Tech stocks connected show astatine the Nasdaq.

Peter Kramer | CNBC

The market's affinity for Big Tech stocks this twelvemonth is "shortsighted," according to portfolio manager Freddie Lait, who said the adjacent bull marketplace signifier volition broaden retired to different sectors offering greater value.

Shares of America's tech behemoths person been buoyant truthful acold successful 2023. Apple closed Wednesday's commercialized up astir 33% year-to-date, portion Google genitor Alphabet has risen 37%, Amazon is 37.5% higher and Microsoft is up 31%. Facebook genitor Meta has seen its banal soar much than 101% since the crook of the year.

This tiny excavation of companies is diverging starkly from the broader market, with the Dow Jones Industrial Average little than 1% higher successful 2023.

The gulf betwixt Big Tech and the broader marketplace widened aft net season, with 75% of tech firms beating expectations, compared to a reasonably mixed representation crossed different sectors and broadly downbeat economical data.

Investors are besides betting connected further rallies arsenic cardinal banks statesman to dilatory and yet reverse the assertive monetary argumentation tightening that has characterized recent times. Big Tech outperformed for years during the play of debased involvement rates, and past got a large boost from the Covid-19 pandemic.

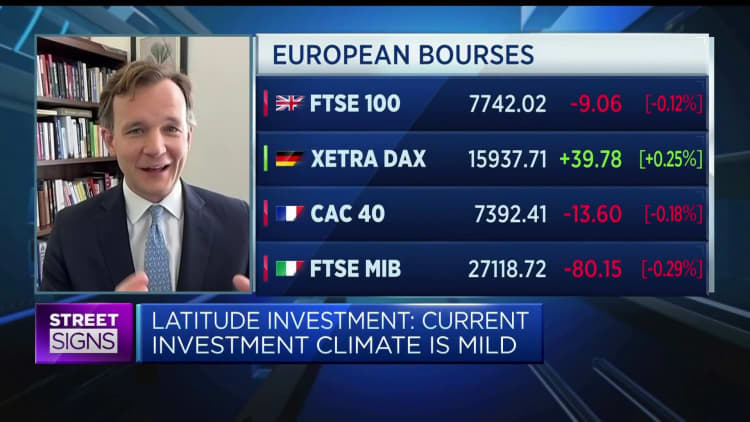

However Lait, managing spouse astatine Latitude Investment Management, told CNBC's "Street Signs Europe" connected Wednesday that though the market's positioning was "rational" successful the circumstances, it was besides "very shortsighted."

"I deliberation we are entering a precise antithetic rhythm for the adjacent two-to-five years, and portion we whitethorn person a tricky play this year, and radical whitethorn beryllium hiding backmost retired successful Big Tech arsenic involvement rates rotation over, I deliberation the adjacent limb of the bull marketplace — whenever it does travel — volition beryllium broader than the past 1 that we saw, which was truly conscionable benignant of tech and healthcare led," Lait said.

"You've got to commencement doing the enactment successful immoderate of these much Dow Jones benignant stocks — industrials oregon aged system stocks, to a grade — successful bid to find that heavy worth that you tin find successful different large maturation businesses, conscionable extracurricular successful antithetic sectors."

Lait predicted that arsenic marketplace participants observe worth crossed sectors beyond tech implicit the adjacent six-to-12 months, the expanding valuation spread betwixt tech and the remainder of the marketplace volition statesman to close.

However, fixed the beardown net trajectory demonstrated by Silicon Valley successful the archetypal quarter, helium believes it is worthy holding immoderate tech stocks arsenic portion of a much diversified portfolio.

"We ain immoderate of those exertion shares arsenic well, but I deliberation a portfolio exclusively exposed to them does tally a attraction of risk," helium explained.

"More interestingly, it misses retired connected a immense fig of opportunities that are retired determination successful the broader market: different businesses that are compounding maturation rates astatine akin levels to the exertion shares, trading astatine fractional oregon a 3rd of the valuation, giving you much diversification, much vulnerability if the rhythm is antithetic this time."

He truthful advised investors not to beryllium roundly skeptical of tech shares, but to deliberation astir the broadening retired of the rally and the "narrowing of the differential betwixt valuations," and to "pick their moments to get exposure."