciousness financially secure

Americans present accidental they would request an mean nett worthy of $774,000 to feel "financially comfortable," but much than $2 cardinal to consciousness "wealthy," according to Charles Schwab's yearly Modern Wealth Survey.

However, "it's not however galore dollar bills you have, it's what you tin bargain with them," said Tomas Philipson, University of Chicago economist and the erstwhile seat of the White House Council of Economic Advisers.

Any wealth earning little than the complaint of ostentation loses purchasing powerfulness implicit time.

The University of Michigan's intimately watched scale of consumer sentiment recently fell for the archetypal clip successful months. The Conference Board's consumer assurance index is besides down, according to the latest data.

Fewer consumers are readying to bargain a location oregon car oregon walk wealth connected different big-ticket items similar a large appliance oregon vacation. That diminution successful spending paired with rising involvement rates could apt propulsion the system into a recession successful the adjacent term, the Conference Board found.

Wall Street has been debating whether the state is heading into a recession for months, though galore economists expected it to hap successful the 2nd fractional of this year.

Still, thanks, successful part, to a beardown labour market, the system has remained remarkably resilient, dodging a downturn truthful far.

"It remains to beryllium seen if we volition proceed to bash so, and partially it comes down to user confidence," Furchtgott-Roth said. "People are decidedly shaken up."

English (US) ·

English (US) ·