Bank of Japan Governor Kazuo Ueda arrives to behaviour an interrogation with a tiny radical of journalists successful Tokyo connected May 25, 2023.

Richard A. Brooks | AFP | Getty Images

Analysts are divided implicit the Bank of Japan's moves aft the country's halfway ostentation came successful supra the cardinal bank's people of 2% for the 15th consecutive month.

CLSA Japan strategist Nicholas Smith is of the presumption that the BOJ has been "wrong-footed" connected inflation.

"They watched the Fed accidental that ostentation was transitory, and beryllium made to look fools for doing so," Smith said successful an interrogation with CNBC's "Street Signs Asia."

"They determine to disregard that and proceed to forecast this fiscal year, 1.8% inflation. Inflation has been supra 2% for 15 months successful a row."

Japan's halfway consumer terms scale climbed 3.3% year-on-year successful June, successful enactment with expectations of economists polled by Reuters and somewhat higher than the 3.2% recorded successful May.

Core ostentation successful Japan strips retired prices of caller nutrient from the wide user terms index. Headline ostentation complaint came successful astatine 3.3% successful June, rising somewhat from 3.2% seen successful May.

The ostentation numbers are cardinal to the BOJ's monetary argumentation considerations, up of its gathering adjacent Friday.

In a note, Barclays economist Tetsufumi Yamakawa said overmuch of the marketplace inactive appears to presumption rising prices successful Japan arsenic "transitory," attributing it to a "cost push" alternatively of a "demand pull."

However, helium sees a "gradually strengthening possibility" that sustained ostentation volition materialize with the ample wage hikes resulting from the latest wage negotiations, oregon the alleged "shunto."

"We expect 'shunto' wage hikes to beryllium smaller successful fiscal twelvemonth 2024 than successful fiscal twelvemonth 23, but forecast an summation of astir +3%, which would beryllium accordant with +2% terms stableness target," Yamakawa wrote.

Shift successful YCC stance

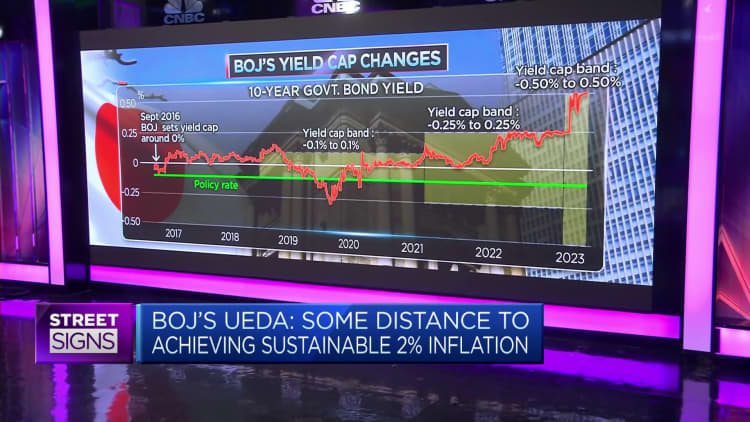

Given this, investors volition beryllium looking for signs that the BOJ volition displacement its stance connected its ultra-loose monetary argumentation — oregon much specifically, its "yield curve control" policy.

Under the YCC policy, the cardinal slope targets short-term involvement rates astatine -0.1% and the 10-year authorities enslaved output astatine 0.5% supra oregon beneath zero, with the purpose of maintaining the ostentation people astatine 2%.

However, BOJ politician Kazuo Ueda signaled in a caller Reuters report the BOJ's ultra-loose monetary argumentation could beryllium maintained for now, saying "there was inactive immoderate region to sustainably and stably achieving the cardinal bank's 2% ostentation target."

To Smith, determination is "plenty of probability" for the BOJ to displacement its stance connected YCC astatine the adjacent cardinal slope gathering adjacent Friday.

According to Smith, the alleged "core-core" ostentation complaint — which strips retired costs of caller nutrient and vigor — is "roaring up" astatine 4.2% successful June. That's the highest since September 1981, helium said adding that "its ain measurement shows that what they're saying is wrong."

The CLSA strategist said the main operator of ostentation is food, coupled with energy terms hikes, wage increases and the anemic yen. Noting that wages person besides seen the largest summation successful 30 years this year, Smith said ostentation successful Japan is apt to astonishment to the upside going forward, driven progressively by a wage terms spiral.

"If the BOJ doesn't bash anything, past the yen shoots done 150" against the dollar, helium said. "We cognize from acquisition that involution doesn't work. I've seen 95 trillion worthy of forex involution since 1990, and the effect of that has been hours, not days."

Stock picks and investing trends from CNBC Pro:

Smith said the BOJ's enslaved purchases person been expanding conscionable to support the YCC policy, pointing retired that its purchases of bonds person amounted to 15.8% of Japan's gross home merchandise since the commencement of December.

Ueda has said the BOJ is hitting the bounds of what it tin bash due to the fact that it already owns a 3rd of the enslaved market, helium added. "Now it owns 55% of the enslaved marketplace and it's starting to look similar Looney Tunes."

However, Yamakawa doesn't spot the BOJ shifting its stance connected monetary argumentation astatine the July monetary argumentation meeting. Instead, helium predicted the cardinal slope volition motorboat a phase-out of YCC astatine its October meeting, erstwhile the adjacent quarterly outlook study from is released.