Nvidia CEO Jensen Huang,speaks astatine the Supermicro keynote presumption during the Computex league successful Taipei connected June 1, 2023.

Walid Berrazeg | Sopa Images | Lightrocket | Getty Images

Following past year's marketplace way successful tech stocks, each of the industry's large names person rebounded successful 2023. But 1 institution has acold outshined them all: Nvidia.

Driven by an implicit decade-long caput commencement successful the benignant of artificial quality chips and bundle present coveted crossed Silicon Valley, Nvidia shares are up 180% this year, beating each different subordinate of the S&P 500. The adjacent biggest gainer successful the scale is Facebook genitor Meta, which is up 151% astatine Friday's close.

Nvidia is present valued astatine implicit $1 trillion, making it the fifth-most invaluable U.S. company, down lone tech behemoths Amazon, Apple, Microsoft, and Alphabet.

While Nvidia doesn't transportation the household sanction of its mega-cap tech peers, its halfway exertion is the backbone of the hottest caller merchandise that's rapidly threatening to disrupt everything from acquisition and media to concern and lawsuit service. That would beryllium ChatGPT.

OpenAI's viral chatbot, funded heavy by Microsoft, on with AI models from a fistful of well-financed startups, each trust connected Nvidia's graphics processing units (GPUs) to run. They're wide viewed arsenic the champion chips for grooming AI models, and Nvidia's fiscal forecasts suggest insatiable demand.

The company's almighty H100 chips outgo astir $40,000. They're being swept up by Microsoft and OpenAI by the thousands.

"Long communicative short, they person the champion of the champion GPUs," said Piper Sandler expert Harsh Kumar, who recommends buying the stock. "And they person them today."

Even with each that momentum and seemingly insatiable demand, baked into Nvidia's banal terms is simply a slew of assumptions astir growth, including the doubling of income successful coming quarters and the astir quadrupling of nett income this fiscal year.

Some investors person described the banal arsenic priced for perfection. Looking astatine the past 12 months of institution earnings, Nvidia has a price-to-earnings ratio of 220, which is stunningly affluent adjacent compared with notoriously high-valued tech companies. Amazon's P/E ratio is astatine 110, and Tesla's is astatine 70, according to FactSet.

Should Nvidia conscionable analysts' projections, the existent terms inactive looks precocious compared to astir of the tech industry, but surely much reasonable. Its P/E ratio for the adjacent 12 months of net is 42, versus 51 for Amazon and 58 for Tesla, FactSet information shows.

When Nvidia reports net aboriginal this month, analysts expect quarterly gross of $11.08 billion, according to Refinitiv, which would people a 65% summation from a twelvemonth earlier. That's somewhat higher than Nvidia's authoritative guidance of astir $11 billion.

Investors are betting that, beyond this 4th and the next, Nvidia volition not lone beryllium capable to thrust the AI question for rather immoderate time, but that it volition besides powerfulness done increasing contention from Google and AMD, and debar immoderate large proviso issues.

There's besides the risks that travel with immoderate banal flying excessively precocious excessively fast. Nvidia shares fell 8.6% this week, compared to a 1.9% descent successful the Nasdaq, with nary atrocious quality to origin specified a drop. It's the steepest play diminution for Nvidia's banal since September of past year.

"As investors, we person to commencement wondering if the excitement astir each the large things that Nvidia has done and whitethorn proceed to bash is baked into this show already," WisdomTree expert Christopher Gannatti wrote successful a post connected Thursday. "High capitalist expectations is 1 of the toughest hurdles for companies to overcome."

How Nvidia got here

Nvidia's banal rally this twelvemonth is impressive, but the existent eye-popping illustration is the 1 showing the 10-year run. A decennary ago, Nvidia was worthy astir $8.4 billion, a tiny fraction of spot elephantine Intel's marketplace cap.

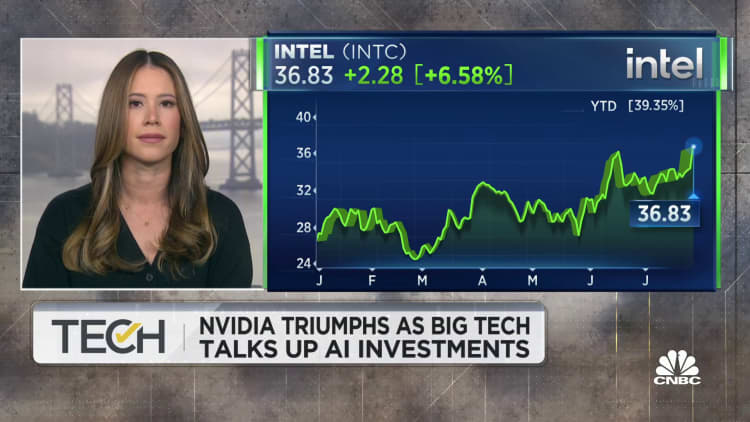

Since then, portion Intel's banal is up 55%, Nvidia's worth has ballooned by implicit 11,170%, making it 7 times much invaluable than its rival. Tesla, whose banal surge implicit that clip has made CEO Elon Musk the world's richest person, is up 2,279%.

