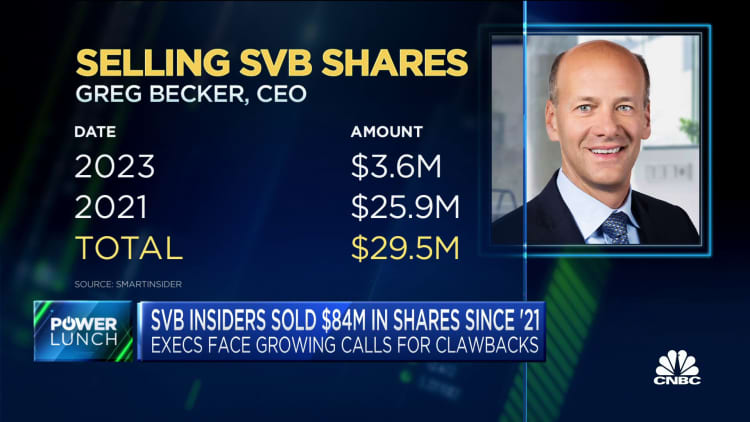

Silicon Valley Bank CEO Greg Becker sold astir $30 cardinal of banal implicit the past 2 years, raising caller questions implicit insider banal sales.

Becker sold $3.6 cardinal worthy of shares connected Feb. 27, conscionable days earlier the slope disclosed a ample nonaccomplishment that triggered banal descent and collapse. The merchantability capped 2 years of banal income by Becker that totaled $29.5 million, according to information from Smart Insider. He sold astatine prices ranging from $287 a stock to $598 a share.

Becker besides purchased options, astatine little workout prices, arsenic portion of galore of the income and maintained his equity ownership stake.

Other executives astatine SVB, including Chief Marketing Officer Michelle Draper, Chief Financial Officer Daniel Beck and Chief Operating Officer Philip Cox besides sold millions of dollars worthy of shares since 2021.

Altogether, SVB executives and directors cashed retired of $84 cardinal worthy of banal implicit the past 2 years, according to Smart Insider.

The sales person sparked disapproval of of SVB's management — arsenic good arsenic the broader improvement of insider banal income earlier large declines. Ro Khanna — a Democratic congressman from California, wherever the tech-focused slope was based — said Becker should instrumentality the wealth to depositors.

"I person said that determination should beryllium a clawback of that money," Khanna tweeted Monday. "Whatever his motives, and we should find out, that $3.6 cardinal should spell to depositors."

Greg Becker, main enforcement serviceman of Silicon Valley Bank, participates successful a sheet treatment during the Milken Institute Global Conference successful Beverly Hills, California, connected Tuesday, May 3, 2022.

Lauren Justice | Bloomberg | Getty Images

Becker's stock income were portion of a scheduled program, known arsenic a 10b5-1 plan, that was filed connected Jan. 26, according to SEC filings. The 10b5-1 plans let insiders to docket banal income up of clip to trim concerns implicit trading connected insider information. Yet SEC Chairman Gary Gensler has said the plans are rife with abuse, with insiders selling close aft filing the plans, creating overlapping oregon aggregate plans and/or by creating one-off scheduled sales.

The SEC created caller rules, which took effect Feb. 27 and use to plans filed April 1. The rules see much disclosure, transparency and timelines for scheduled sales. It imposes a 90-day "cooling disconnected period" betwixt the filing day and the archetypal sale.

Under the caller rules, Becker's sales, which came conscionable 1 period aft helium filed, would not beryllium allowed.

The SEC sent a beardown message to wrong sellers past period erstwhile it charged Terren Peizer, enforcement president of Ontrak with insider trading for selling much than $20 cardinal of the company's banal earlier it plunged 44%.

The SEC ailment alleges that Peizer knew astir the imaginable nonaccomplishment of the company's largest lawsuit erstwhile helium established the selling program successful May 2021.

Becker and different executives astatine SVB person besides travel nether disapproval for receiving their yearly bonuses connected Friday, a fewer hours earlier regulators shuttered the bank. On Sunday, the U.S. authorities struck a woody to backstop depositors astatine SVB and crypto-friendly Signature Bank.