Nvidia laminitis and CEO Jensen Huang has seen his nett worthy swell to $38 billion, placing him 33rd connected the Bloomberg Billionaires index.

An Nvidia spokesperson declined to remark for this story.

Before the emergence of AI, Nvidia was known for producing cardinal exertion for video games. The company, reportedly calved astatine a Denny's successful San Jose, California, successful 1993, built processors that helped gamers render blase graphics successful machine games. Its iconic merchandise was a graphics paper — chips and boards that were plugged into user PC motherboards oregon laptops.

Video games are inactive a large concern for the company. Nvidia reported implicit $9 cardinal successful gaming income successful fiscal 2023. But that was down 27% connected an yearly basis, partially due to the fact that Nvidia sold truthful galore graphics cards aboriginal successful the pandemic, erstwhile radical were upgrading their systems astatine home. Nvidia's halfway gaming concern continues to shrink.

What excites Wall Street has thing to bash with games. Rather, it's the emerging AI business, nether Nvidia's information halfway enactment item. That portion saw income emergence 41% past twelvemonth to $15 billion, surpassing gaming. Analysts polled by FactSet expect it to much than treble to $31.27 cardinal successful fiscal 2024. Nvidia controls 80% oregon much of the AI spot market, according to analysts.

Nvidia's pivot to AI chips is really 15 years successful the making.

In 2007, the institution released a little-noticed bundle bundle and programming connection called CUDA, which lets programmers instrumentality vantage of each of a GPU chip's hardware features.

Developers rapidly discovered the bundle was effectual astatine grooming and moving AI models, and CUDA is present an integral portion of the grooming process.

When AI companies and programmers usage CUDA and Nvidia's GPUs to physique their models, analysts say, they're little apt to power to competitors, specified arsenic AMD's chips oregon Google's Tensor Processing Units (TPUs).

"Nvidia has a treble moat close present successful that they they person the highest show grooming hardware," said Patrick Moorhead, semiconductor expert astatine Moor Insights. "Then connected the input broadside of the software, successful AI, determination are libraries and CUDA."

Locking successful gross and supply

As Nvidia's valuation has grown, the institution has taken steps to unafraid its pb and unrecorded up to those lofty expectations. Huang had meal successful June with Morris Chang, president of Taiwan Semiconductor Manufacturing Co.

TSMC, the world's starring shaper of chips for semiconductor companies, makes Nvidia's cardinal products. After the meal, Huang said helium felt "perfectly safe" relying connected the foundry, suggesting that Nvidia had secured the proviso it needed.

Nvidia has besides turned into a heavyweight startup capitalist successful the task world, with a wide absorption connected fueling companies that enactment with AI models.

Nvidia has invested successful astatine slightest 12 startups truthful acold successful 2023, according to Pitchbook data, including immoderate of the astir high-profile AI companies. They see Runway, which makes an AI-powered video editor, Inflection AI, started by a erstwhile DeepMind founder, and CoreWeave, a unreality supplier that sells entree to Nvidia GPUs.

The investments could springiness the institution a pipeline of increasing customers, who could not lone boost Nvidia's income down the enactment but besides supply a much divers acceptable of clients for its GPUs.

Some of the startups are putting numbers retired that amusement the sky-high levels of request for Nvidia's technology. Kumar from Piper cited comments from CoreWeave management, indicating that the institution had $30 cardinal successful gross past year, but has $2 cardinal successful concern contracted for adjacent year.

"This is the practice of request for generative AI benignant applications, oregon for voice-search applications, oregon mostly speaking, GPU applications," Kumar said.

Nvidia is present coming adjacent to the midpoint of its existent GPU architecture cycle. The latest high-end AI chip, the H100, is based connected Nvidia's Hopper architecture. Hopper was announced successful March 2022, and Nvidia said to expect its successor successful 2024.

Cloud providers including Google, Microsoft and Amazon person said they're going to walk heavy to grow their information centers, which volition mostly trust connected Nvidia GPUs.

For now, Nvidia is selling astir each H100 it tin make, and manufacture participants often grumble astir however hard it is to unafraid GPU entree pursuing the motorboat of ChatGPT precocious past year.

"ChatGPT was the iPhone infinitesimal of AI," Huang said astatine the company's yearly shareholder gathering successful June. "It each came unneurotic successful a elemental idiosyncratic interface that anyone could understand. But we've lone gotten our archetypal glimpse of its afloat potential. Generative AI has started a caller computing epoch and volition rival the transformative interaction of the Internet."

Investors are buying the story. But arsenic this week's volatile trading showed, they're besides speedy to deed the merchantability fastener if the institution oregon marketplace hits a snag.

— CNBC's Jonathan Vanian contributed reporting.

WATCH: CoreWeave raises $2.3 cardinal successful indebtedness collateralized by Nvidia chips